Enterprise risk management (ERM) is a holistic approach to managing risk across an organization. It is a process of identifying, assessing, and mitigating risks associated with an organization’s operations, objectives, and strategies. It is a proactive approach to risk management that seeks to prevent losses, protect assets, and ensure compliance with applicable laws and regulations.

Overview of ERM

ERM is a comprehensive approach to managing risk that takes into account the entire organization. It is a process of identifying, assessing, and mitigating risks associated with an organization’s operations, objectives, and strategies. It is a proactive approach to risk management that seeks to prevent losses, protect assets, and ensure compliance with applicable laws and regulations.

Benefits of ERM

ERM provides organizations with a comprehensive view of their risk exposure and helps them to better understand and manage their risk. It can also help organizations identify potential opportunities and develop strategies to capitalize on them. Additionally, ERM can help organizations reduce losses, protect assets, and ensure compliance with applicable laws and regulations.

Components of ERM

ERM is composed of several components, including risk identification, risk assessment, risk control, and risk monitoring. Risk identification involves identifying potential risks and their sources. Risk assessment involves evaluating the likelihood and impact of a risk. Risk control involves developing and implementing strategies to reduce or eliminate the risk. Finally, risk monitoring involves monitoring the effectiveness of risk management strategies and taking corrective action as necessary.

Risk Categories

ERM covers a wide range of risk categories, including strategic risks, operational risks, financial risks, regulatory risks, and reputational risks. Strategic risks involve risks associated with an organization’s strategy and objectives. Operational risks involve risks associated with day-to-day operations. Financial risks involve risks associated with finances, such as credit and liquidity risks. Regulatory risks involve risks associated with compliance with applicable laws and regulations. Finally, reputational risks involve risks associated with an organization’s reputation.

ERM Process

The ERM process involves several steps, including risk identification, risk assessment, risk control, and risk monitoring. Risk identification involves identifying potential risks and their sources. Risk assessment involves evaluating the likelihood and impact of a risk. Risk control involves developing and implementing strategies to reduce or eliminate the risk. Finally, risk monitoring involves monitoring the effectiveness of risk management strategies and taking corrective action as necessary.

ERM Tools

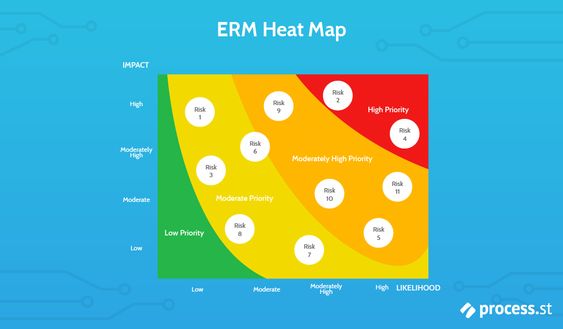

ERM tools are used to help organizations identify, assess, control, and monitor risks. These tools include risk registers, risk matrices, risk assessments, and risk control plans. Risk registers are used to document and track risks. Risk matrices are used to visualize and evaluate risks. Risk assessments are used to identify and evaluate risks. Risk control plans are used to develop and implement strategies to reduce or eliminate risks.

You might find these FREE courses useful

- Empathy and Data in Risk Management

- Identifying, Monitoring, and Analyzing Risk and Incident

- Corporate finance: Know your numbers 2

ERM Best Practices

ERM best practices include developing an ERM framework, creating an ERM team, conducting regular risk assessments, and monitoring and reporting on risks. An ERM framework provides the foundation for the ERM process and outlines the roles and responsibilities of the ERM team. An ERM team is responsible for developing, implementing, and monitoring the ERM process. Regular risk assessments should be conducted to identify and evaluate risks. Finally, risks should be monitored and reported on regularly to ensure that the ERM process is effective.