Download Project Risk Analysis and Management Guide APM

This Guide provides an introduction to the processes involved in Project Risk Analysis and Management, offering a simple but robust and practical framework to help new users get started.

It is not a definitive explanation of all the techniques and methods that can be used in the process. Project Risk Analysis and Management can be used on all projects, whatever the industry or environment, and whatever the timescale or budget.

What Is Project Risk Analysis And Management?

Project Risk Analysis and Management is a process that enables the analysis and management of the risks associated with a project. Properly undertaken it will increase the likelihood of successful completion of a project to cost, time, and performance objectives. Risks for which there is ample data can be assessed statistically.

However, no two projects are the same. Often things go wrong for reasons unique to a particular project, industry, or working environment.

Dealing with risks in projects is therefore different from situations where there is sufficient data to adopt an actuarial approach. Because projects invariably involve strong technical, engineering, innovative or strategic content a systematic process has proven preferable to an intuitive approach. Project Risk Analysis and Management have been developed to meet this requirement.

What is involved?

The first step is to recognize that risk exists as a consequence of uncertainty. In any project there will be risks and uncertainties of various types as illustrated by the following examples:

- The management and financial authority structure are not yet established

- The technology is not yet proven

- Industrial relations problems seem likely

- Resources may not be available at the required level.

All uncertainty produces an exposure to risk, which in project management terms, may cause a failure to:

- keep within budget

- Achieve the required completion date

- Achieve the required performance objective.

PRAM is designed to identify and assess risks that threaten the achievement of project objectives and to take action to avoid, reduce or even accept those risks. The next section of this guide describes the benefits that PRAM can bring to a project and also the wider benefits to the organization and its stakeholders. It should be regarded as an integral part of project or business management and not just as a set of tools or techniques.

The PRAM processes

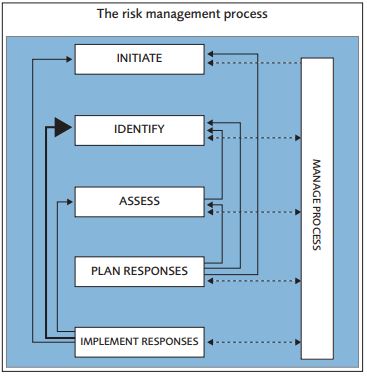

Experienced risk analysts and managers hold perceptions of this process that are subtle and diverse. Figure 1 shows the major phases in the PRAM process. In order to simplify the process, this guide divides the overall process into two constituents or stages: risk analysis and risk management. Risk analysis is the combination of the estimate and evaluation sub-phases within the Assess phase in Figure 1.

Risk analysis

This stage of the process is generally split into two ‘sub-stages’: a qualitative analysis ‘substage’ that focuses on the identification and subjective assessment of risks, and a quantitative analysis ‘sub-stage’ that focuses on an objective assessment of the risks.

Qualitative analysis

Qualitative analysis allows the main risk sources or factors to be identified. This can be done, for example, with the aid of checklists, interviews, or brainstorming sessions. This is usually associated with some form of assessment that could be the description of each risk and its impacts or subjective labeling of each risk (for example, high/low) in terms of both its impact and its probability of occurrence.

A sound aim is to identify the key risks, perhaps between five and 10, for each project (or part-project on large projects), which are then analyzed and managed in more detail.

Quantitative analysis

A quantitative analysis often involves more sophisticated techniques, usually requiring computer software. To some people, this is the most formal aspect of the whole process requiring:

- Measurement of uncertainty in cost and time estimates

- Probabilistic combination of individual uncertainties

Such techniques can be applied with varying levels of effort ranging from modest to extensively thorough. It is recommended that new practitioners start slowly, perhaps even ignoring this ‘sub-stage’, until a climate of acceptability has been developed for project risk analysis and management in the organization.

An initial qualitative analysis is essential. It brings considerable benefit in terms of understanding the project and its problems irrespective of whether or not a quantitative analysis is carried out. It may also serve to highlight possibilities for risk ‘closure’, ie the development of a specific plan to deal with a specific risk issue.

Experience has shown that qualitative analysis – identifying and assessing risks – usually leads to an initial, if simple, level of quantitative analysis. If for any reason – such as time or resource pressure or cost constraints – both a qualitative and quantitative analysis is impossible, it is the qualitative analysis that should remain.

It should be noted that procedures for decision-making would need to be modified if risk analysis is adopted. An example that illustrates this point is the sanction decision for clients, where estimates of cost and time will be produced in the form of ranges and associated probabilities rather than single-value figures.

Risk management

This stage of the process involves the formulation of management responses to the main risks. Risk management may start during the qualitative analysis phase as the need to respond to risks may be urgent and the solution fairly obvious. Iteration between the risk analysis and risk management stages is likely.

Risk management can involve:

- implementing measures to avoid risk, reduce its effect, or reduce its probability of occurrence

- Establishing contingency plans to deal with risks if they should occur

- Initiating further investigations to reduce uncertainty through better information

- considering risk transfer to insurers

- Considering risk allocation in contracts

- Setting contingencies in cost estimates, float in programs and tolerances, or ‘space’ in performance specifications.

- Section 6 of this guide considers some of the techniques of PRAM in more detail