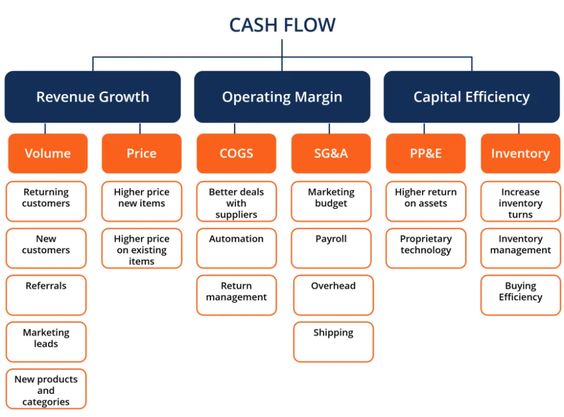

Cash flow analysis is a method of analyzing the financial performance of a business by examining the amount of cash that is coming in and out of the business. It is a way to measure the liquidity of a business and its ability to meet short-term and long-term obligations. The analysis is used to identify potential problems and opportunities in the business and to make informed decisions about how to manage the company’s finances.

The Benefits of Cash Flow Analysis

Cash flow analysis can provide valuable insights into the financial health of a business. It can help identify potential areas of concern and opportunities for improvement. It can also provide a better understanding of the company’s financial position and its ability to meet its obligations. This can help to inform business decisions and strategies, such as whether to invest in new equipment or hire additional staff.

How to Perform Cash Flow Analysis

Cash flow analysis can be performed using a variety of methods. The most common method is to analyze the company’s cash flow statement. This statement provides a detailed overview of the company’s cash inflows and outflows. It includes information such as sales, expenses, investments, and other financial transactions.

Cash Flow Ratios

Cash flow ratios are used to measure the company’s liquidity and its ability to meet short-term and long-term obligations. Common cash flow ratios include the operating cash flow ratio, the cash flow to debt ratio, and the cash flow to equity ratio. These ratios can provide valuable insights into the financial health of the business and help to identify potential areas of concern.

Cash Flow Forecasting

Cash flow forecasting is a process of predicting the future cash flows of a business. It is used to identify potential areas of risk and opportunities for improvement. It can also help to inform decisions about the company’s future investments and strategies.

Cash Flow Management

Cash flow management is the process of managing the company’s cash flows in order to maximize profits and minimize losses. It involves analyzing the company’s current and projected cash flows and making decisions about how to allocate the cash. This can include decisions about investments, debt repayment, and other financial transactions.

Cash Flow Statement

The cash flow statement is a financial statement that provides a detailed overview of the company’s cash inflows and outflows. It includes information such as sales, expenses, investments, and other financial transactions. This statement can be used to analyze the company’s liquidity and its ability to meet short-term and long-term obligations.

You might find these FREE courses useful

- Product Cost and Investment Cash Flow

- Accounting Analysis I: Measurement

- Valuation and Financial Analysis For Startups

- Financial Analysis of Organizations

Conclusion

Cash flow analysis is a valuable tool for analyzing the financial performance of a business. It can provide valuable insights into the company’s liquidity and its ability to meet short-term and long-term obligations. It can also help to identify potential areas of risk and opportunities for improvement. By analyzing the company’s cash flow statement, cash flow ratios, and cash flow forecasting, businesses can make informed decisions about how to manage their finances and maximize their profits.