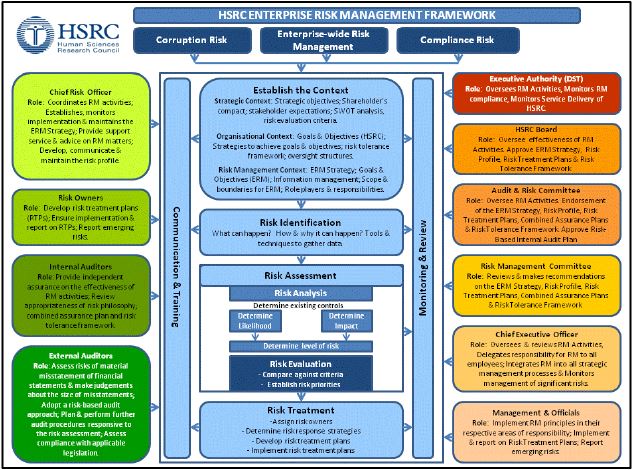

Introduction to Enterprise Risk Management

Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives.

ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization’s objectives (threats and opportunities), assessing them in terms of likelihood and magnitude of impact, determining a response strategy, and monitoring the process.

By identifying and proactively addressing risks and opportunities, business enterprises protect and create value for their stakeholders, including owners, employees, customers, regulators, and society overall.

ERM can also be described as a risk-based approach to managing an enterprise, integrating concepts of internal control, the Sarbanes–Oxley Act, data protection, and strategic planning.

ERM is evolving to address the needs of various stakeholders, who want to understand the broad spectrum of risks facing complex organizations to ensure they are appropriately managed. Regulators and debt rating agencies have increased their scrutiny of the risk management processes of companies.

What is Enterprise Risk Management Framework?

There are various important ERM frameworks, each of which describes an approach for identifying, analyzing, responding to, and monitoring risks and opportunities, within the internal and external environment facing the enterprise.

Management selects a risk response strategy for specific risks identified and analyzed, which may include:

- Avoidance: exiting the activities giving rise to the risk

- Reduction: taking action to reduce the likelihood or impact related to the risk

- Alternative Actions: deciding and considering other feasible steps to minimize risks

- Share or Insure: transferring or sharing a portion of the risk, to finance it

- Accept: no action is taken, due to a cost/benefit decision

Monitoring is typically performed by management as part of its internal control activities, such as review of analytical reports or management committee meetings with relevant experts, to understand how the risk response strategy is working and whether the objectives are being achieved.