Risk management is a process that involves identifying, assessing, and controlling potential risks in order to minimize their impact on an organization. It is an important part of any business strategy, as it helps organizations to identify and address potential risks before they become a problem. In this article, we will take a look at the basics of risk management and how it can be used to protect an organization from potential losses.

What is Risk Management?

Risk management is the process of identifying, assessing, and controlling potential risks in order to minimize their impact on an organization. It is a proactive approach to managing risks that can help organizations to avoid or minimize losses due to unexpected events. Risk management involves assessing the likelihood of potential risks and taking steps to minimize their impact.

Types of Risk

Risks can come in many forms, such as operational, financial, legal, and technological risks. Operational risks are related to the day-to-day operations of an organization and can include things like employee errors, equipment failure, and supply chain disruptions. Financial risks are related to the financial health of an organization and can include things like currency fluctuations and interest rate changes. Legal risks are related to legal issues such as contract disputes and regulatory changes. Technological risks are related to the use of technology and can include things like data breaches and cyber attacks.

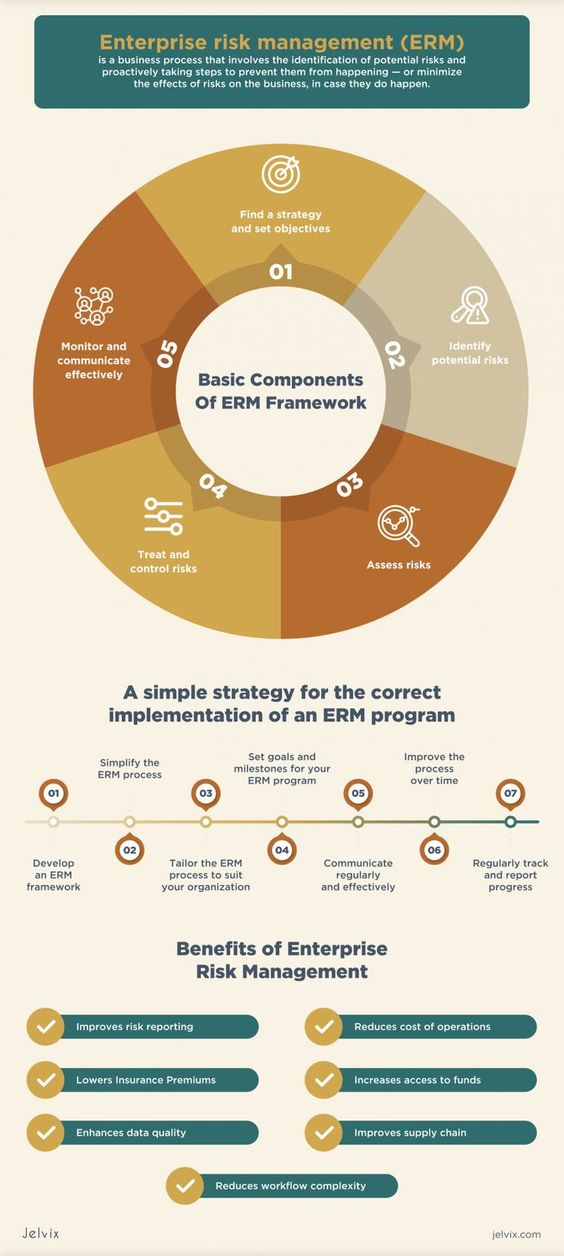

The Risk Management Process

The risk management process involves four steps: identification, assessment, control, and monitoring. The first step is to identify potential risks. This involves looking at the organization’s operations, processes, and environment to identify any potential risks. The next step is to assess the risks, which involves determining the likelihood of the risk occurring and the potential impact it could have on the organization. The third step is to control the risks, which involves taking steps to reduce the likelihood of the risk occurring or to reduce the potential impact. The final step is to monitor the risks, which involves regularly reviewing the risks and making adjustments as needed.

Risk Management Tools

There are a variety of tools and techniques that can be used to manage risks. These include risk registers, risk maps, risk matrices, and risk assessments. Risk registers are used to document and track potential risks and their associated actions. Risk maps are used to visualize potential risks and their associated actions. Risk matrices are used to evaluate the likelihood and severity of potential risks. Risk assessments are used to analyze potential risks and identify the most effective risk management strategies.

Benefits of Risk Management

Risk management can provide a number of benefits to an organization. It can help to reduce losses due to unexpected events, improve decision-making, and increase the organization’s ability to respond quickly to changing circumstances. It can also help to improve the organization’s reputation and reduce the cost of insurance.

You might find these FREE courses useful

- Implementing a Risk Management Framework

- Program Risk Management in ClickUp

- Introduction to Risk Management

- A General Approach to Risk Management

- Risk Management Specialization

Conclusion

Risk management is an important part of any business strategy. It can help organizations to identify and address potential risks before they become a problem. By implementing an effective risk management process, organizations can reduce losses due to unexpected events, improve decision-making, and increase their ability to respond quickly to changing circumstances.