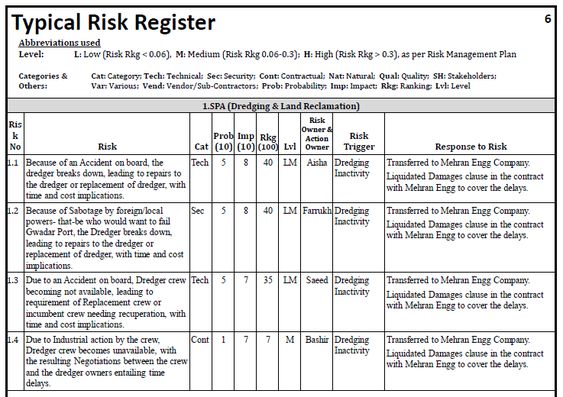

What is Risk Transfer?

Risk transfer is a strategy used by businesses to protect themselves from potential losses due to unforeseen circumstances, such as natural disasters, lawsuits, or financial losses. It involves transferring the risk of loss from one party to another, typically through insurance or contractual agreements. Risk transfer can help businesses protect their assets and reduce their overall risk exposure.

Types of Risk Transfer

There are several different types of risk transfer, including insurance, contractual agreements, and hedging. Insurance is the most common form of risk transfer, and it involves transferring the risk of loss to an insurance company in exchange for a premium. Contractual agreements involve transferring the risk of loss to another party through a contract, such as a lease agreement or a service agreement. Hedging is a form of risk transfer that involves using financial instruments, such as derivatives, to reduce the risk of loss due to market fluctuations.

Benefits of Risk Transfer

Risk transfer can help businesses protect their assets and reduce their overall risk exposure. It can also help businesses manage their cash flow and reduce the impact of unexpected losses. Risk transfer can help businesses protect themselves from potential lawsuits, natural disasters, and other unforeseen circumstances.

Risks of Risk Transfer

While risk transfer can be beneficial for businesses, it can also come with some risks. For example, transferring the risk of loss to another party can be expensive, and it can also be difficult to find an insurance company or other party willing to take on the risk. Additionally, transferring the risk of loss can limit the business’s ability to take advantage of potential opportunities.

How to Implement Risk Transfer

To implement risk transfer, businesses should first assess their risk exposure and determine which risks they need to transfer. They should then research potential insurance companies or other parties willing to take on the risk, and compare the costs and benefits of different options. Businesses should also ensure that any contracts or agreements are properly drafted and reviewed by a lawyer.

Considerations for Risk Transfer

When implementing risk transfer, businesses should consider the cost and the potential benefits of transferring the risk. They should also consider any legal or regulatory requirements that may be applicable, as well as any potential conflicts of interest. Additionally, businesses should ensure that any contracts or agreements are properly drafted and reviewed by a lawyer.

You might find these FREE courses useful

- Protect and Grow Your Freelancing Business

- Structure: Building the Frame for Business Growth

- Protecting Business Innovations via Patent

- European Business Law Specialization

Conclusion

Risk transfer is a strategy used by businesses to protect themselves from potential losses due to unforeseen circumstances. It can help businesses protect their assets and reduce their overall risk exposure, but it can also come with some risks. Businesses should assess their risk exposure, research potential insurance companies or other parties willing to take on the risk, and ensure that any contracts or agreements are properly drafted and reviewed by a lawyer.