Introduction

Risk management is a process used by businesses and organizations to identify, assess, and prioritize risks to their operations. It is an important part of any organization’s overall strategy and helps to ensure that it is prepared to deal with any potential threats or challenges that may arise. A risk management framework is a set of processes and procedures that an organization uses to assess, monitor, and manage risks. It provides a structured approach to identifying, assessing, and controlling risks, and is designed to help organizations protect their assets, operations, and reputation.

Purpose of the Framework

The purpose of a risk management framework is to provide a structured and systematic approach to identifying, assessing, and responding to risks. It helps to ensure that risks are identified, assessed, and managed in a consistent and effective manner. The framework also provides a basis for developing policies and procedures that can be used to manage risks.

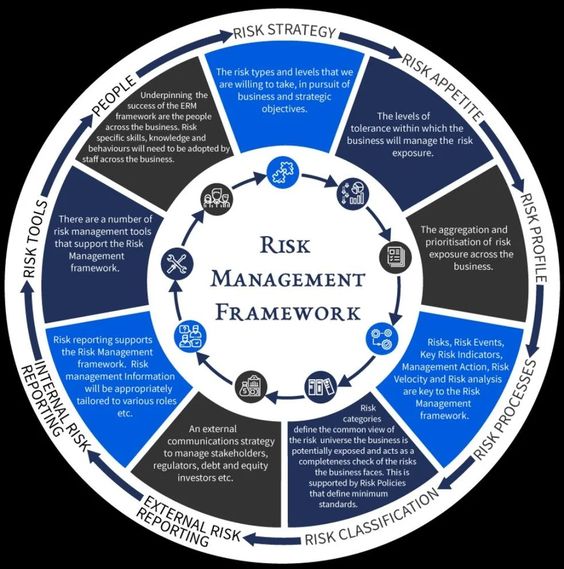

Components of a Risk Management Framework

A risk management framework typically consists of four components: risk identification, risk assessment, risk mitigation, and risk monitoring.

Risk identification is the process of identifying potential risks that could affect an organization’s operations. This includes identifying both internal and external risks.

Risk assessment is the process of evaluating the potential impact of identified risks. This includes determining the likelihood of the risk occurring and the potential consequences if it does occur.

Risk mitigation is the process of reducing or eliminating the potential impact of identified risks. This includes developing strategies to reduce the likelihood of the risk occurring and to minimize the potential consequences if it does occur.

Risk monitoring is the process of regularly assessing the effectiveness of risk management processes and procedures. This includes assessing the effectiveness of risk mitigation strategies and making any necessary adjustments.

Benefits of a Risk Management Framework

A risk management framework provides a number of benefits to an organization. It helps to ensure that risks are identified and assessed in a consistent and effective manner. It also provides a basis for developing policies and procedures to manage risks. Additionally, it helps to ensure that risk mitigation strategies are effective and that any necessary adjustments are made.

Risk Management Policy

A risk management policy is a document that outlines an organization’s approach to managing risks. It typically includes a statement of the organization’s risk management objectives, the roles and responsibilities of those involved in risk management, and the processes and procedures that will be used to manage risks.

Developing a Risk Management Policy

When developing a risk management policy, it is important to consider the organization’s risk management objectives and the roles and responsibilities of those involved in risk management. The policy should also include the processes and procedures that will be used to identify, assess, and manage risks.

Implementing a Risk Management Policy

Once a risk management policy has been developed, it is important to ensure that it is implemented effectively. This includes training staff on the policy, providing guidance and support, and regularly assessing the effectiveness of the policy.

You might find these FREE courses useful

- Implementing a Risk Management Framework

- Program Risk Management in ClickUp

- Introduction to Risk Management

- A General Approach to Risk Management

- Risk Management Specialization

Conclusion

Risk management is an important part of any organization’s overall strategy. A risk management framework provides a structured and systematic approach to identifying, assessing, and responding to risks. Additionally, a risk management policy outlines an organization’s approach to managing risks. By implementing a risk management framework and policy, organizations can ensure that risks are identified, assessed, and managed in a consistent and effective manner.