Operational risk is not a new concept in the banking industry. Risks associated with operational failures stemming from events such as processing errors, internal and external fraud, legal claims, and business disruptions have existed at financial institutions since the inception of banking.

As this article will discuss, one of the great challenges in systematically managing these types of risks is that operational losses can be quite diverse in their nature and highly unpredictable in their overall financial impact. Banks have traditionally relied on appropriate internal processes, audit programs, insurance protection, and other risk management tools to counteract various aspects of operational risk.

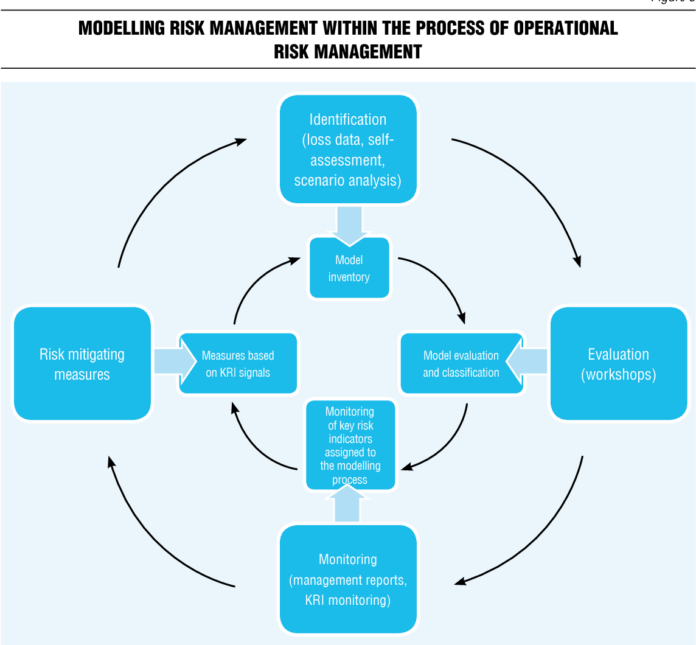

These tools remain of paramount importance; however, growing complexity in the banking industry, several large and widely publicized operational losses in recent years, and a changing regulatory capital regime have prompted both banks and banking supervisors to increasingly view operational risk management (ORM) as an evolving discipline. Of particular note is the application of quantitative concepts, similar to those used to measure credit and market risks, to the measurement of operational risk.

This book provides an introduction to operational risk, outlines the current state of ORM, and describes different quantification approaches in this evolving field.

Operational risk definition in banking

The definition of operational risk continues to evolve, in part owing to its scope. Before attempting to define the term, it is essential to understand that operational risk is present in all activities of an organization. As a result, some of the earliest practitioners defined operational risk as every risk source that lies outside the areas covered by market risk and credit risk.

But this definition of operational risk includes several other risks (such as interest rate, liquidity, and strategic risk) that banks manage and does not lend itself to the management of operational risk per se. As part of the revised Basel framework,1 the Basel Committee on Banking Supervision set forth the following definition:

Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. This definition includes legal risk but excludes strategic and reputational risk.