Overview:

Risk management systems are an important part of any financial institution’s operations. Banks use these systems to monitor, analyze, and manage their financial risks. Risk management systems help banks identify potential risks and develop strategies to mitigate them. They also help banks comply with regulations, protect their assets, and ensure the safety of their customers’ deposits.

Types of Risk Management Systems:

There are a variety of risk management systems used by banks. These include credit risk management systems, market risk management systems, liquidity risk management systems, operational risk management systems, and fraud risk management systems. Each of these systems has its own set of tools and techniques that help banks identify and manage risks.

Benefits of Risk Management Systems:

Risk management systems provide banks with a number of benefits. These systems help banks identify potential risks and take steps to mitigate them. This can help banks protect their assets and reduce the chances of losses. Risk management systems also help banks comply with regulations and ensure the safety of their customers’ deposits.

Risk Management Strategies:

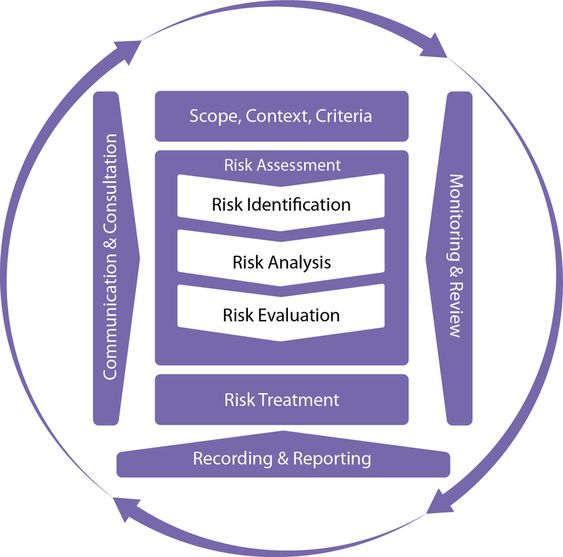

Banks use a variety of strategies to manage risks. These strategies include identifying potential risks, developing risk management plans, monitoring and analyzing risks, and taking corrective action when necessary. Banks also use risk mitigation strategies such as diversification, hedging, and insurance to reduce their exposure to risks.

Risk Management Tools:

Banks use a variety of tools to manage risks. These tools include risk assessment tools, risk monitoring tools, and risk management software. Risk assessment tools help banks identify potential risks and develop strategies to mitigate them. Risk monitoring tools help banks monitor and analyze risks, while risk management software helps banks automate their risk management processes.

Data Analysis:

Banks use data analysis to identify potential risks and develop strategies to mitigate them. Data analysis involves collecting, analyzing, and interpreting data to identify trends and patterns. Banks use this data to identify potential risks and develop strategies to mitigate them.

Regulatory Requirements:

Banks must comply with a variety of regulatory requirements when it comes to risk management. These requirements vary from country to country, but generally require banks to have risk management systems in place and to report on their risk management activities.

You might find these FREE courses useful

- Corporate Finance II: Financing Investments and

- Financial Risk Management with R

- Information Systems Auditing, Controls and

Conclusion:

Risk management systems are an important part of any financial institution’s operations. Banks use these systems to monitor, analyze, and manage their financial risks. Risk management systems help banks identify potential risks and develop strategies to mitigate them. They also help banks comply with regulations, protect their assets, and ensure the safety of their customers’ deposits.