What Exactly Is a Family Budget?

Budgets and budget proposals are made by business owners and project developers to ask for financing to finish a project. This will guarantee that the task is effectively finished. One of the files they employ is seen in the example below. Individual assistance Non-profit groups regularly look for funding to support their efforts in the community and humanitarian development.

You can create a new corporation or firm using this template. But in recent years, they have grown rarer and rarer. Private donors, investors, entrepreneurs, and philanthropists receive funding requests from people and organizations all around the world. They firmly believe that this should go place. To ensure that the individual helping them understands their project, they painstakingly document every part of it.

It will demonstrate their financial requirements, project timeline, and available time. You should also make sure that your proposal is organized and presented professionally in order to capture the readers’ attention. Avoid stuffing your paper with extra information if you want it to appear larger than it is.

They will get worn out and angry if you offer them too much information. It doesn’t matter how much you donate. They ought to be eager to learn more, therefore they should. If your document’s primary material is properly displayed, readers will give it greater attention.

The rest of your manuscript will be introduced on the title page. In this speech, you will outline the origins of your concept, your decision to pursue it, and your plans for carrying it out. Keep this in mind when submitting a financing proposal. Understanding your objectives and how you plan to reach them is essential. Think about the benefits your project will provide to your donors and collaborators.

Managing a Family Budget

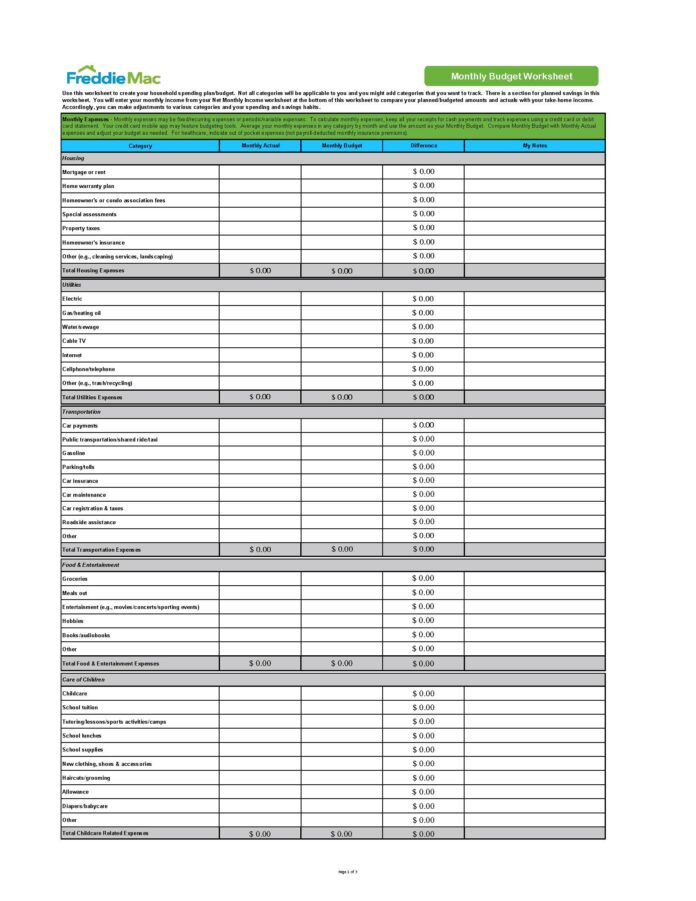

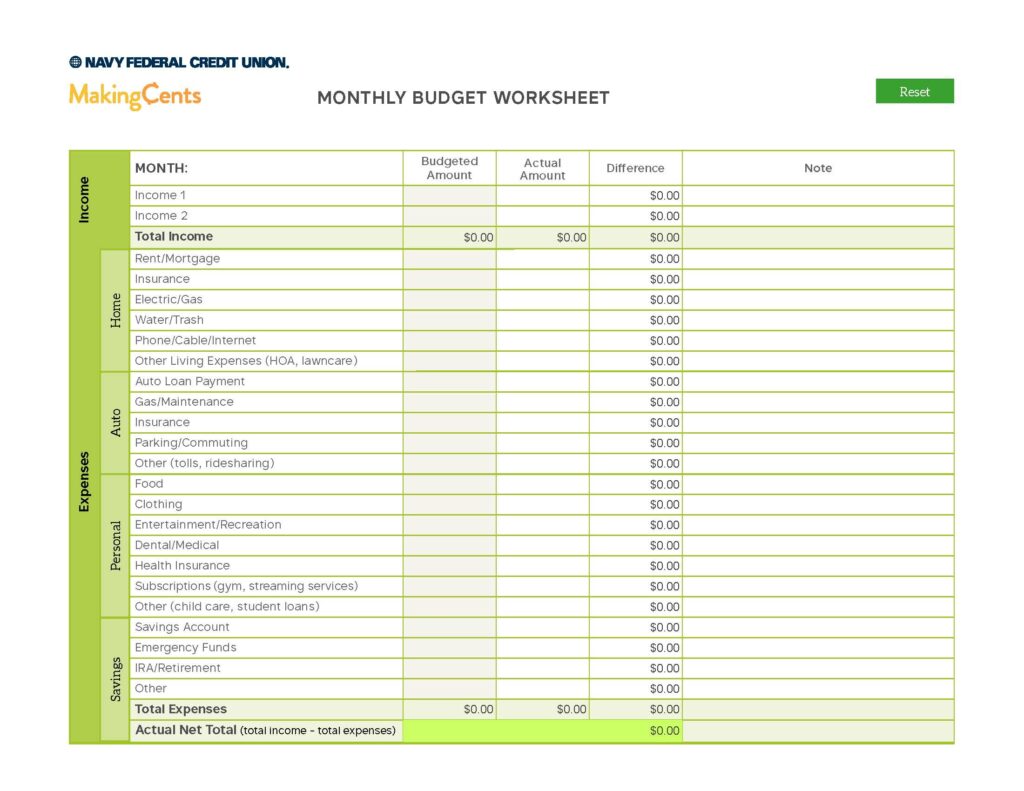

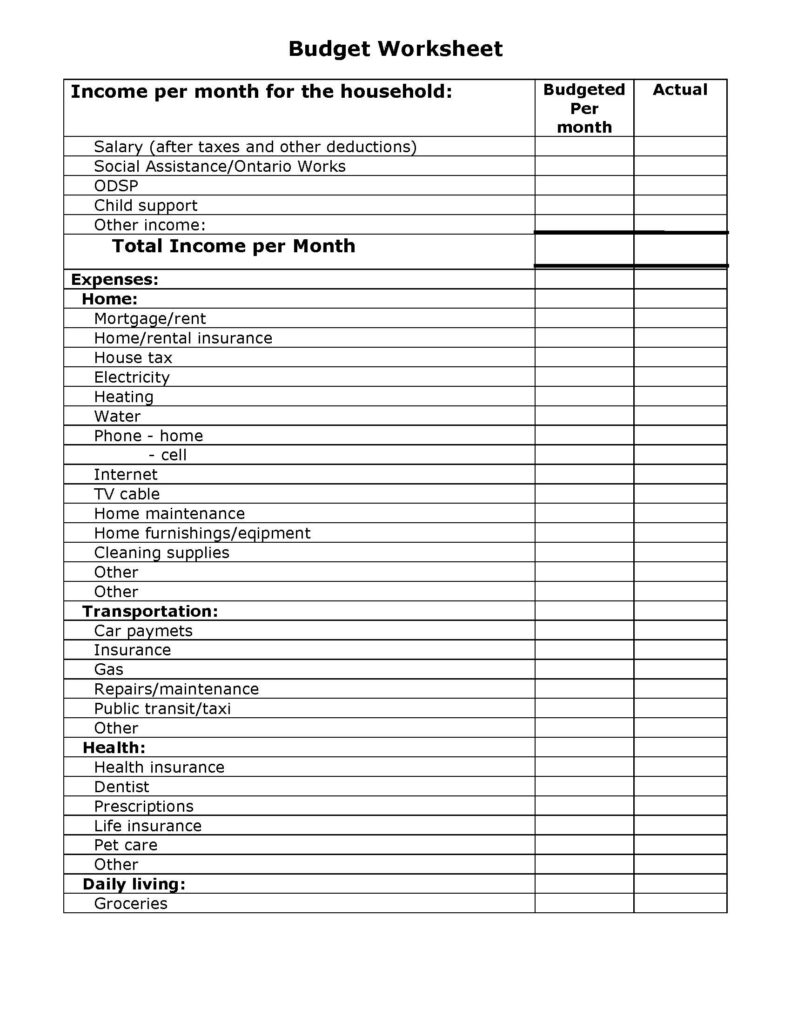

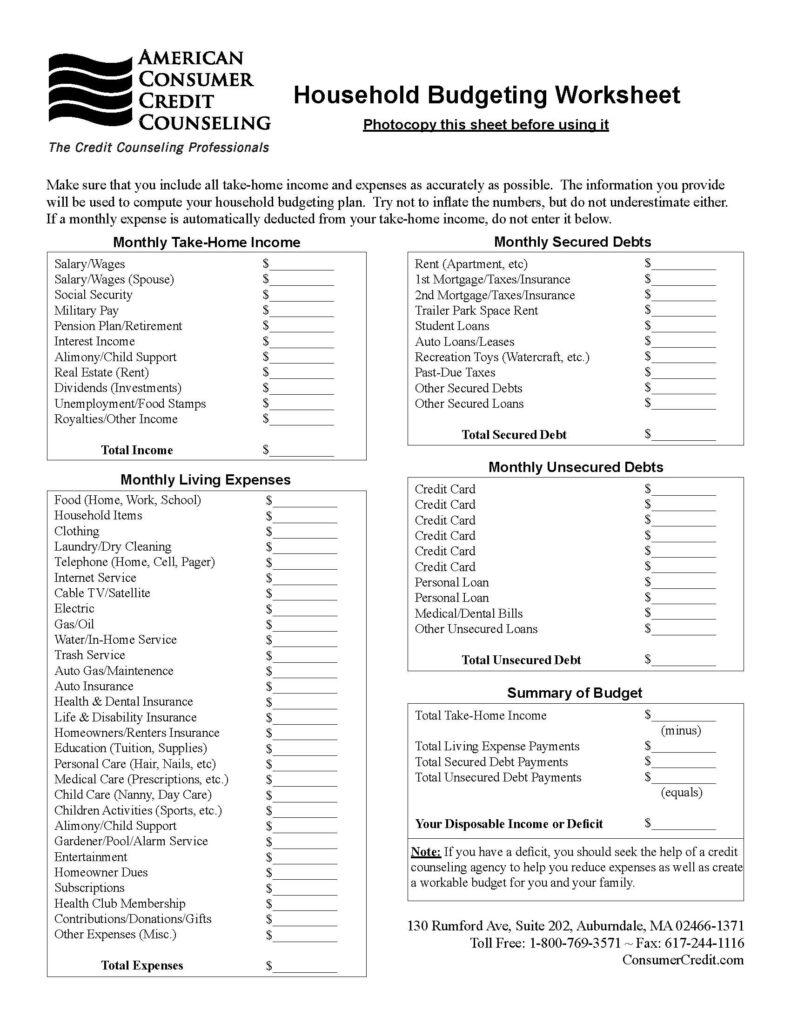

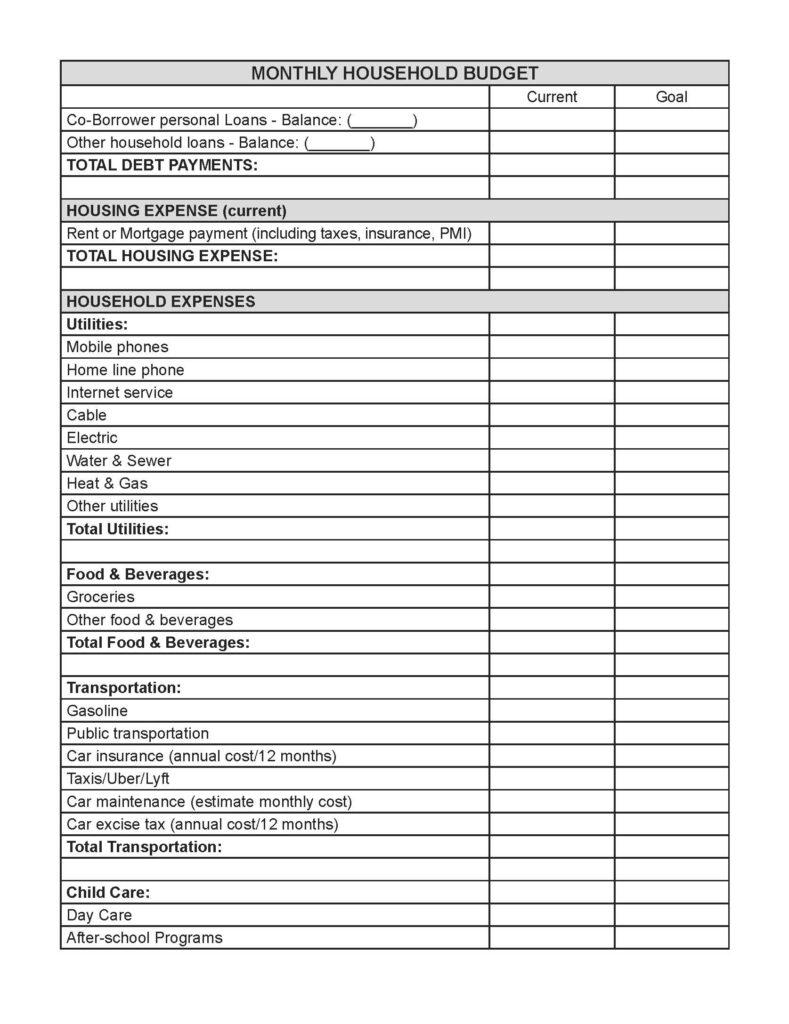

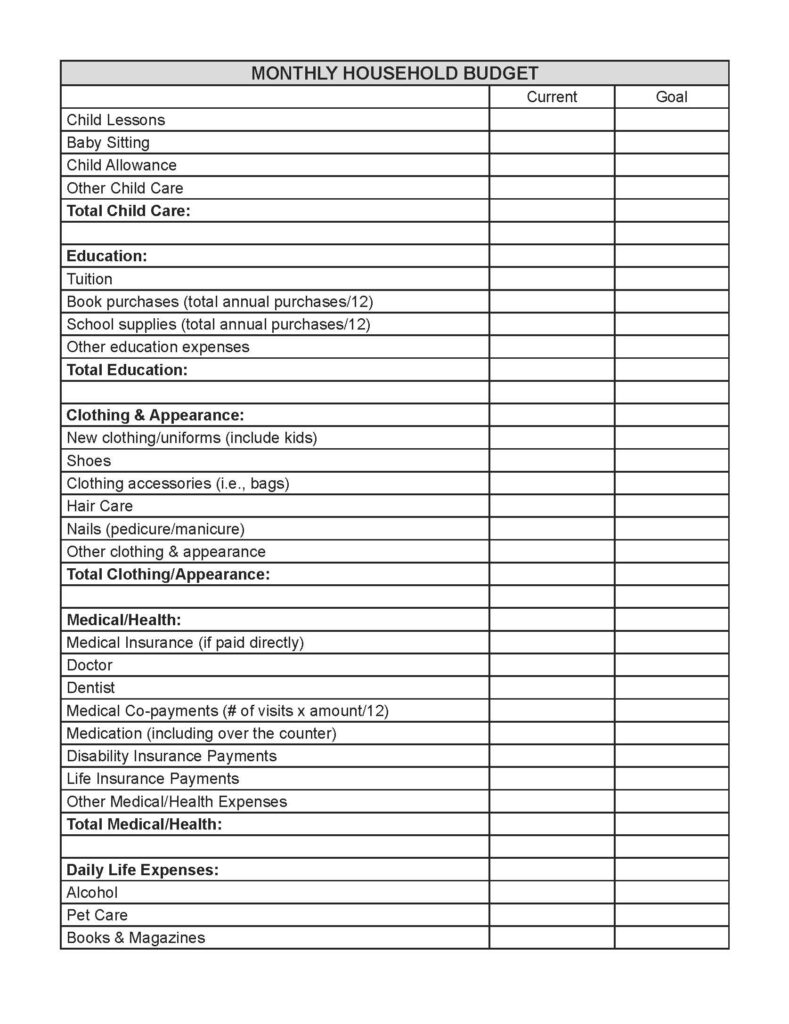

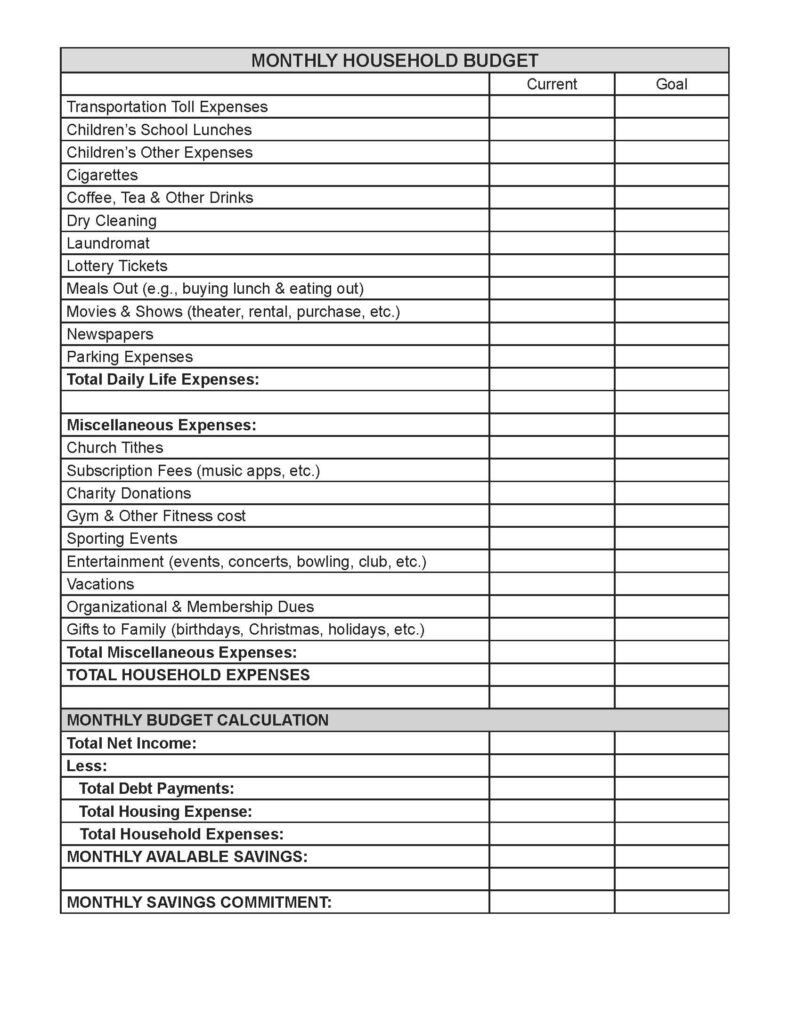

Budgeting for family income and expenses is often a lower priority for farm and ranch families than budgeting for the business. Without budgeting, however, family living expenses may exceed the available income and jeopardize the overall financial goals of the farm and family. The management of family expenses within a set of mutual family goals can help to keep money from slipping needlessly away. Some reasons producers do not devote more time to managing family finances include:

- They are not tax-deductible.

- Family budgeting is difficult and time

- Consuming. Compared to farm/ranch expenses, family

- Living expenses are too small to worry about. Non-farm income pays for family expenses so it doesn’t matter.

Many producers devote attention to family living expenditures only once a year—at loan renewal time. To approve an operating loan, many lenders require that the borrower provide an estimate of family living costs, either as an annual total or broken down by expense category. Producers may rarely go back and compare their actual family living expenses against their budgeted amounts.

Why is it important to have a family budget

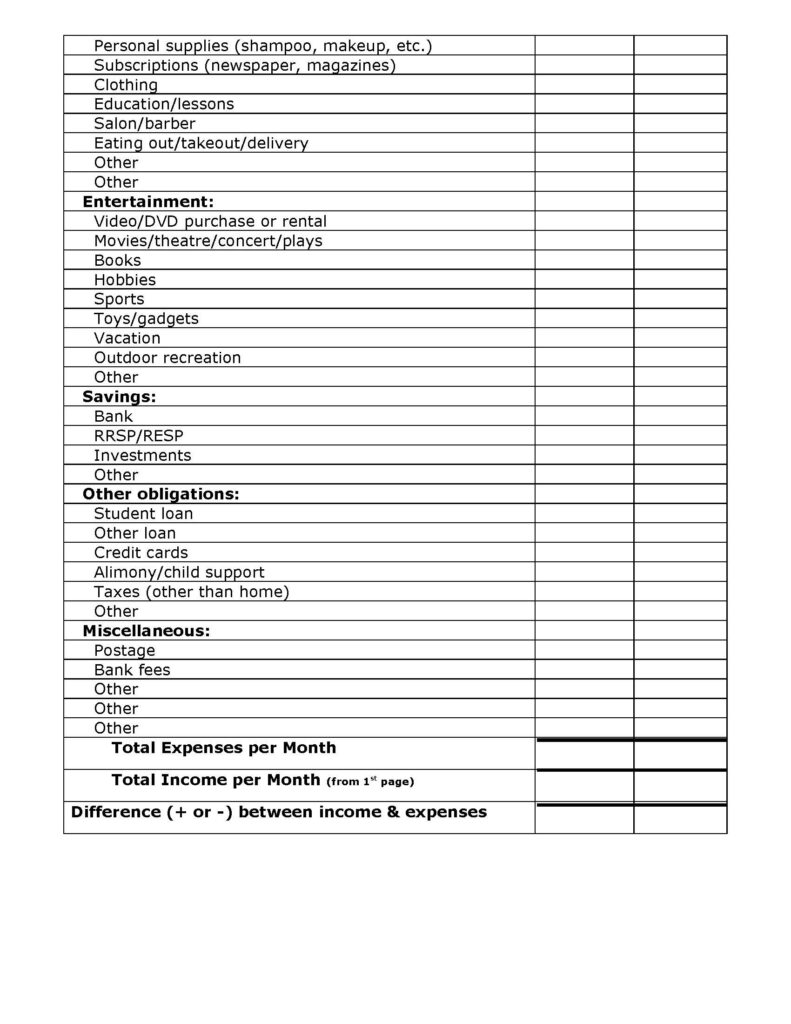

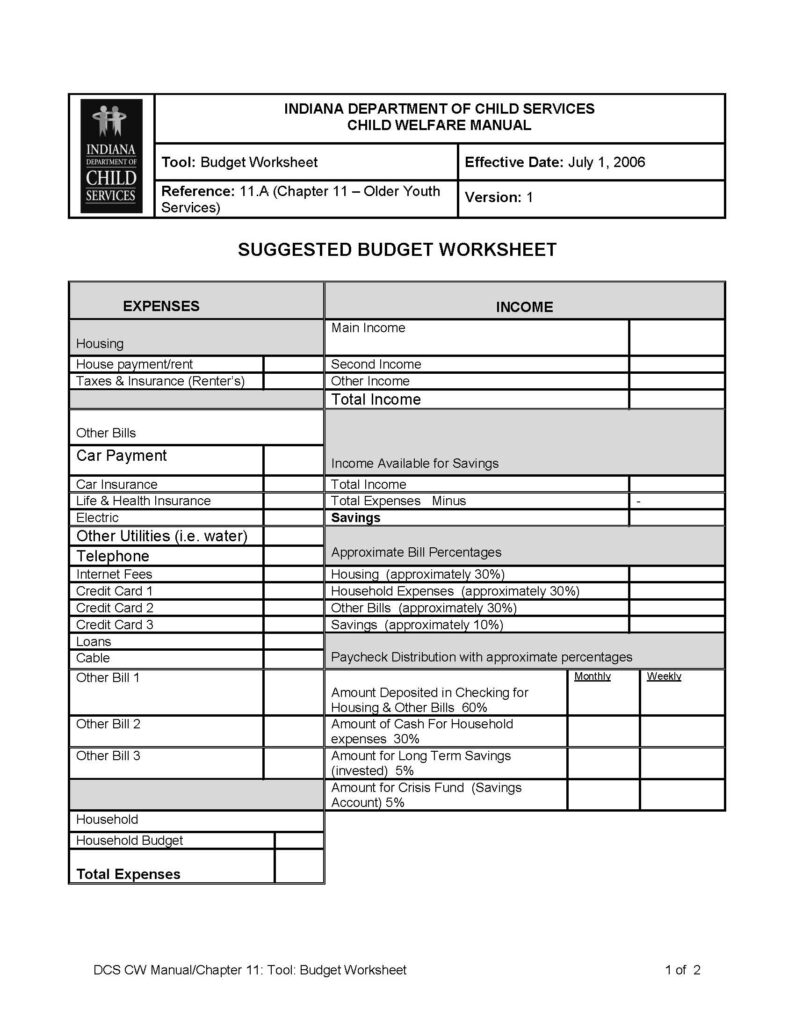

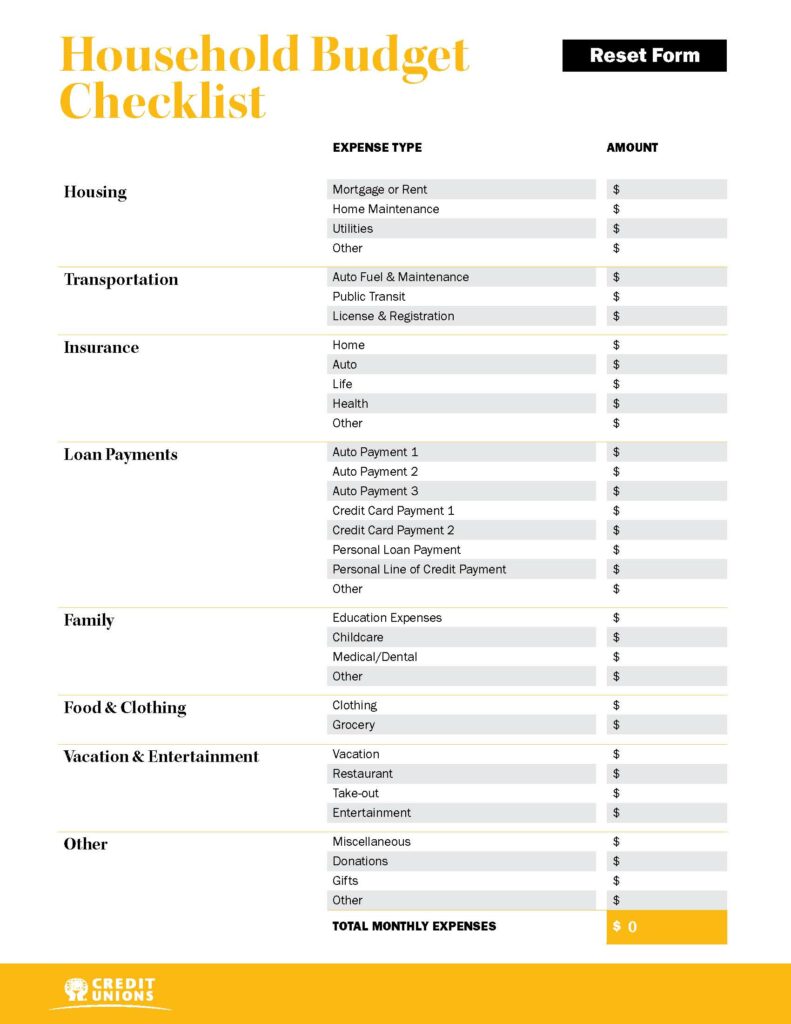

Budgeting for family expenditures is the foundation of a sound financial management plan. When used in conjunction with records of actual spending, a family budget allows you to pinpoint unnecessary spending and areas where actual costs may be higher or lower than you previously thought.

Given the tight profit margins in agriculture, adhering to a finely tuned family budget can give a much-needed boost to your financial future. Not having a family budget means you are not managing your family finances. This most often leads to spending more money than you realize in some areas.

Managing a family budget can also allow you to discover ways to put your money to better use, such as debt reduction, retirement savings, or college savings. The most difficult part of managing a family budget is having the discipline to dedicate enough time each month to manage it.

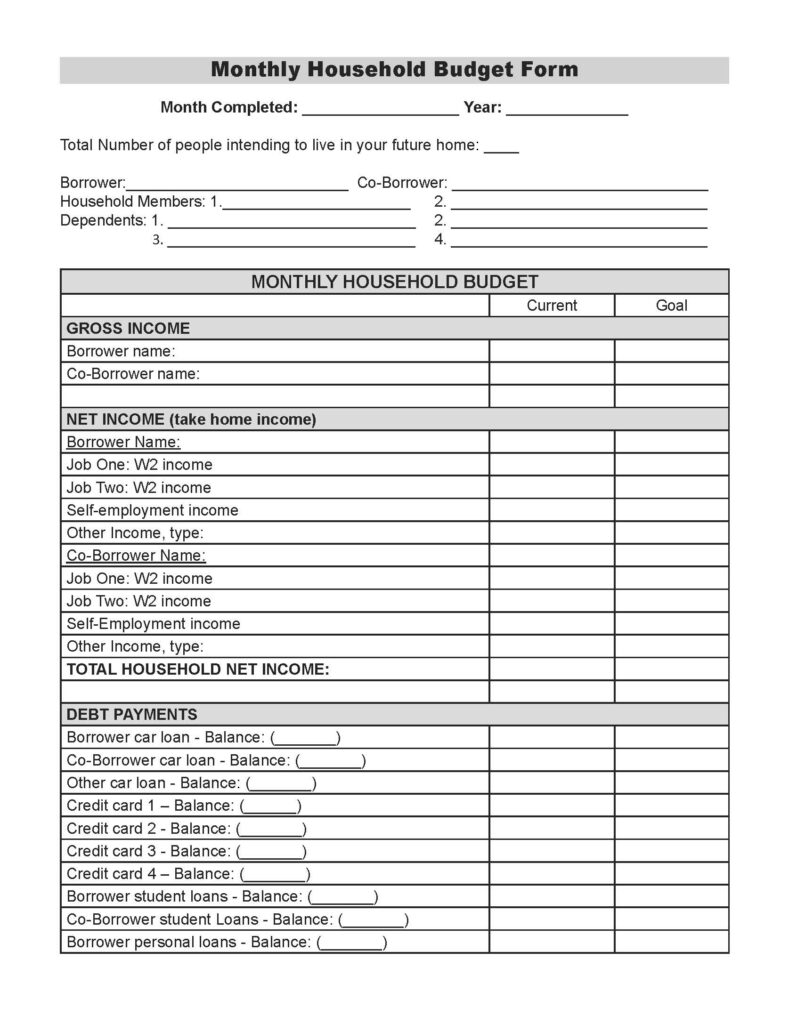

Family Goals and Standard of Living

Before developing your family budget, you must first determine your farm and family goals, and the standard of living your family desires. It is important that all members of the family be involved in this goal-setting process so that the goals reflect the perceptions and ambitions of each member of the family.

Open communication is important in this process. When establishing family goals, be as realistic as possible and consider all available income. Setting unattainable family goals will cause unnecessary frustration and render the process less effective.

The financial goals of your family can be divided into two categories—short-term and long-term. Short-term goals are those you hope to achieve in the coming year, while long-term goals are those you hope to achieve further into the future and that usually require substantial financial resources.

Examples of short-term goals are replacing the washer and dryer or trading in the family car. Examples of long-term goals include saving for your children’s education, saving for retirement, and paying off the farm/ranch. The Standard of living is mostly perception. What one person or family perceives as being a lavish lifestyle may seem frugal to someone else.

The standard of living your family desires can be something you want now, or it can be a goal to strive for in the coming years. Do you want to drive a $40,000 vehicle or a $15,000 vehicle? Do you want to live in a $250,000 house or a $65,000 house? How frequently do you want to dine out at an expensive restaurant—twice a week, once a month? These are the kinds of standard of living questions you need to address.

How to Create a Family Budget Step by Step

If you want to work with a lot of people, break out your proposal into sections for each person. The term “donor policies” refers to these. There should be multiple identical things in the document, regardless of format. Several subjects will be looked at and addressed in further detail later on in the book. We did a good job of giving you, wise counsel.

Brief overview

A title page should always be attached to your grant application. You will next go into greater detail about why you require the funding in the first portion of your statement. Always keep things straightforward, concise, and simple. This is a crucial issue to emphasize.

That is not mean that you should attempt to fit as much information as you can into a small amount of space. We won’t write a lot because we don’t want to overwhelm your readers with information. While giving a high-level overview of your project is necessary, there are also a number of other things to take into account.

Description

Think of the project as a solution to the problem that has been identified. What you want to do, how and when you want to achieve it, and the criteria you’ll use to gauge your project’s success must all be well-defined. This illustrates to potential partners the depth of the community impact of your program.

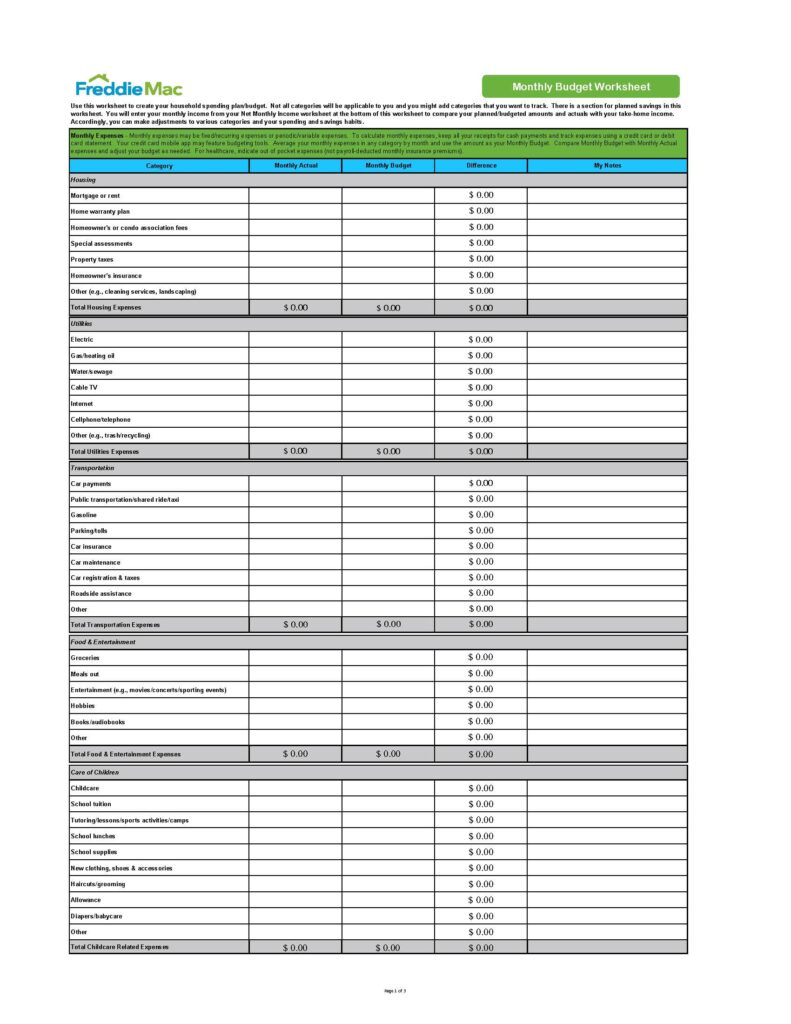

To demonstrate to funders how much additional funding and resources will be required, compile a list of the resources you are now using. To make it easier to understand, a well-thought-out budget plan should be laid out in tables and numbers. Clearly label each component as you assemble your budget to ensure that all necessary information is visible and clear.

various parts

Additional portions of your funding application may be necessary, depending on the data that your potential investors demand. Simple cover letters or extra business information could also be needed.

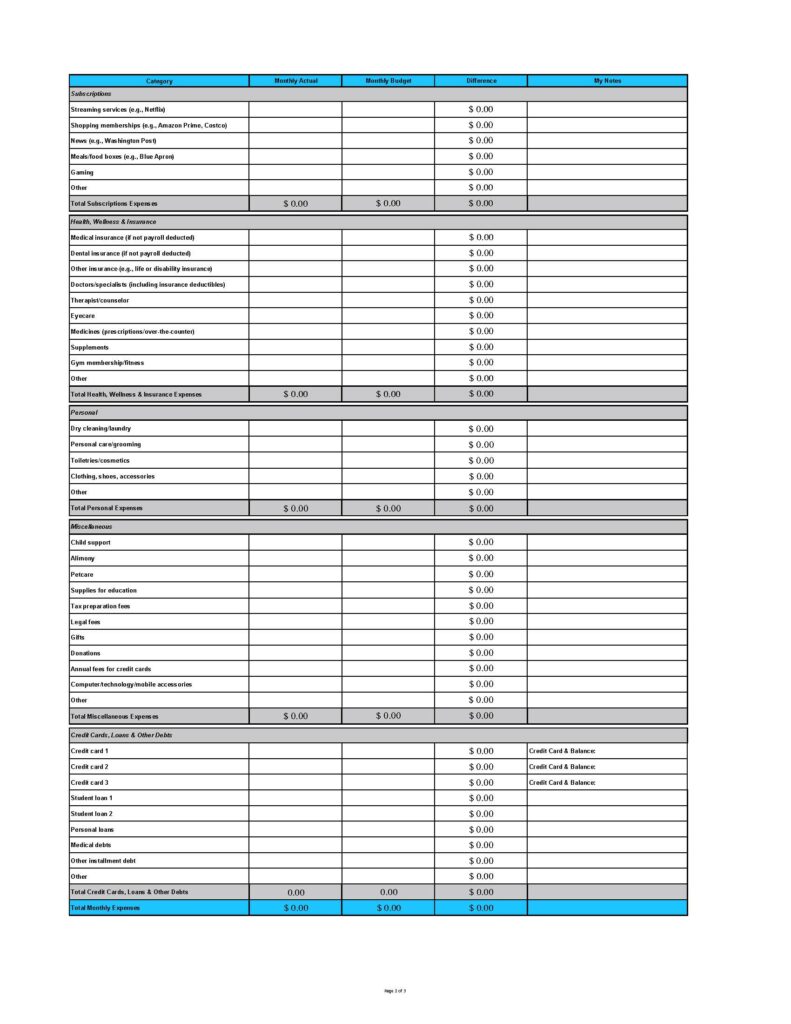

Tips for Effective Budgeting

Budgeting for the Home

- Each year, set aside 1% to 3% of your home’s purchase price for maintenance and repairs.

- Worried about heating and cooling costs? Ask if your utility provider offers budget billing options that spread seasonal spikes across the year.

- Dirty filters can lead to higher energy costs, so make a habit of replacing the filters in your heating system on a regular basis.

Paying Off Debt

- If you’re able to make extra payments toward loans, prioritize paying off the one with the highest interest rate.

- Want to simplify your student loan payments and possibly save on interest? Navy Federal now refinances and consolidates federal and private student loans.

Planning for the Future

- Trying to reach a savings goal? Consider breaking it up into smaller, monthly contributions.

- If college is in your or your child’s future, consider making a monthly contribution to a tax-advantaged 529 plan.

- As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement.

Regular Expenses

Food

Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time.

Health

Consider enrolling in a Flexible Spending Account (FSA) if your employer offers this benefit. FSAs allow you to put money aside, pre-tax, to pay for certain out-of-pocket healthcare expenses.

Personal/Family

Do you have childcare expenses? See if your employer offers Dependent Care Flexible Savings—a pre-tax benefit account used to pay for eligible dependent care services like preschool, summer camp, and child or adult daycare.

Transportation

Consider using public transportation, if available. If you have to use a car, consider ride-sharing, especially for your daily commute. Some employers even offer incentives to those who carpool or use public transit.