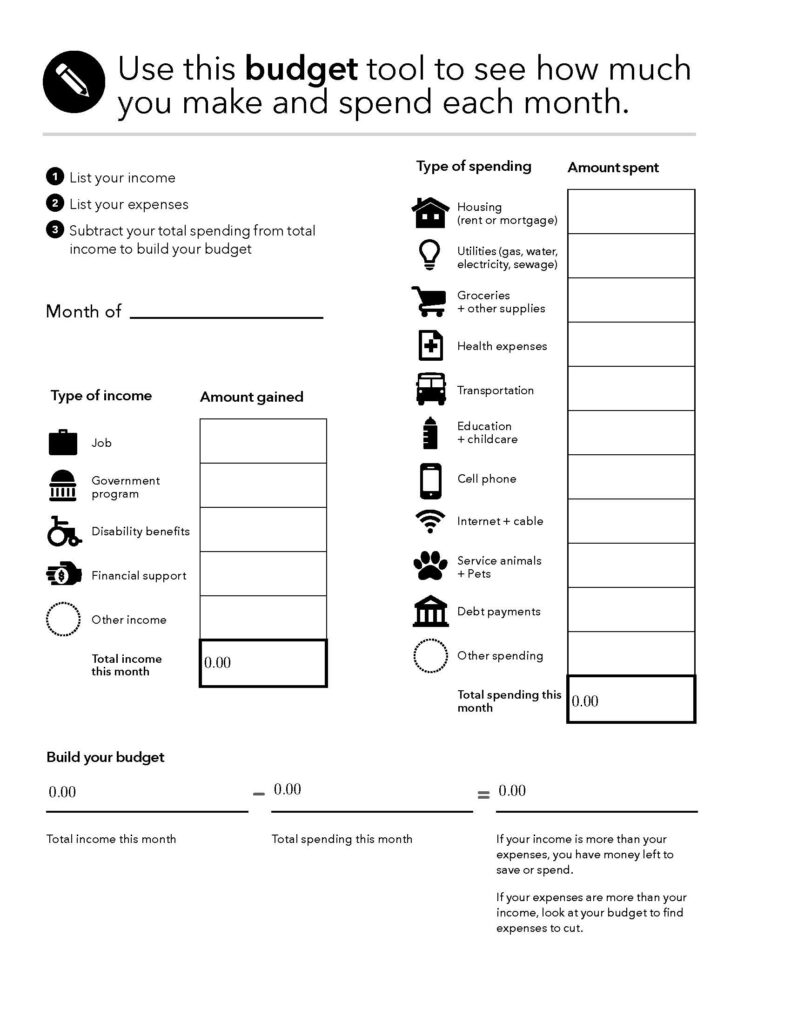

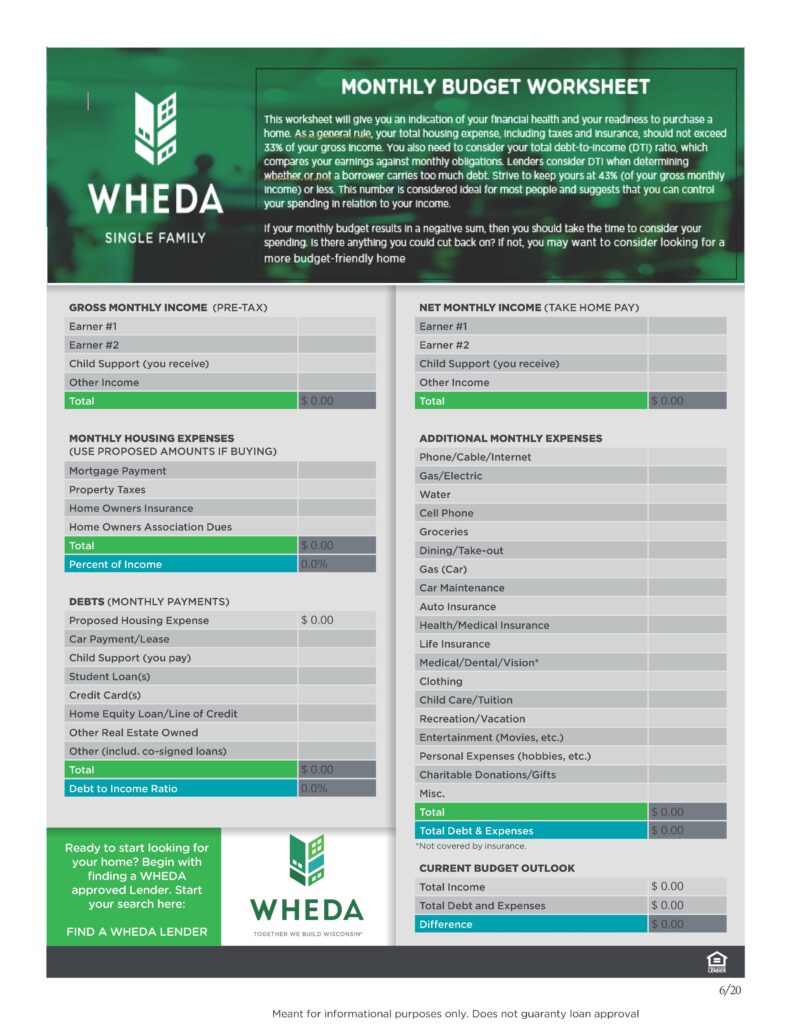

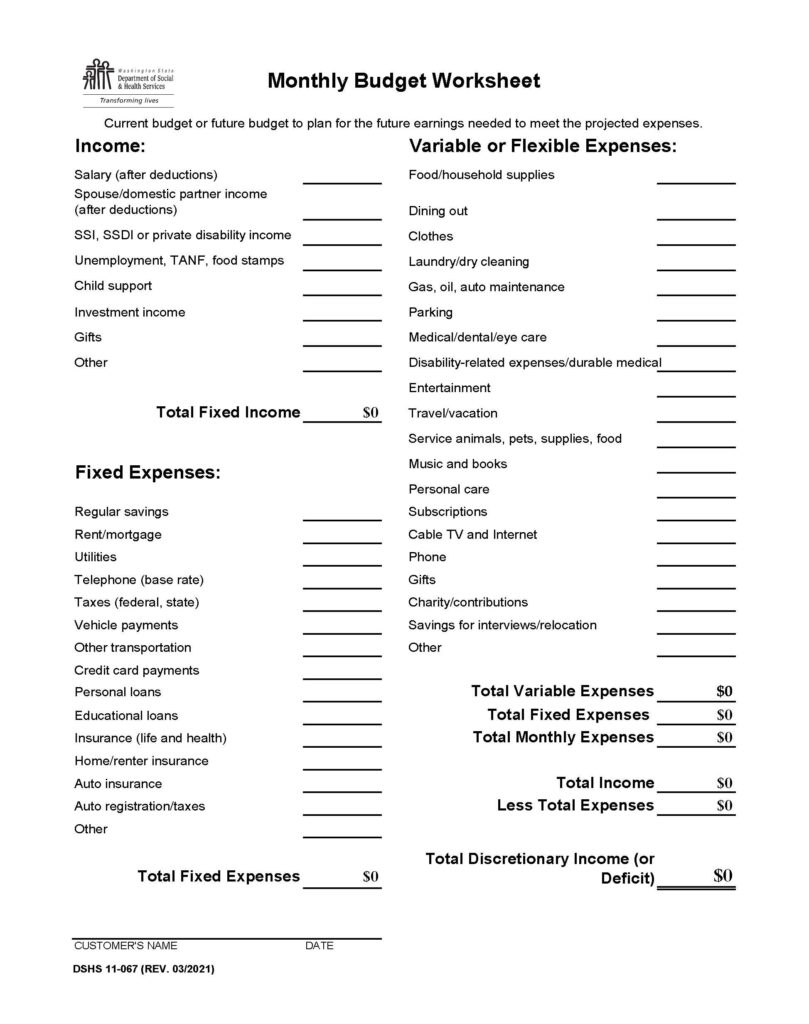

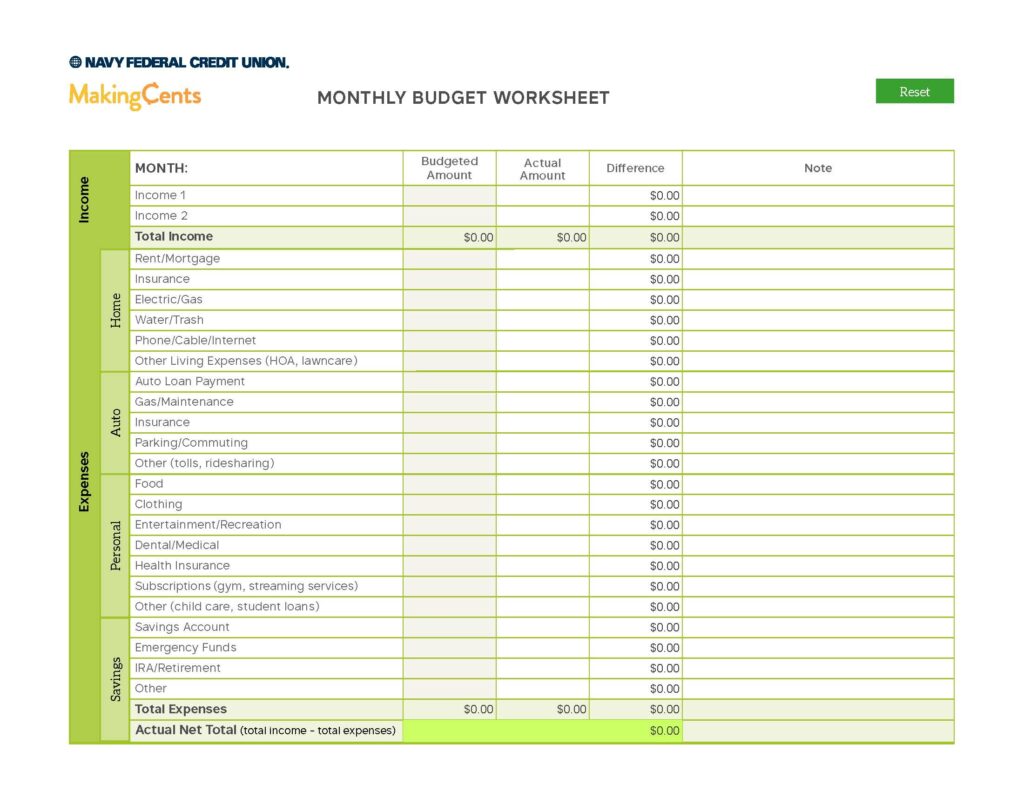

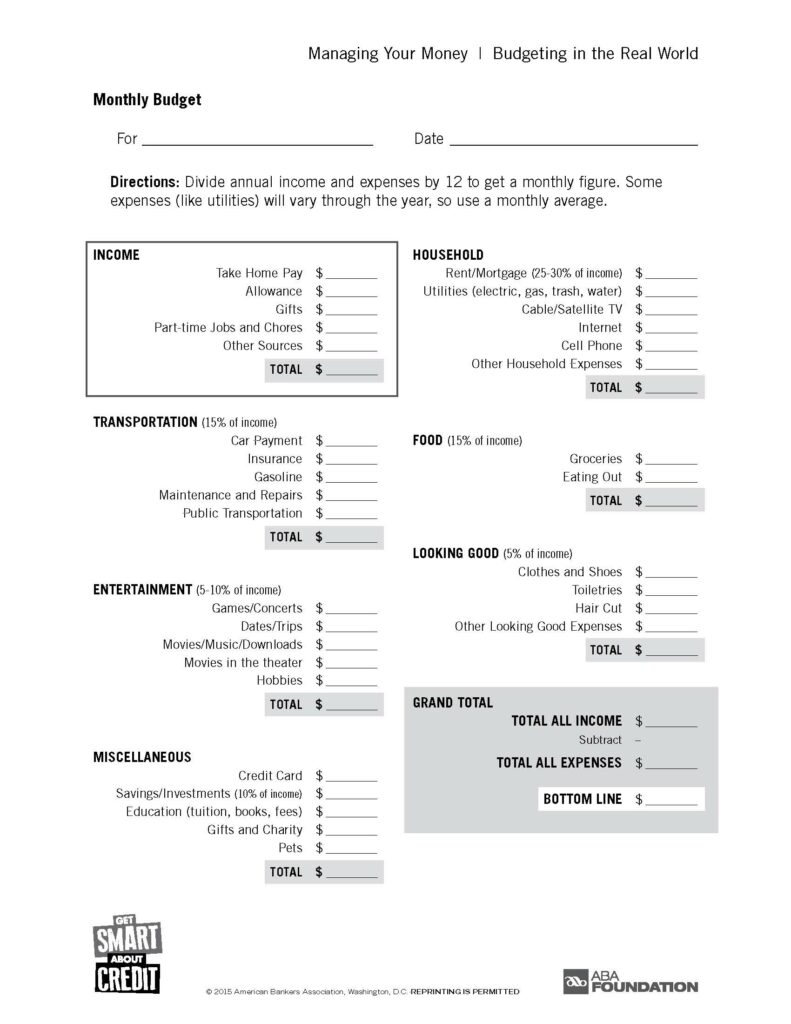

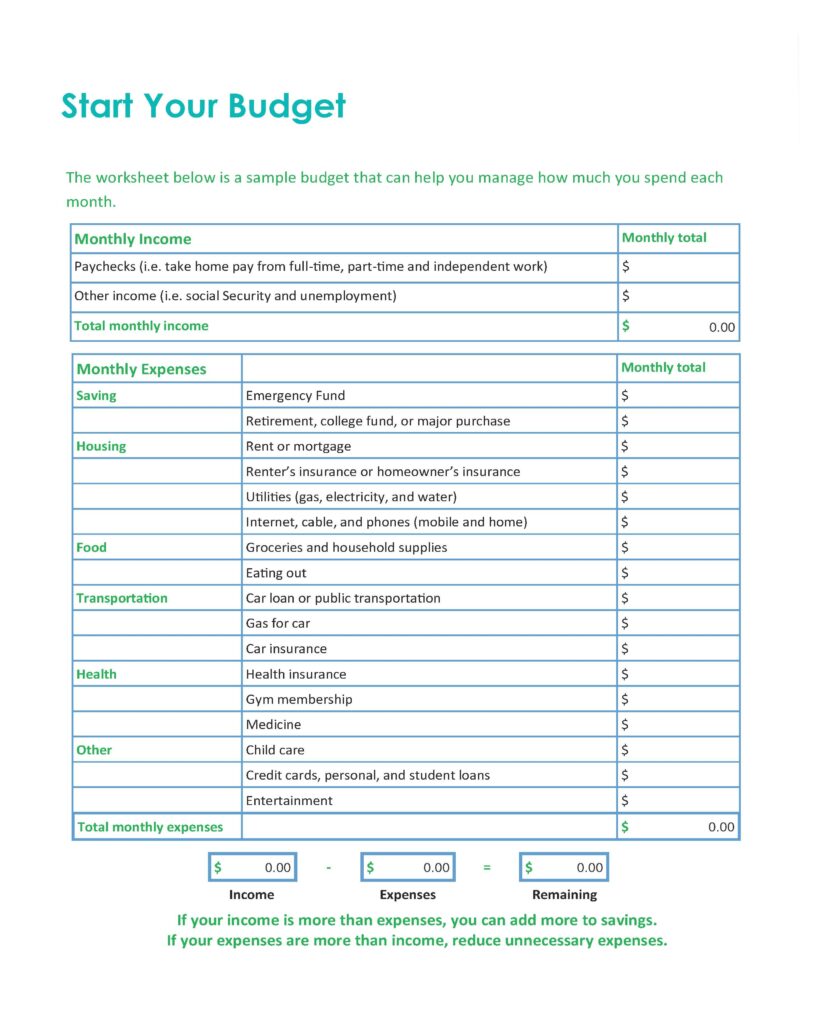

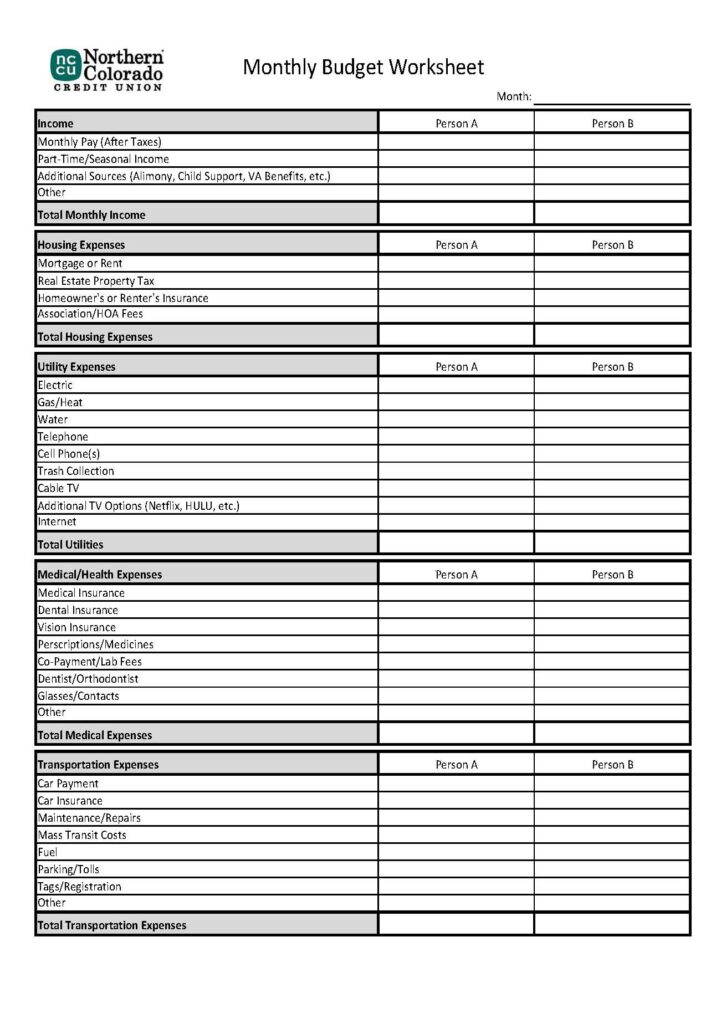

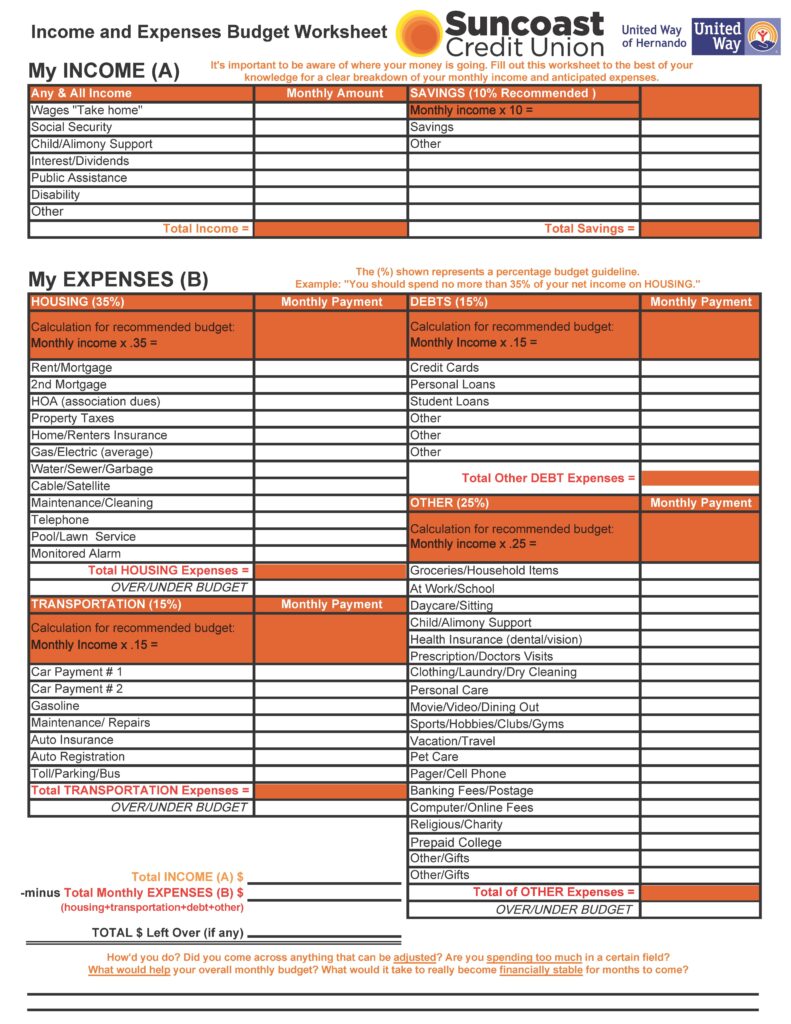

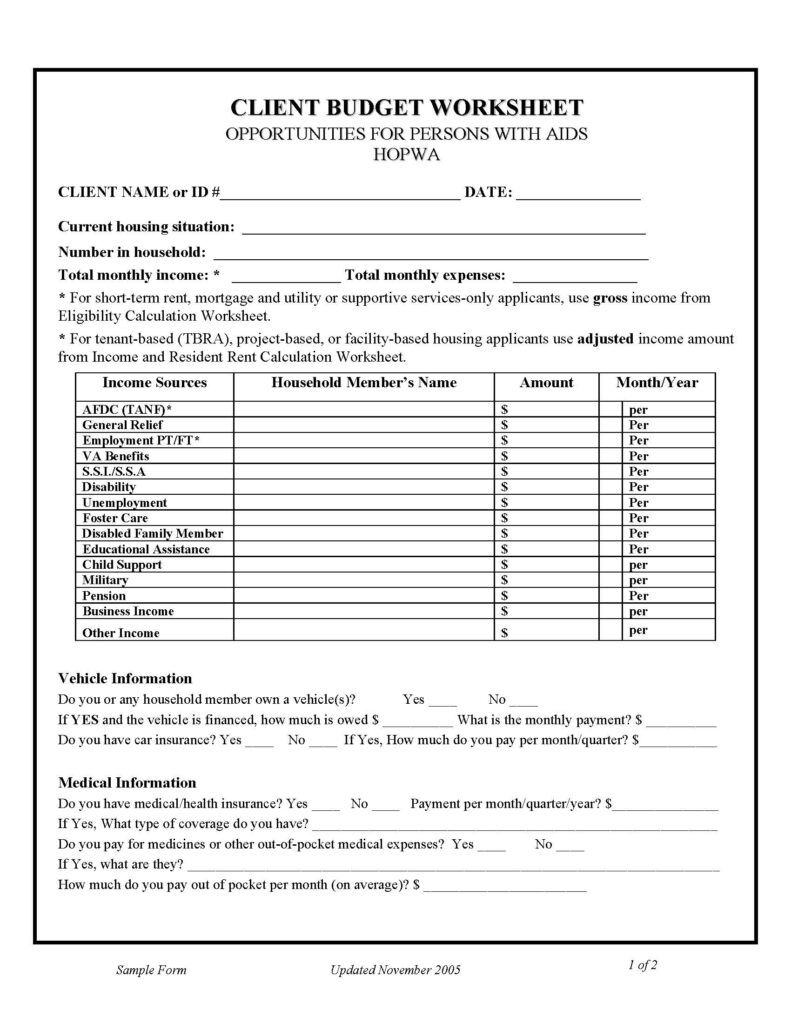

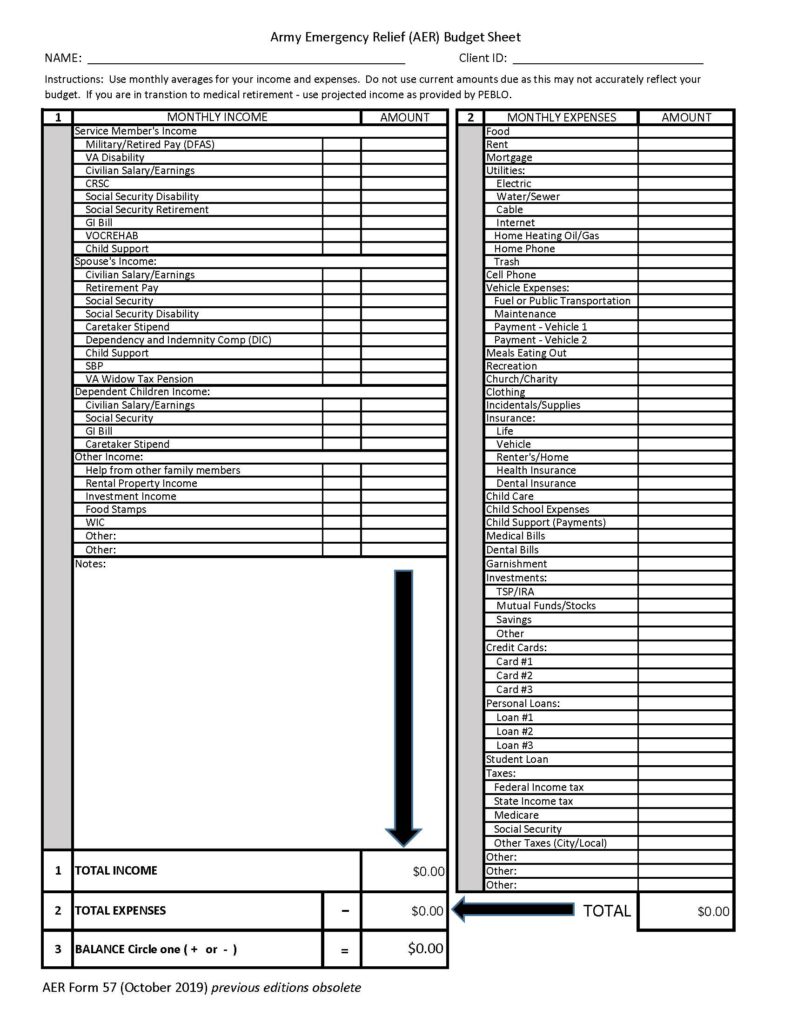

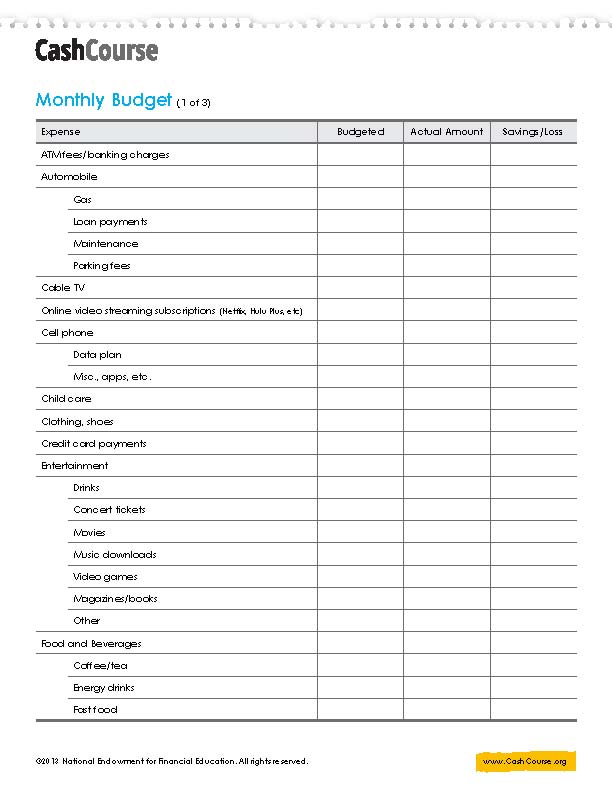

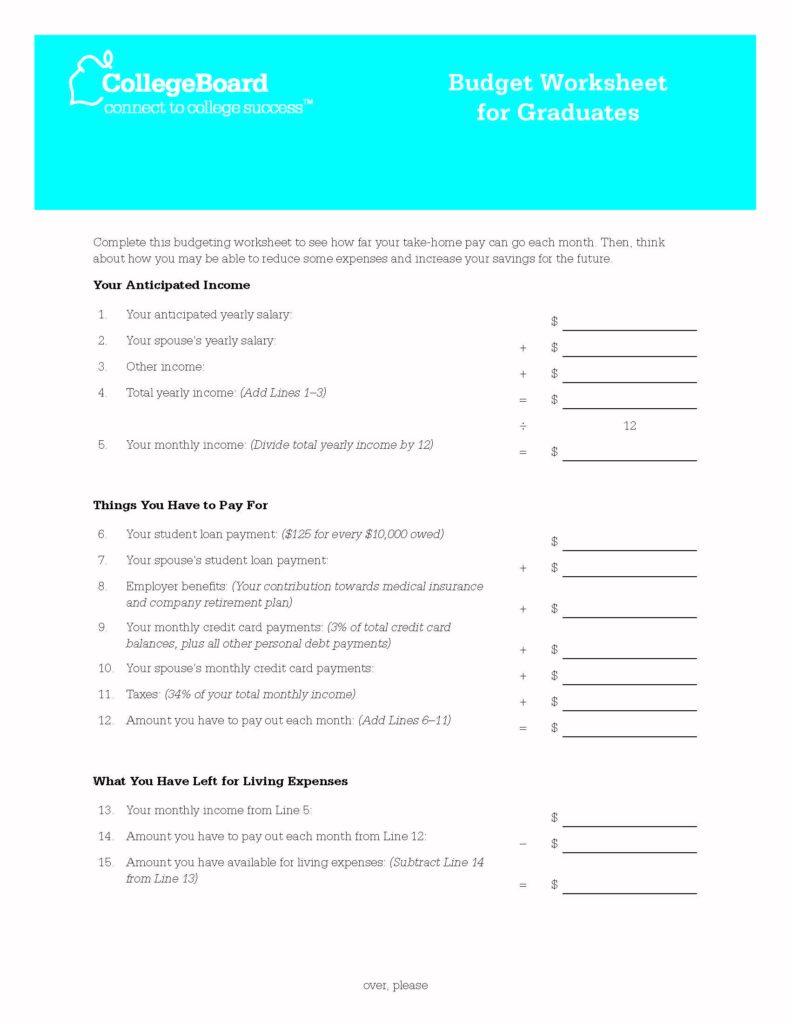

Worksheet for Creating a Monthly Budget

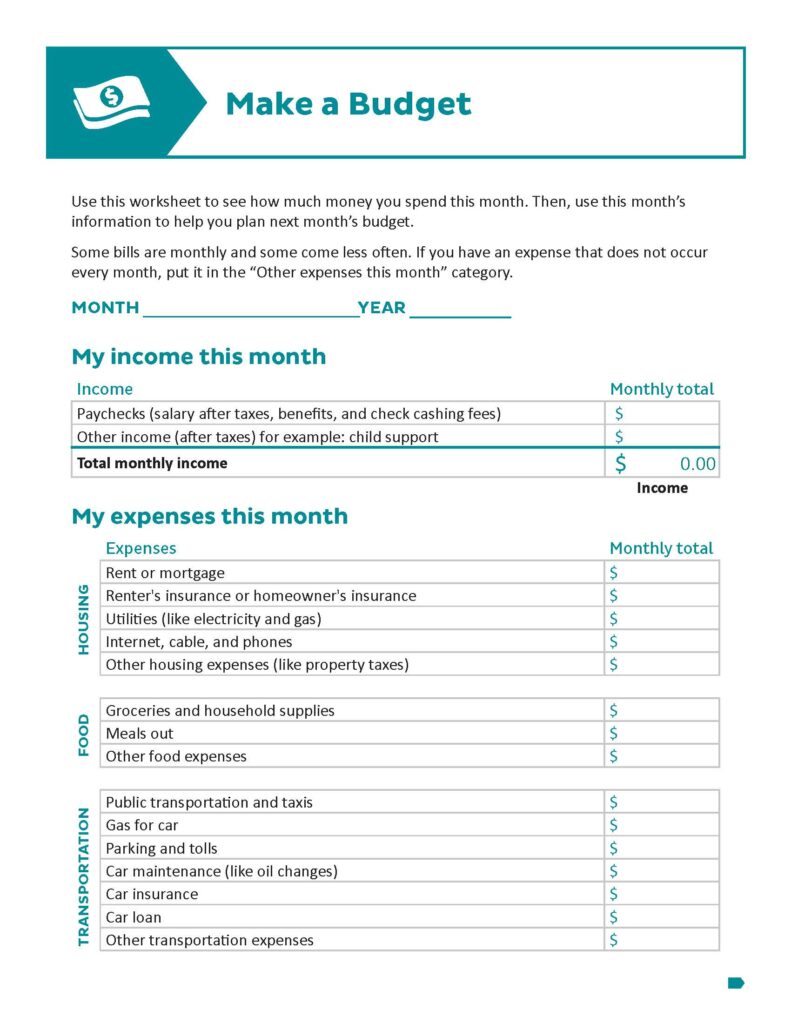

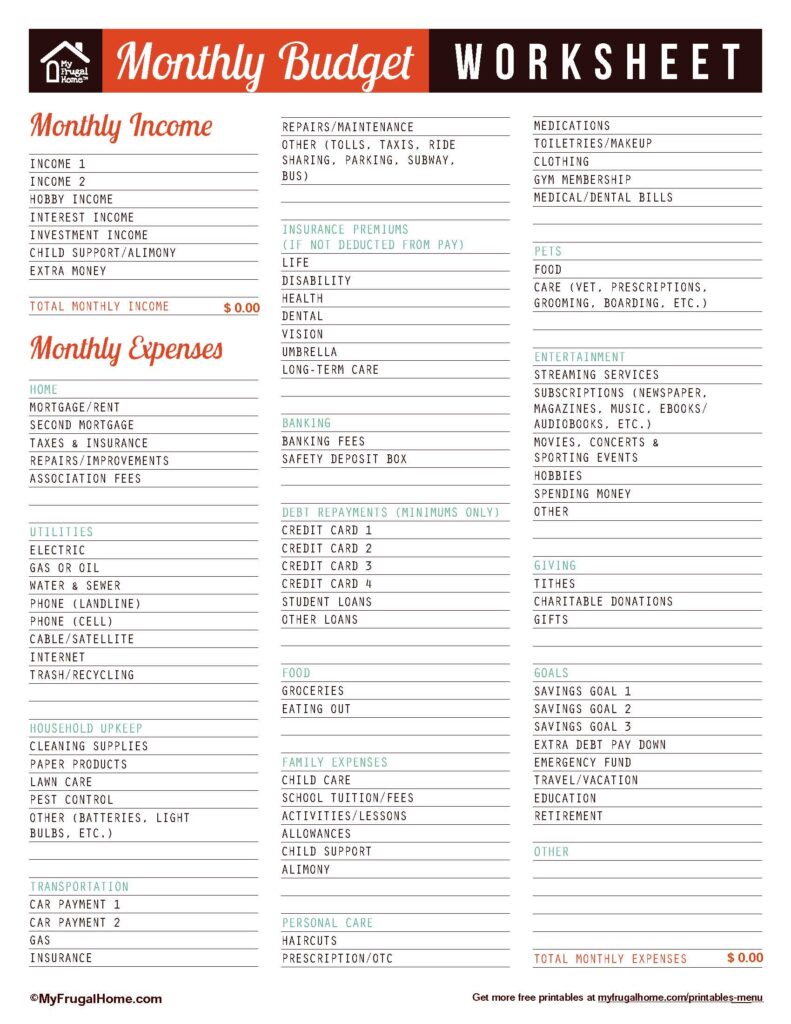

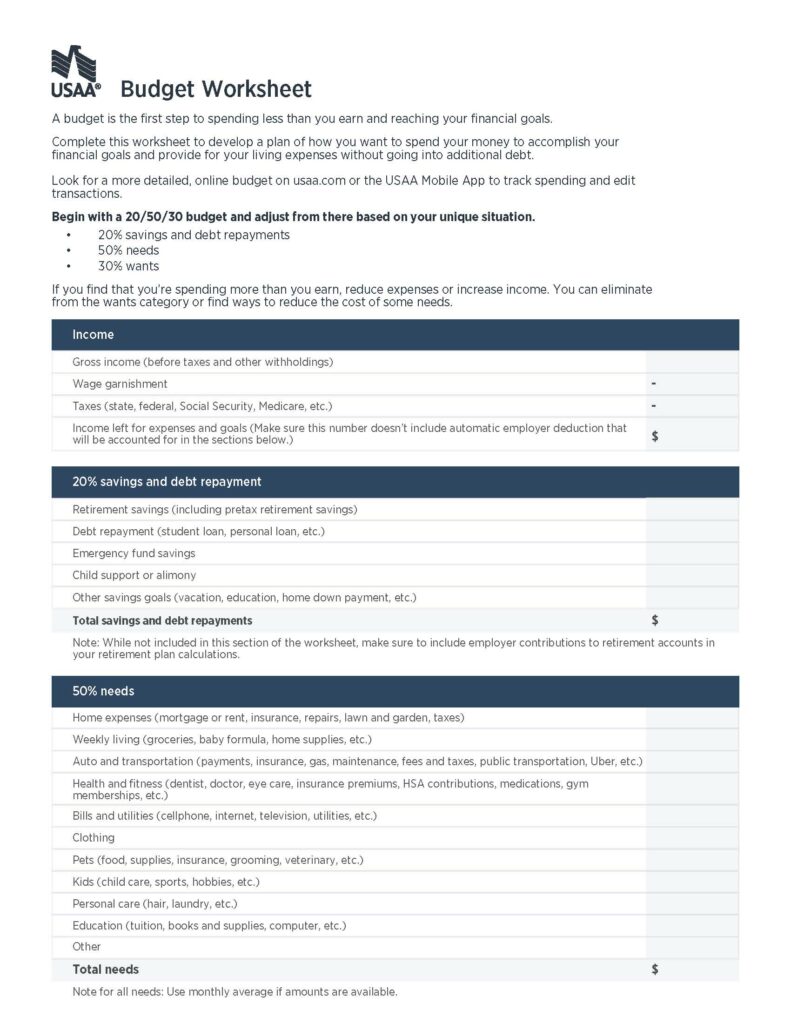

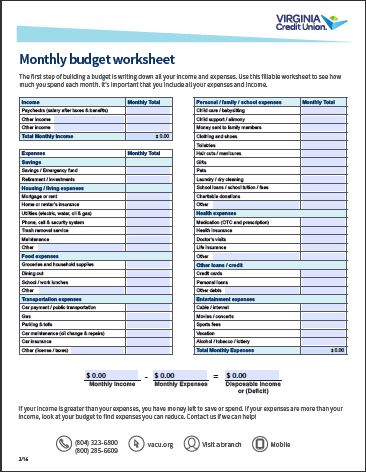

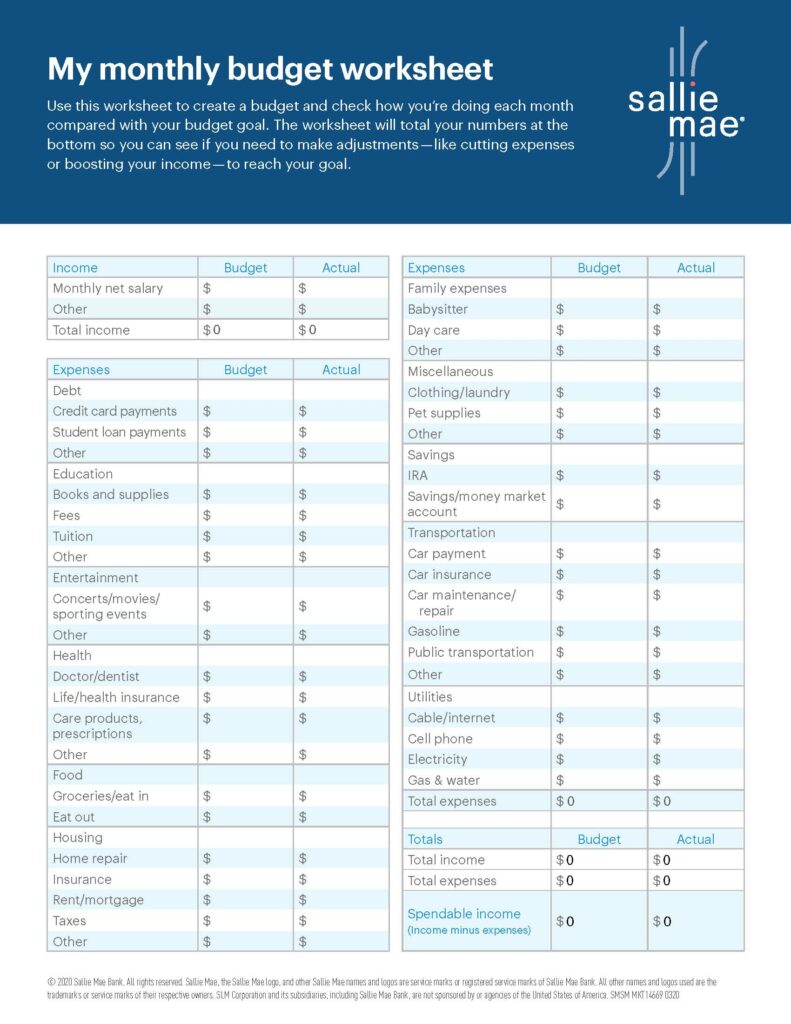

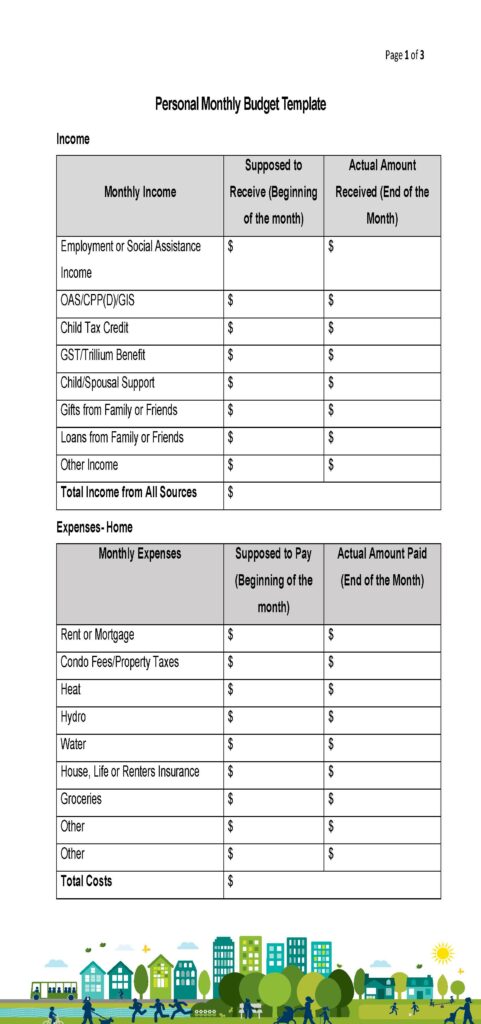

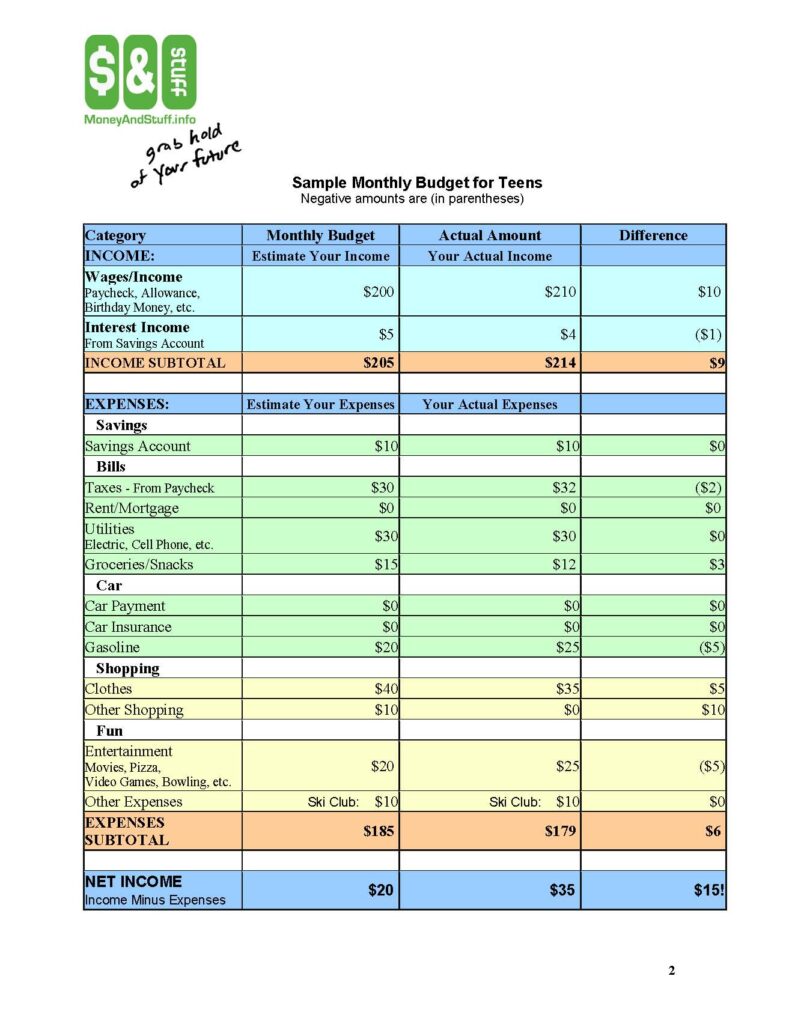

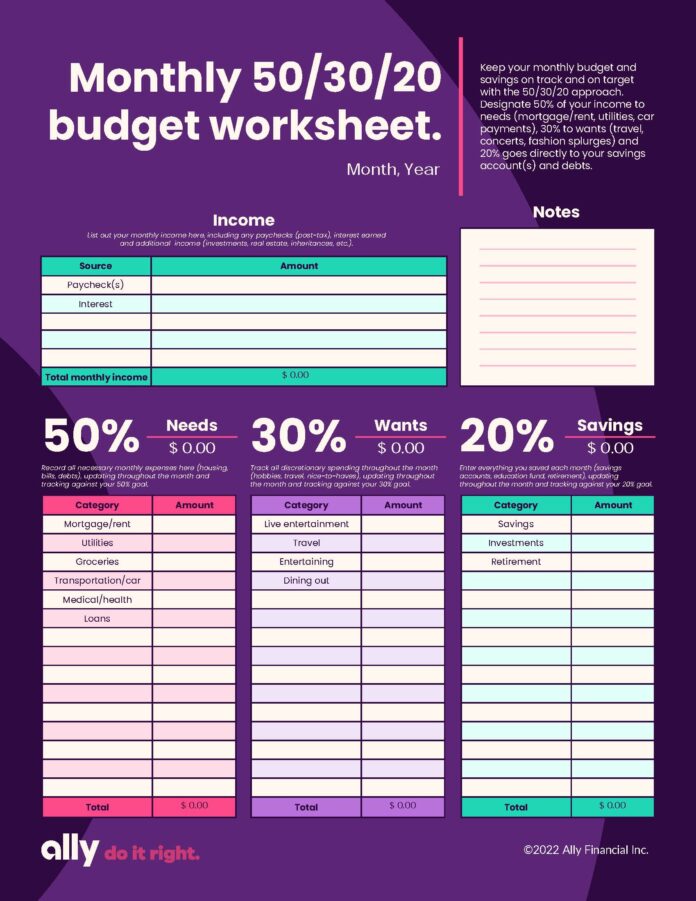

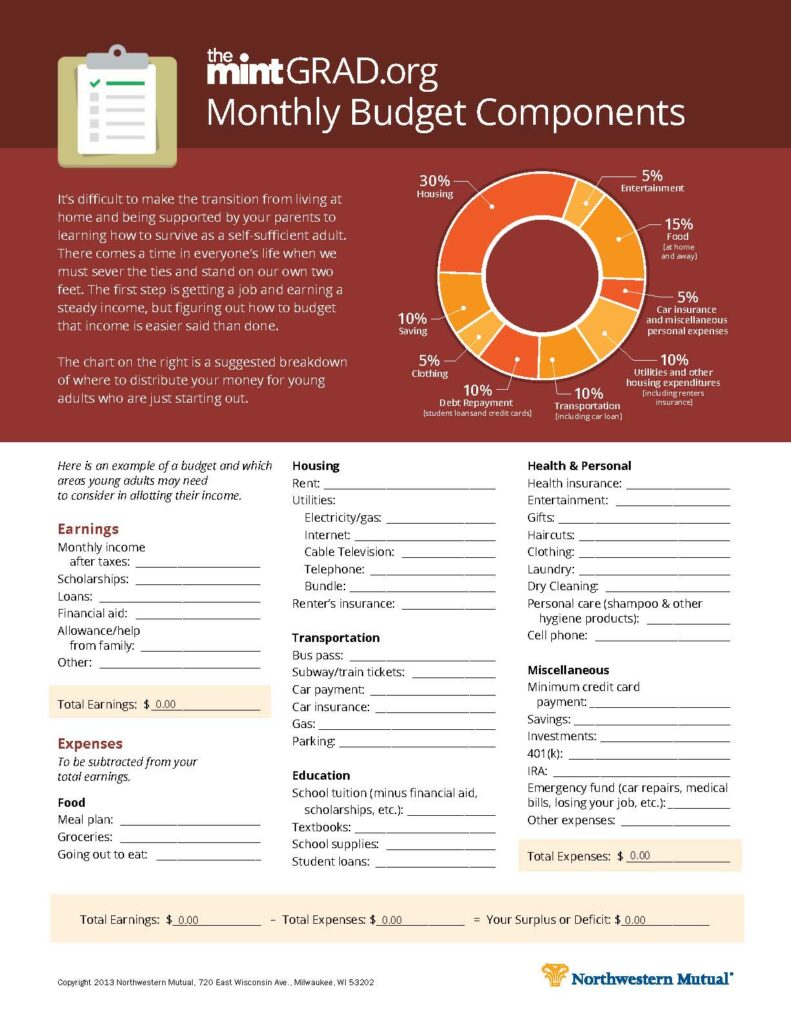

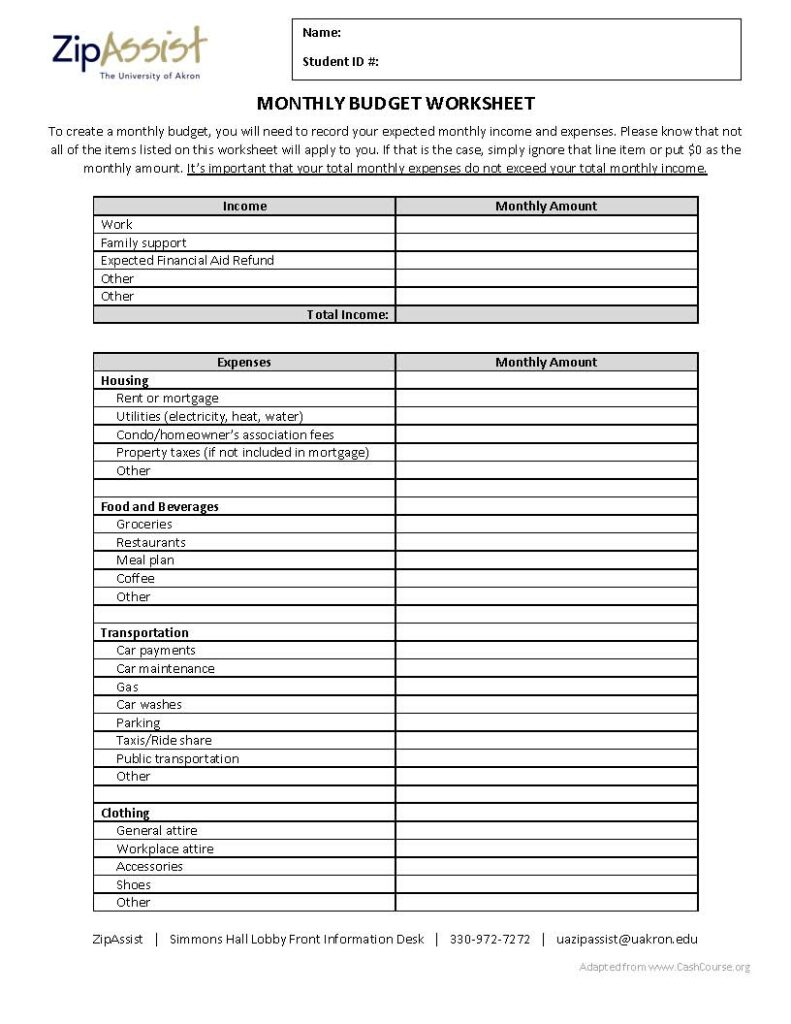

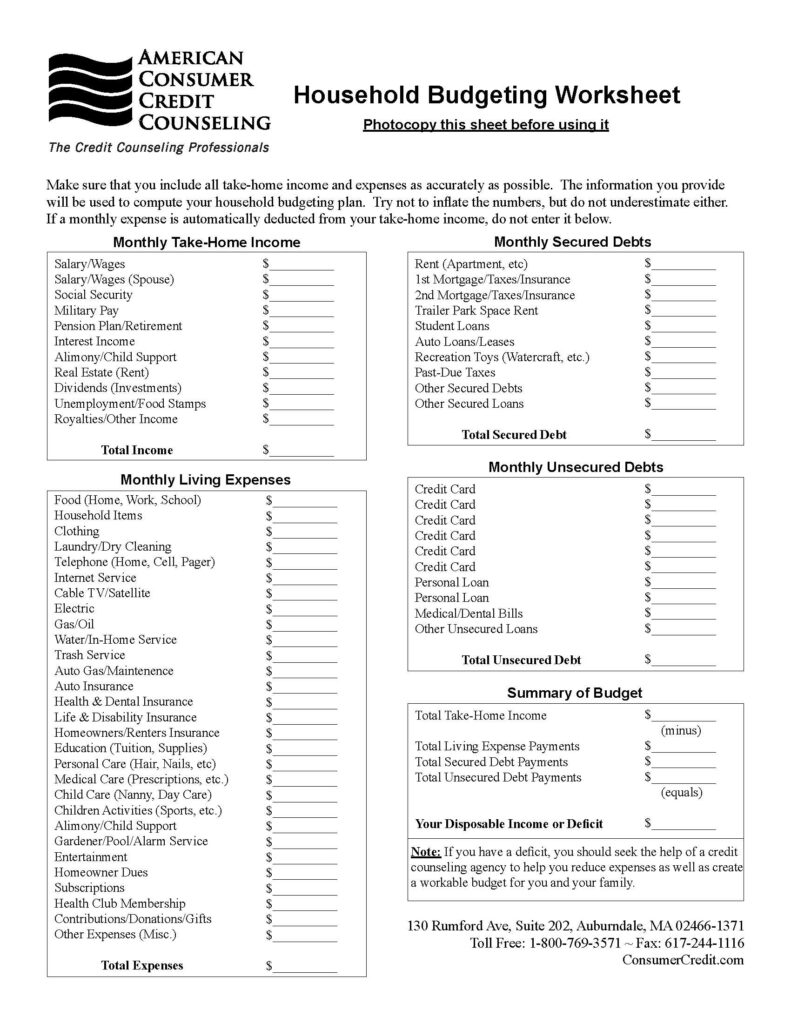

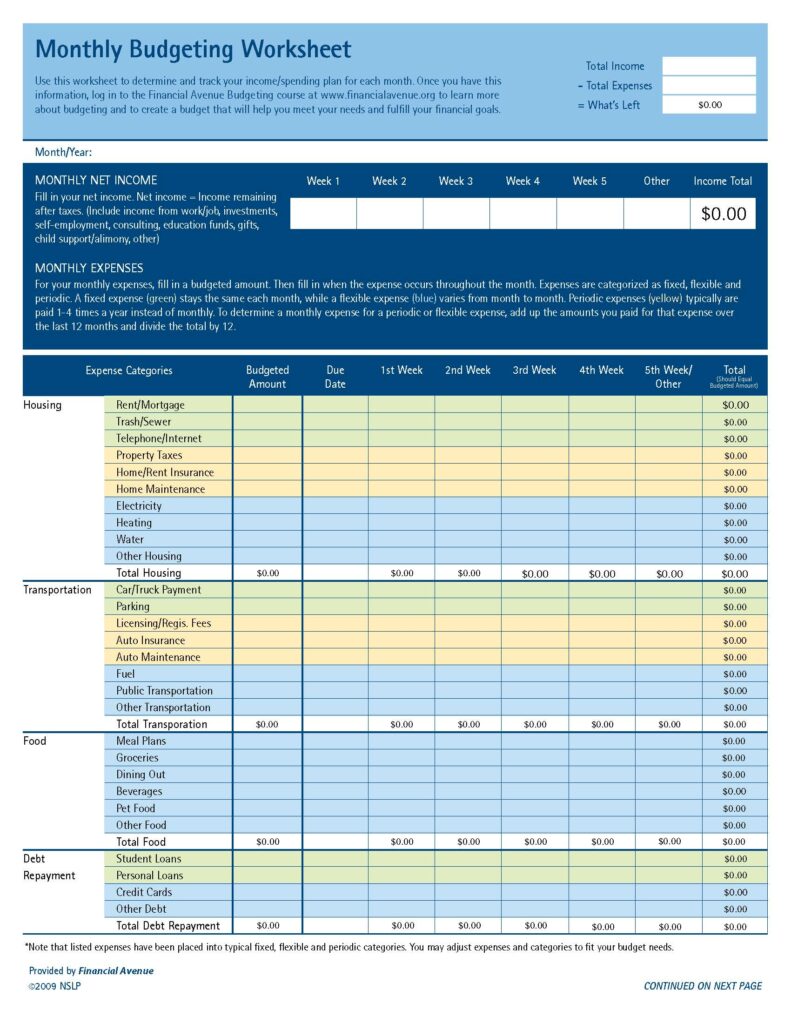

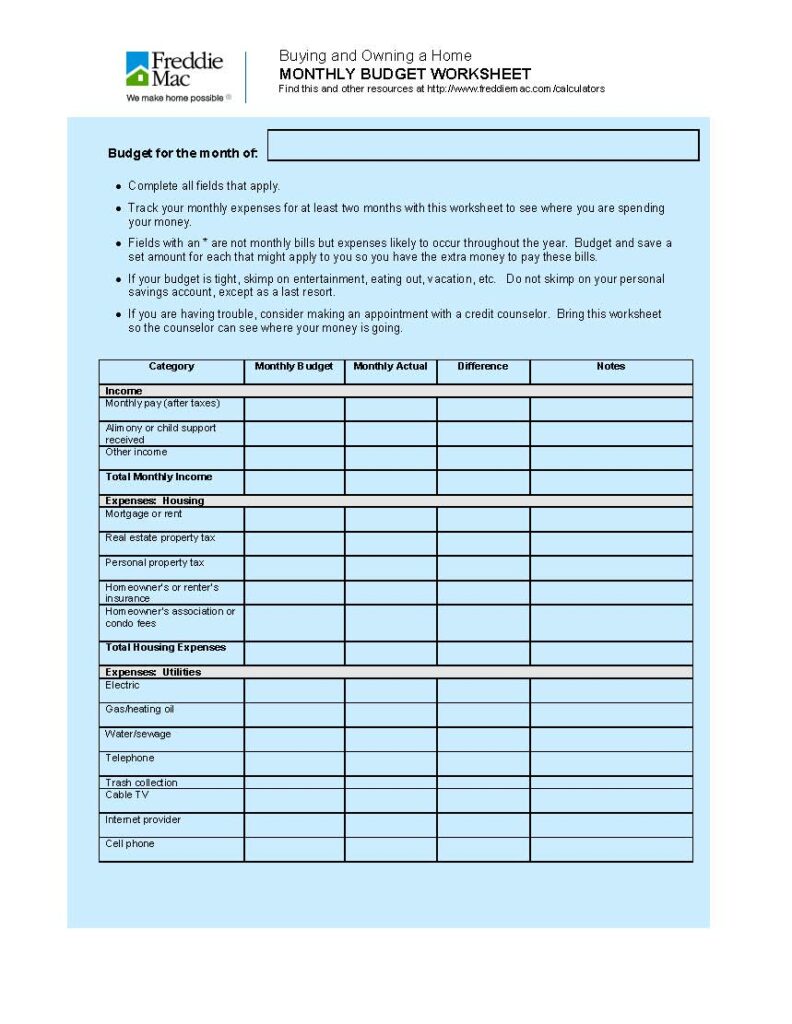

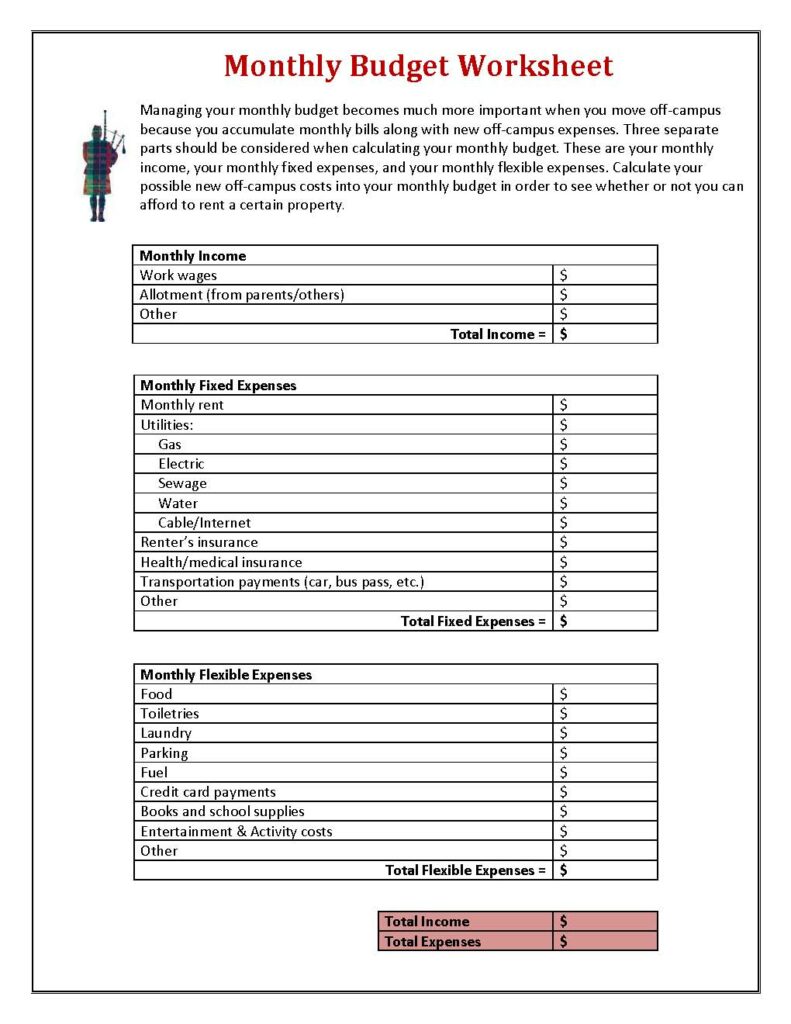

An effective budget worksheet may help you keep track of your expenses, spot spending patterns that can prevent overspending, and boost your ability to save money each month. You can acquire the framework you need from a monthly budget worksheet template to make sure you have a prepared and reliable worksheet on hand. You can achieve this by selecting one of our top-notch templates from the list above.

If you decide to write it yourself, use the steps listed below as a guide:

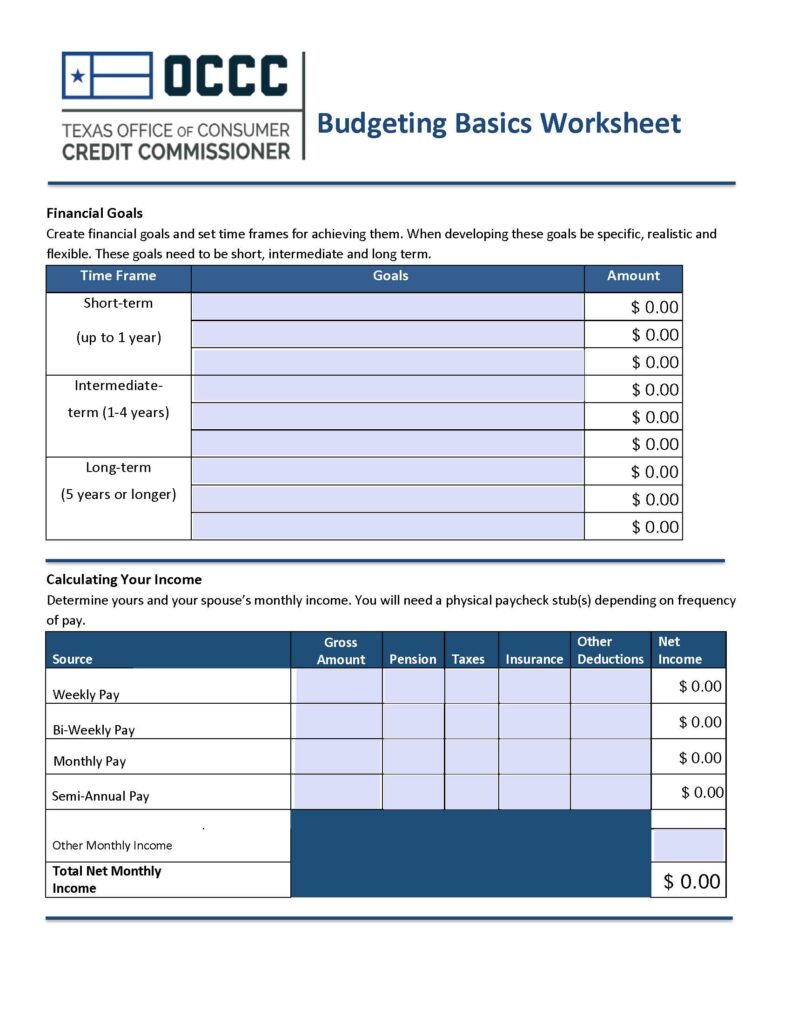

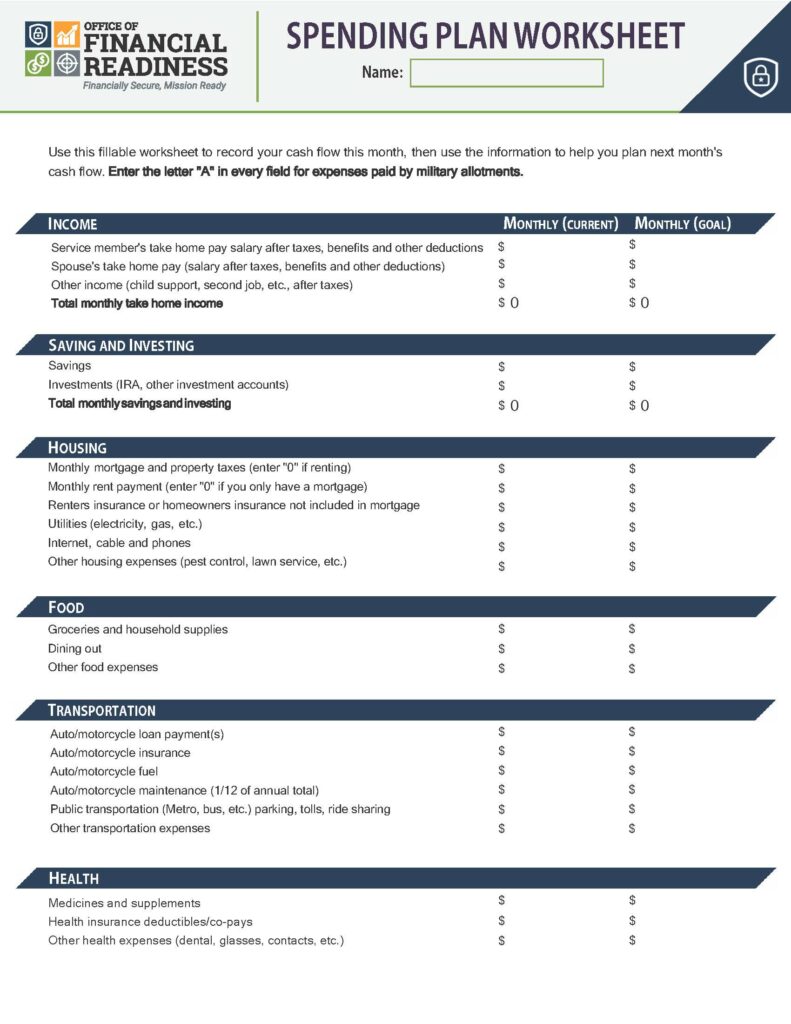

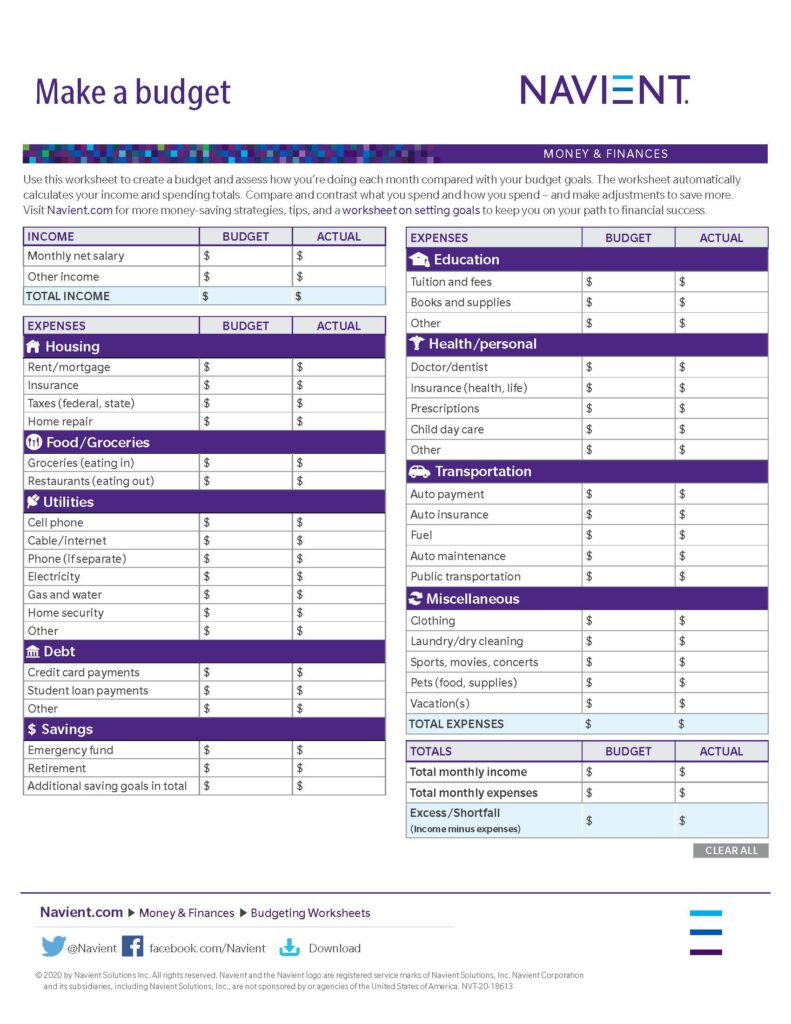

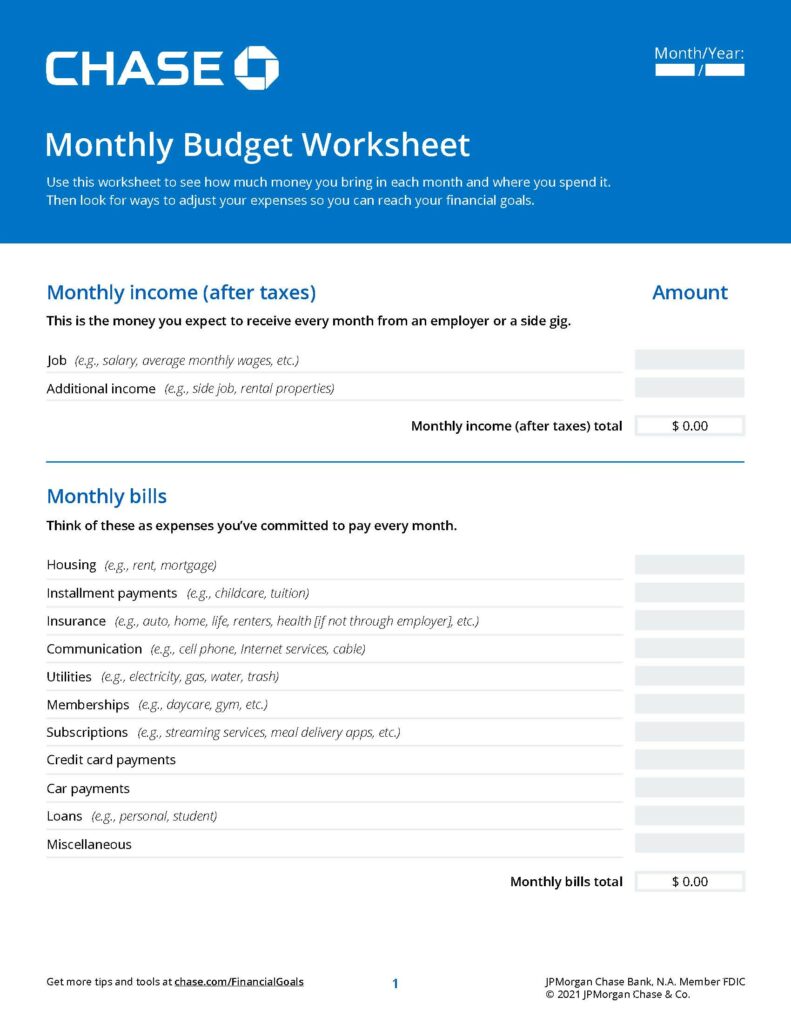

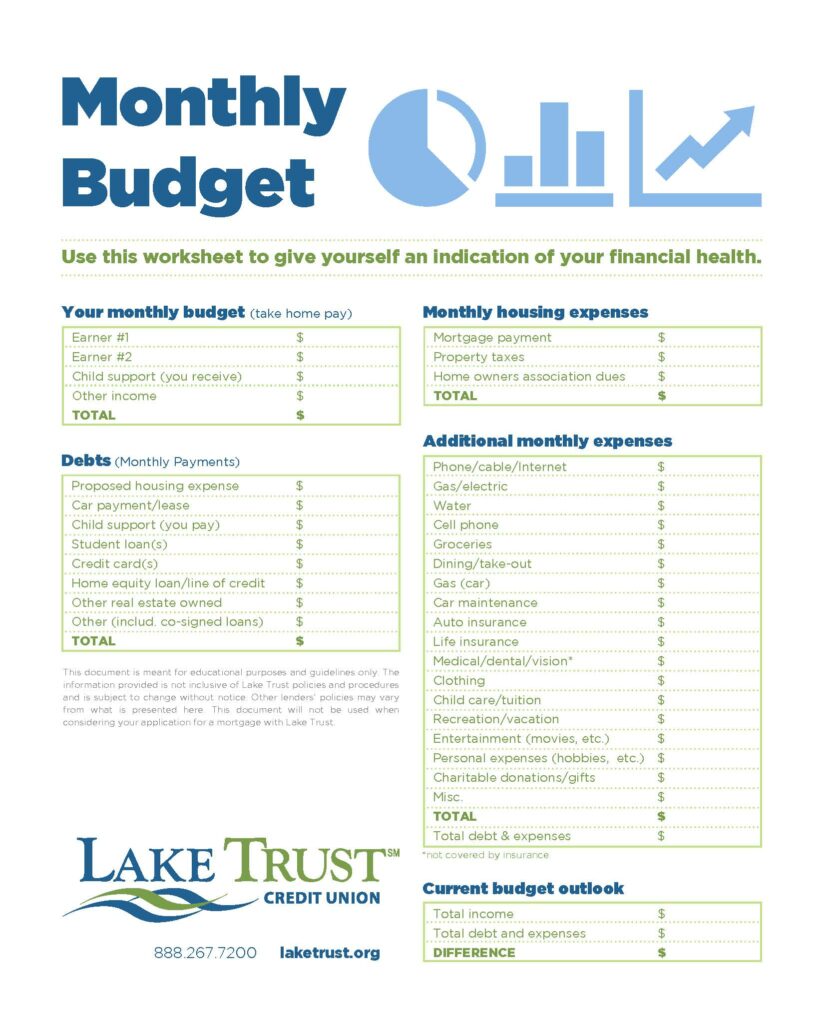

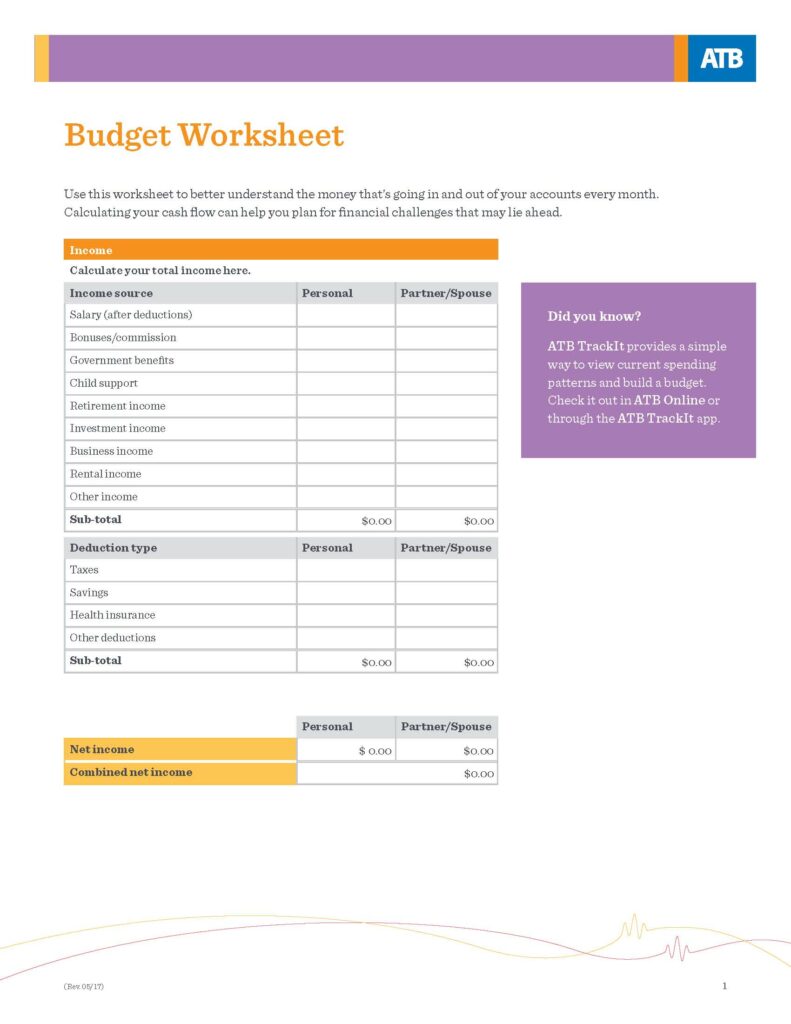

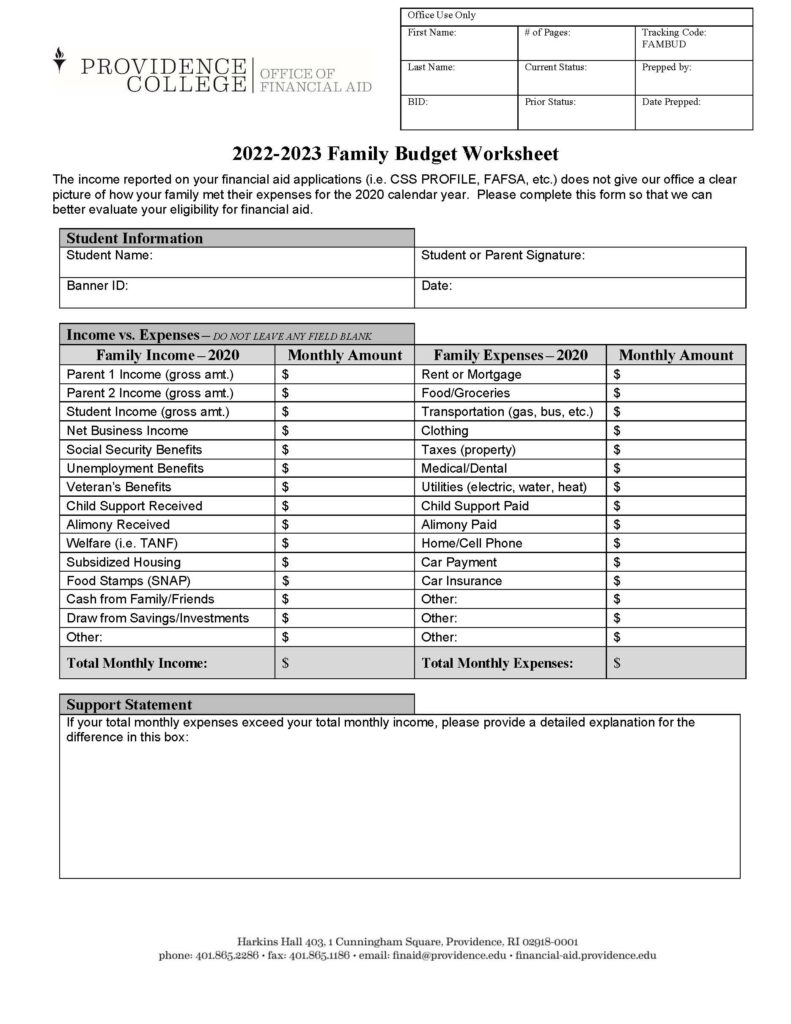

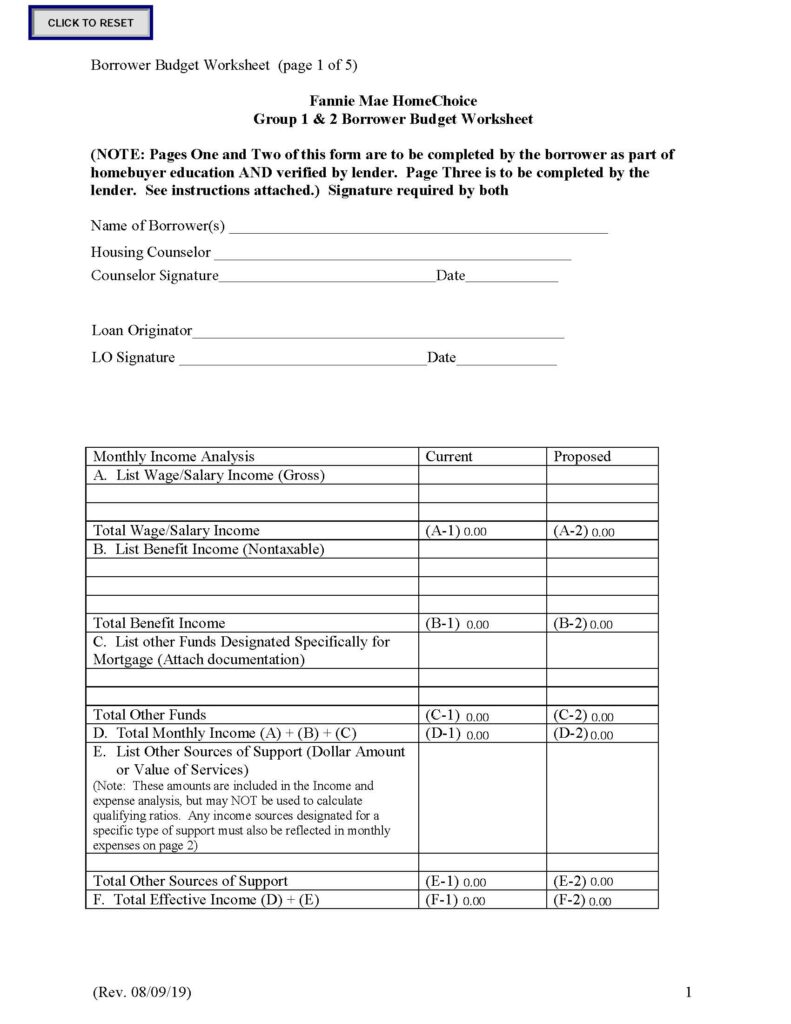

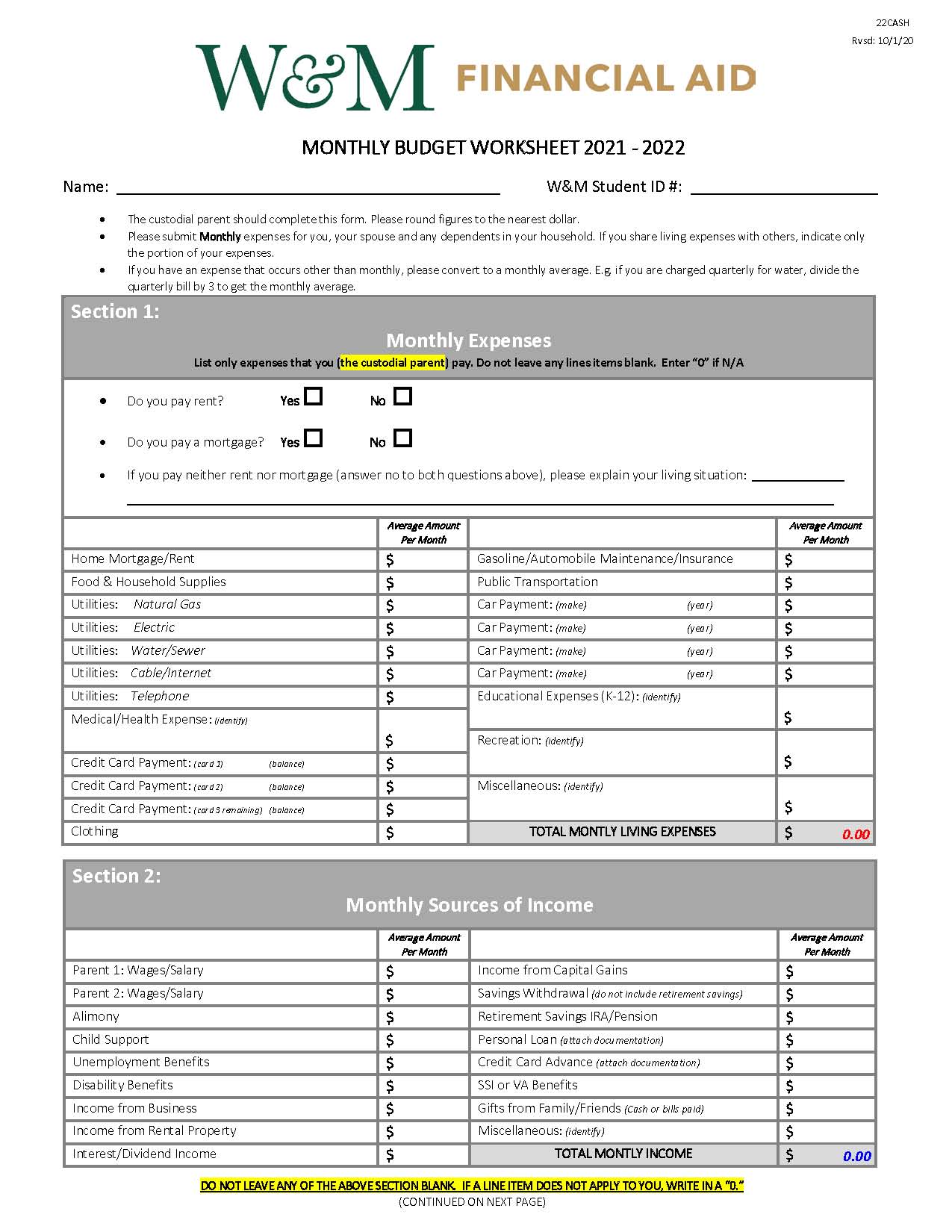

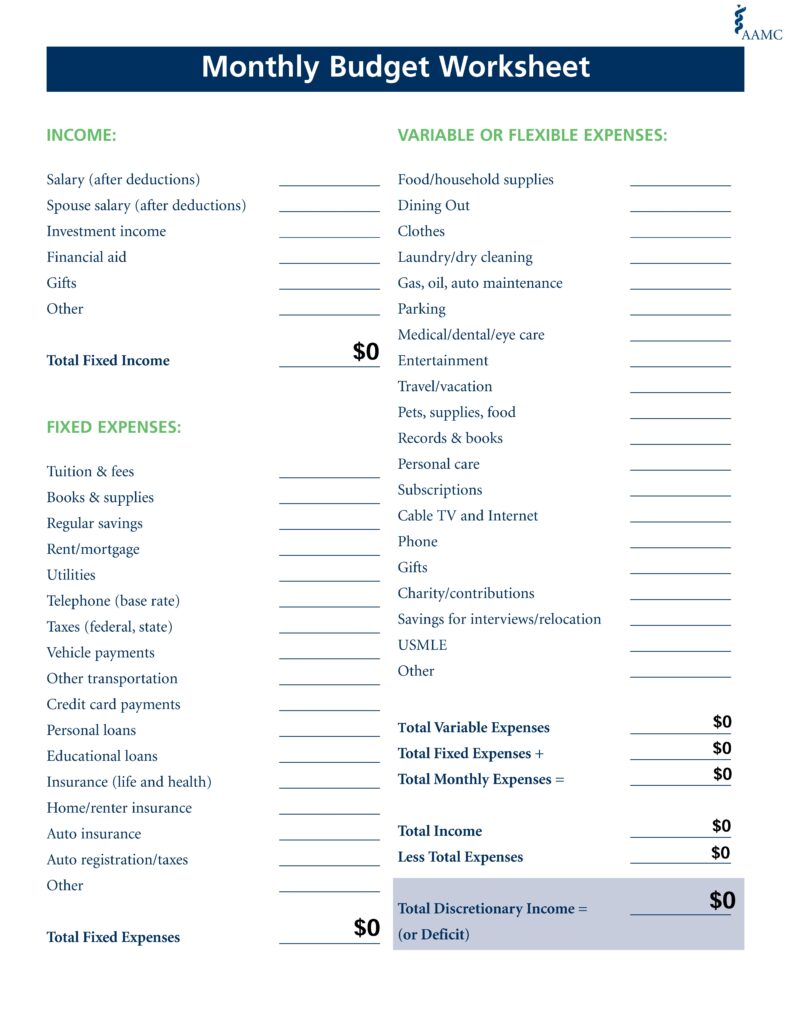

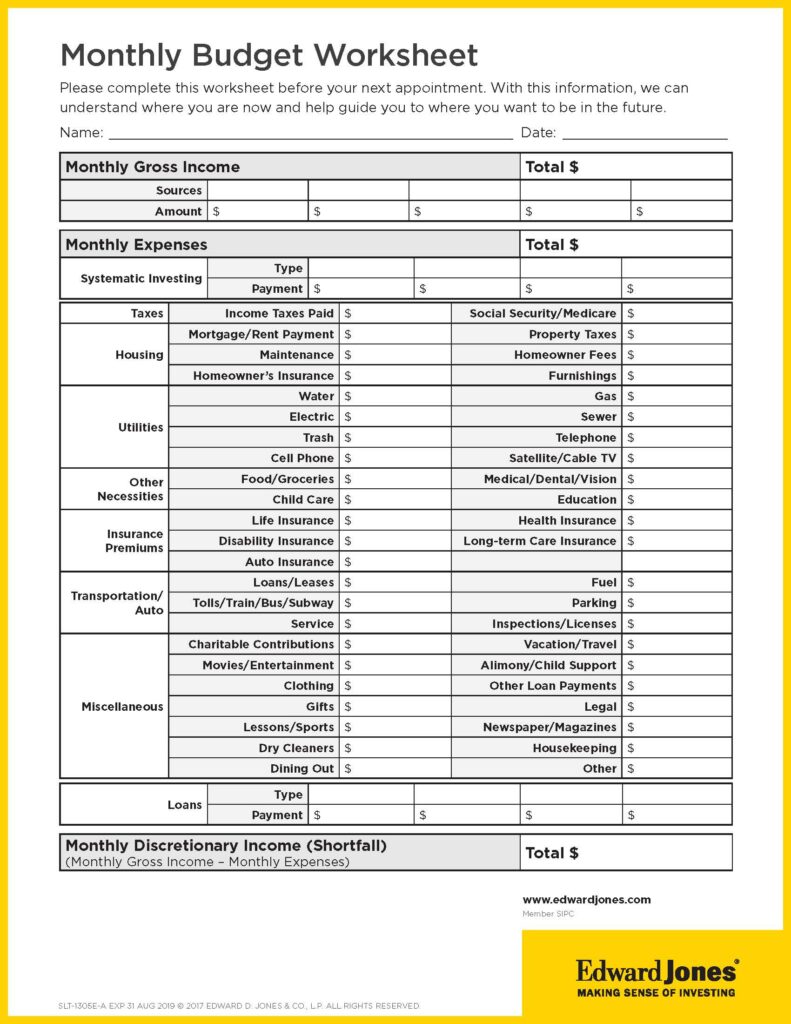

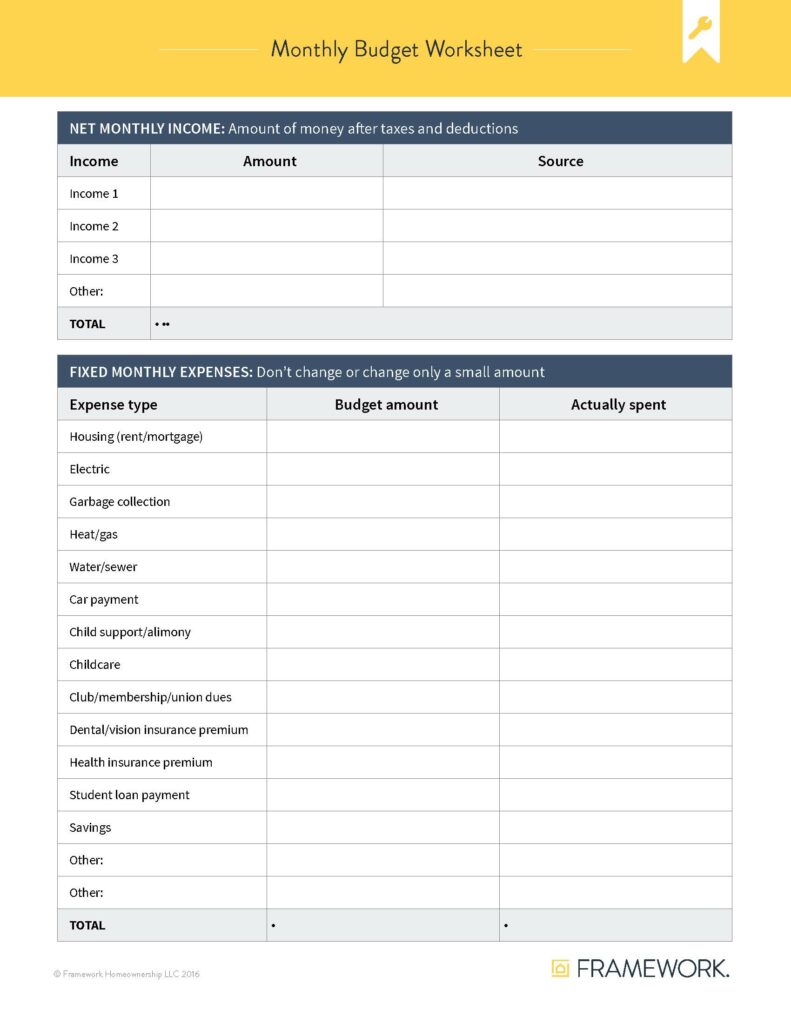

First, figure out your net income

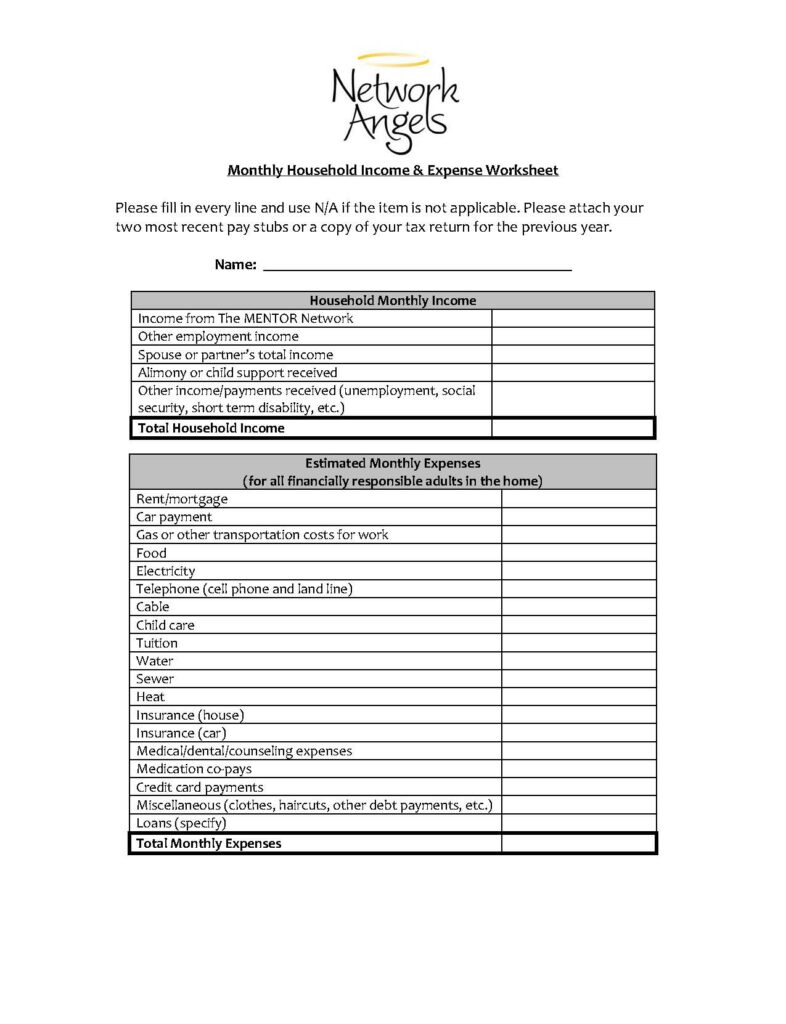

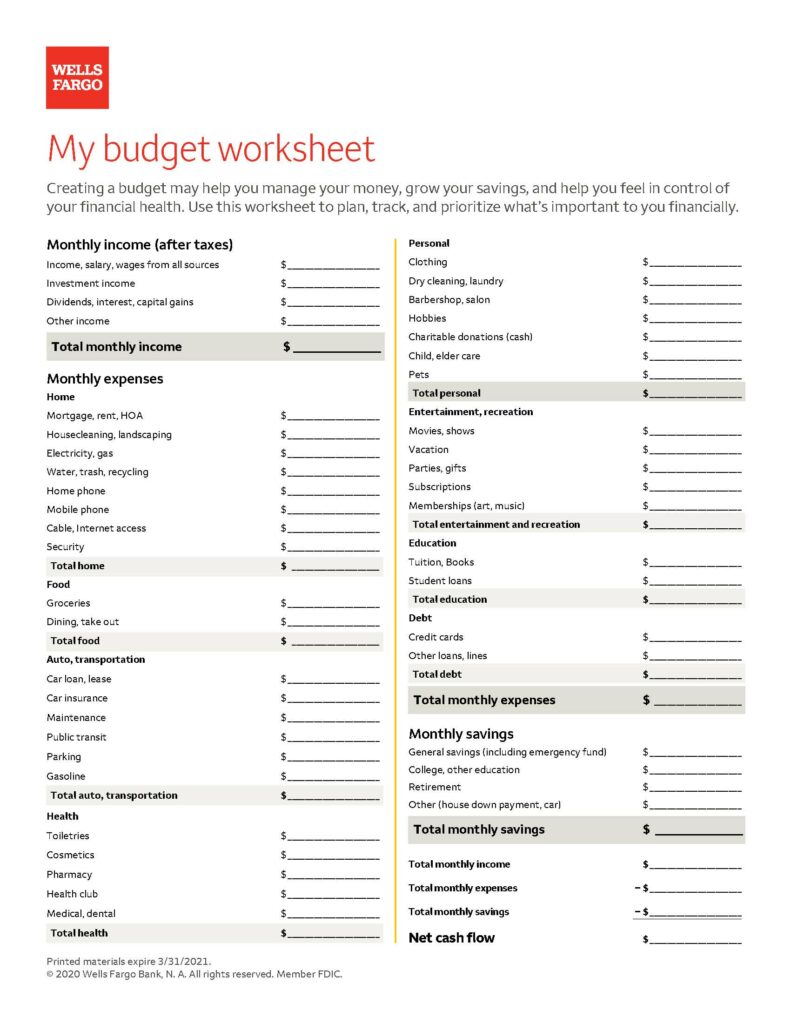

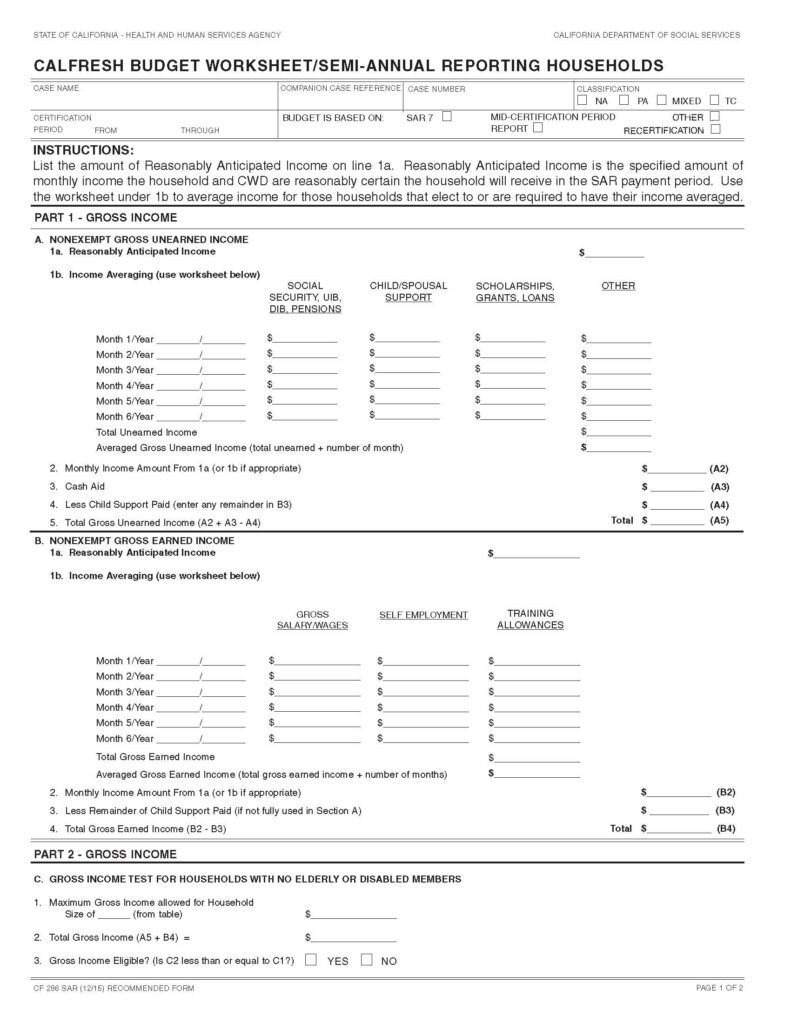

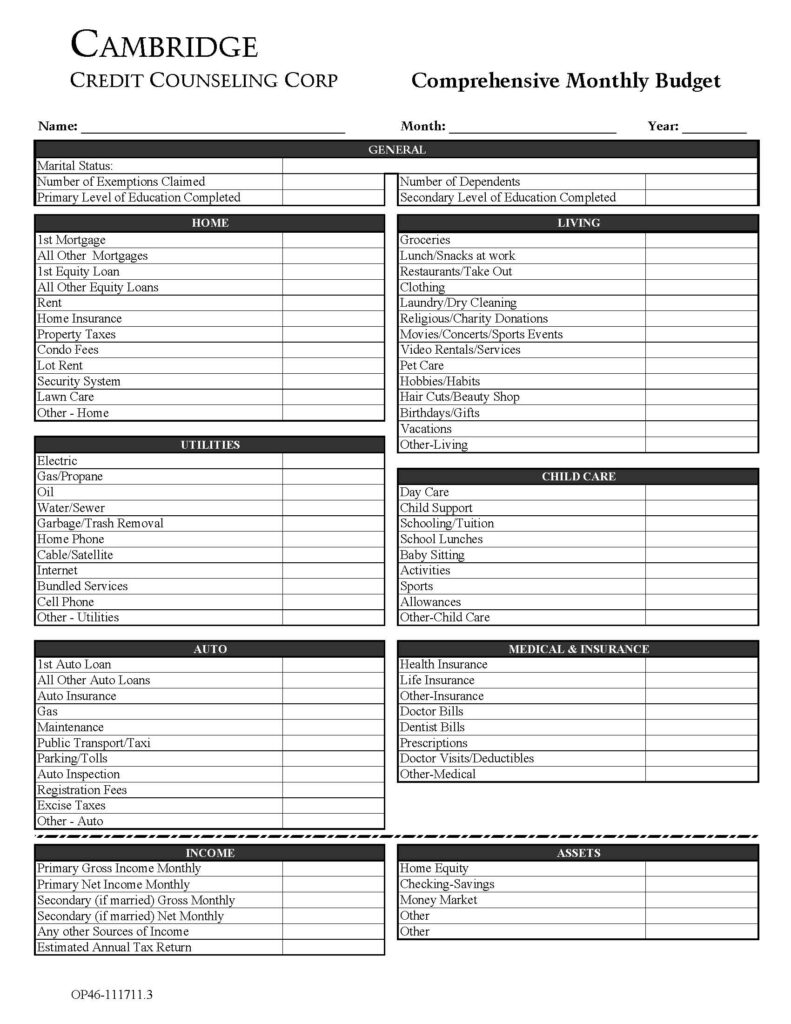

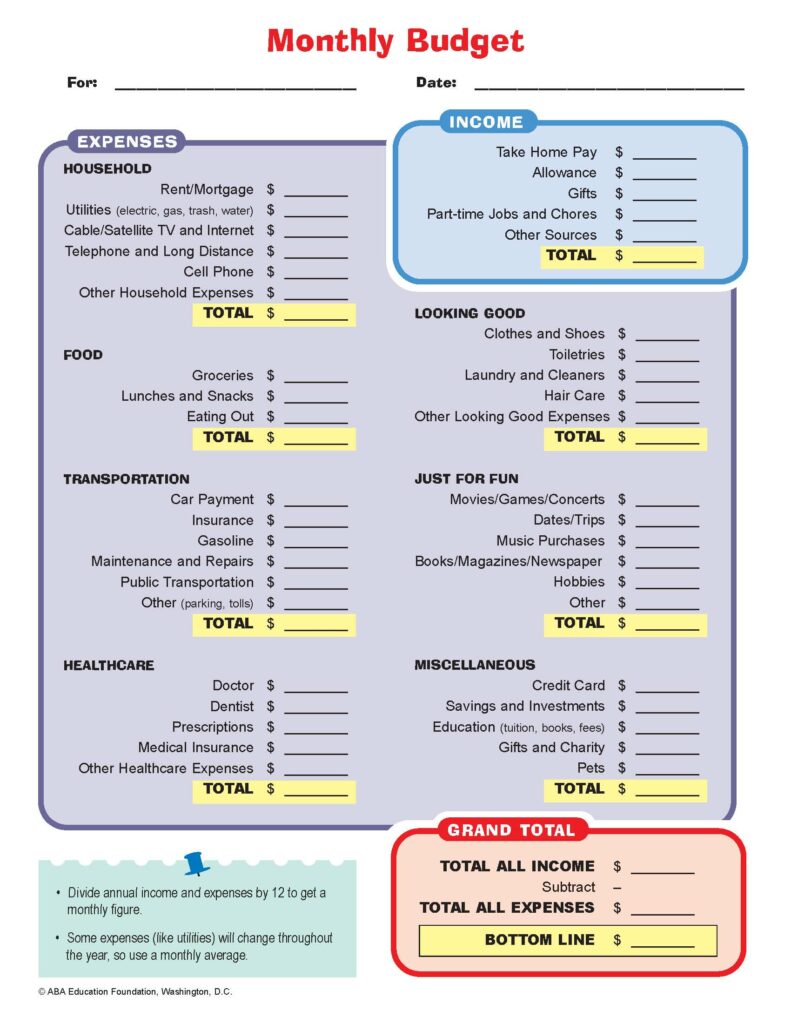

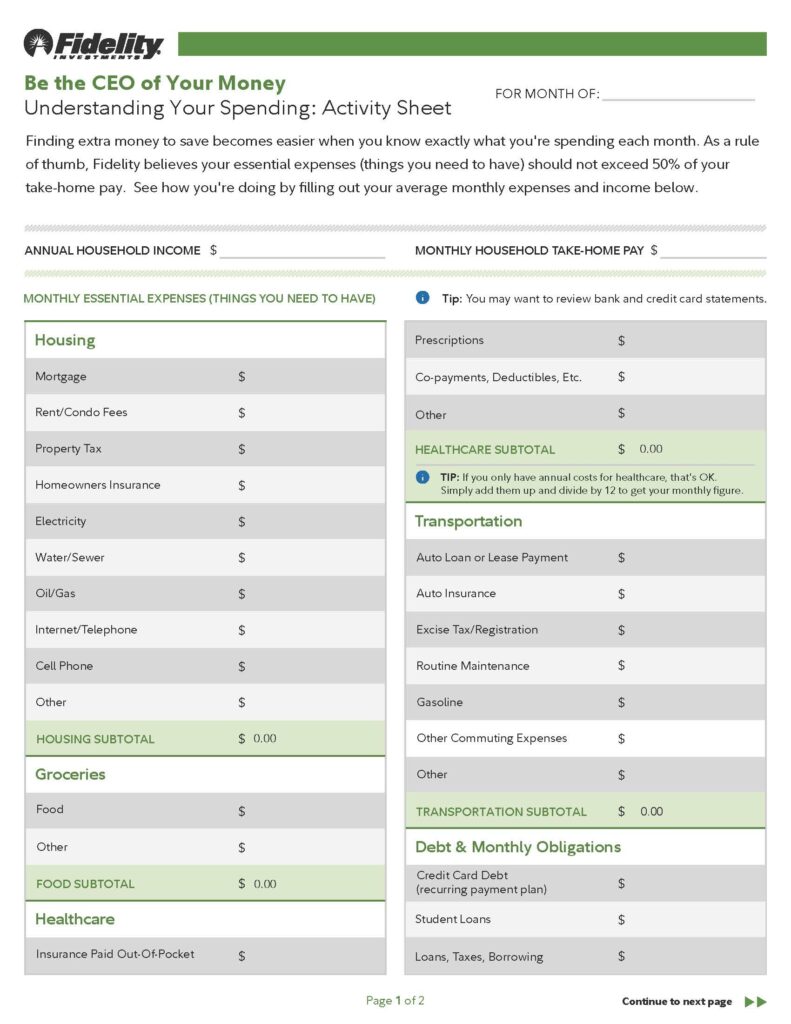

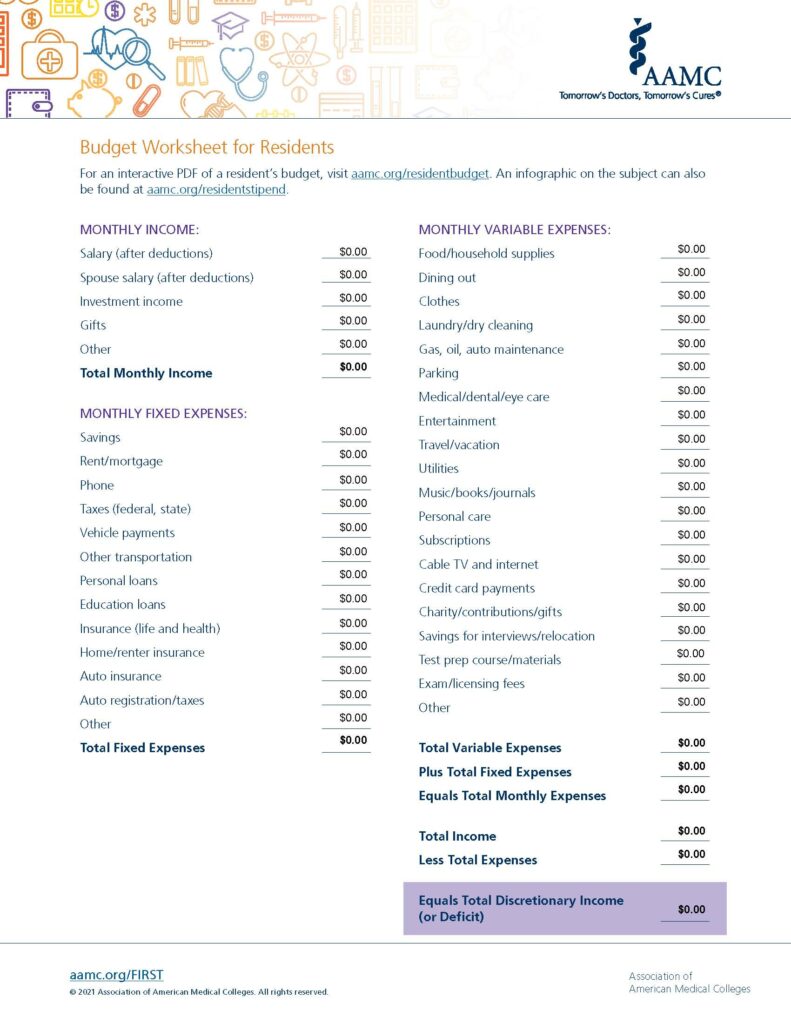

A great budget is built on your net income as its main component. Your take-home pay is the total of your income or salary fewer taxes and any perks offered by your employers, such as retirement plans and health insurance. You can overspend if you place more emphasis on your total compensation than on your net income since you’ll think you have more money than you actually do.

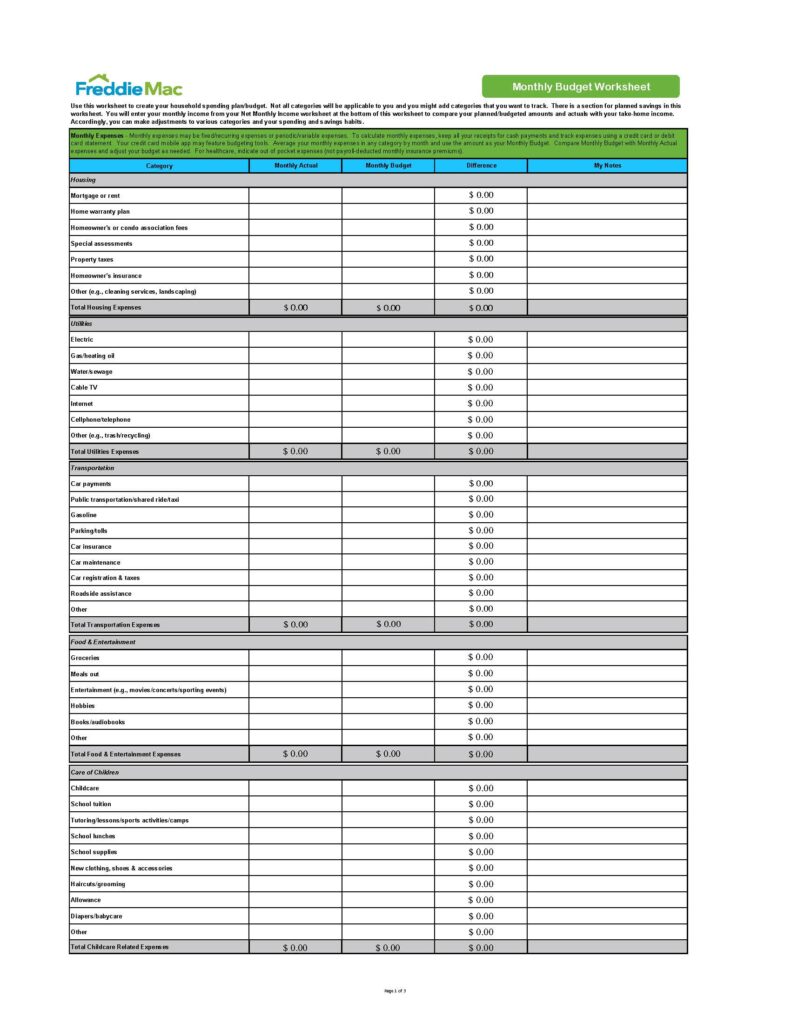

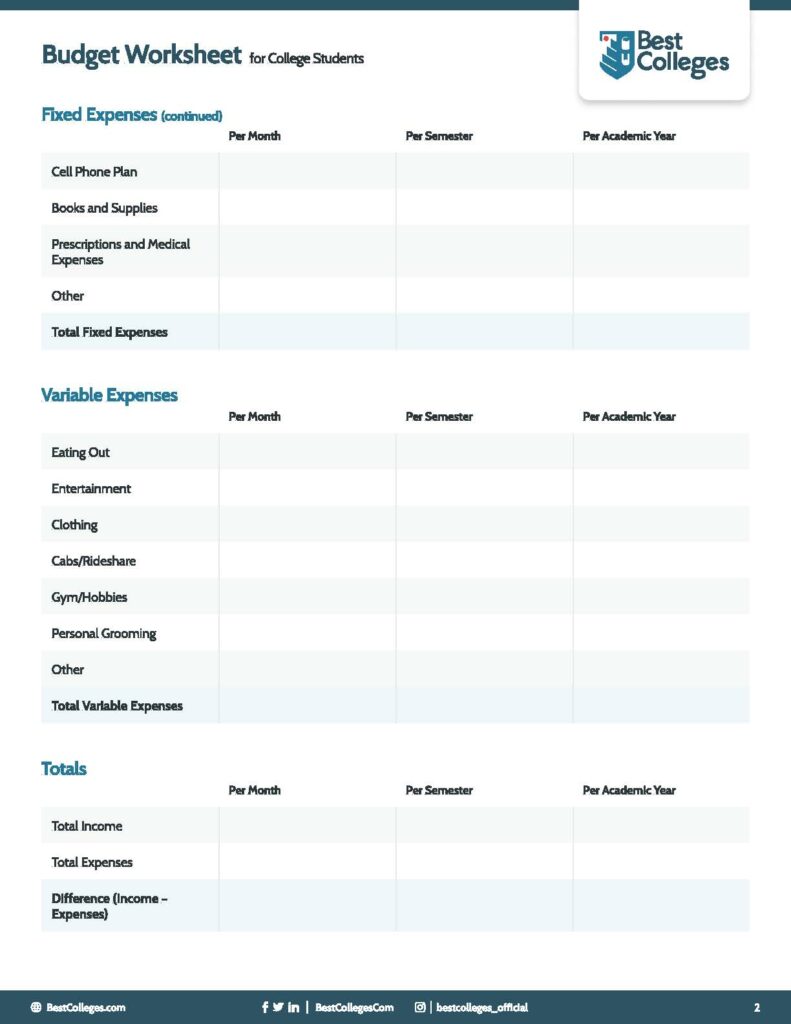

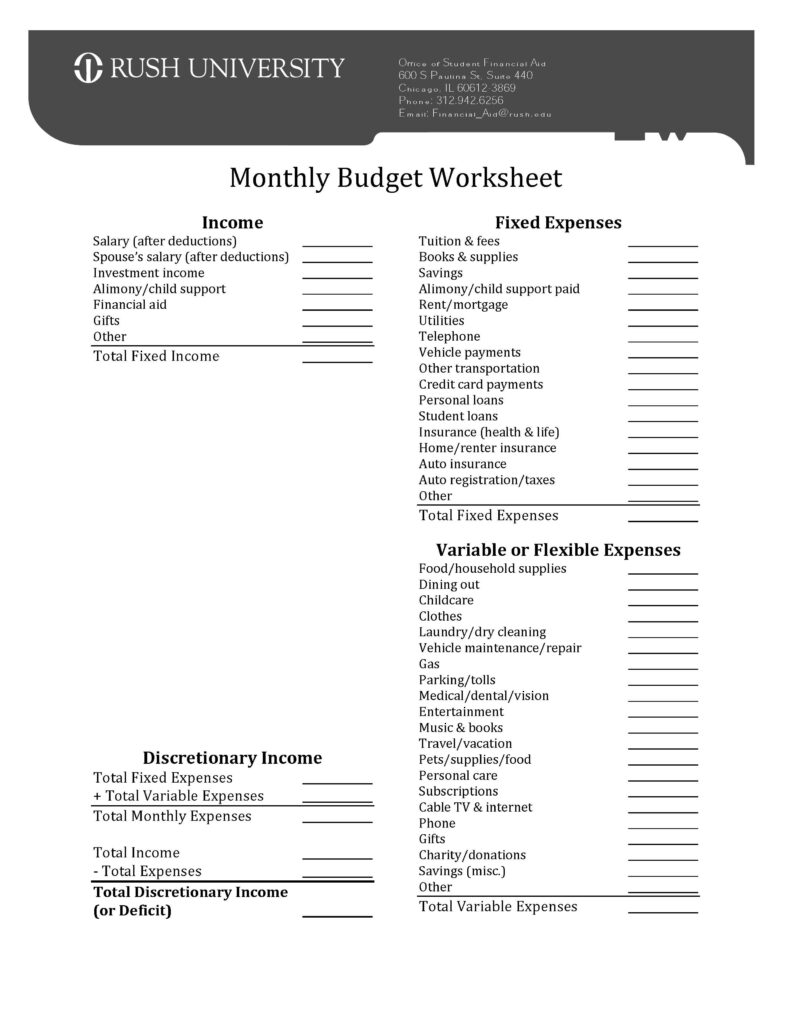

Second, Keep an eye on your spending

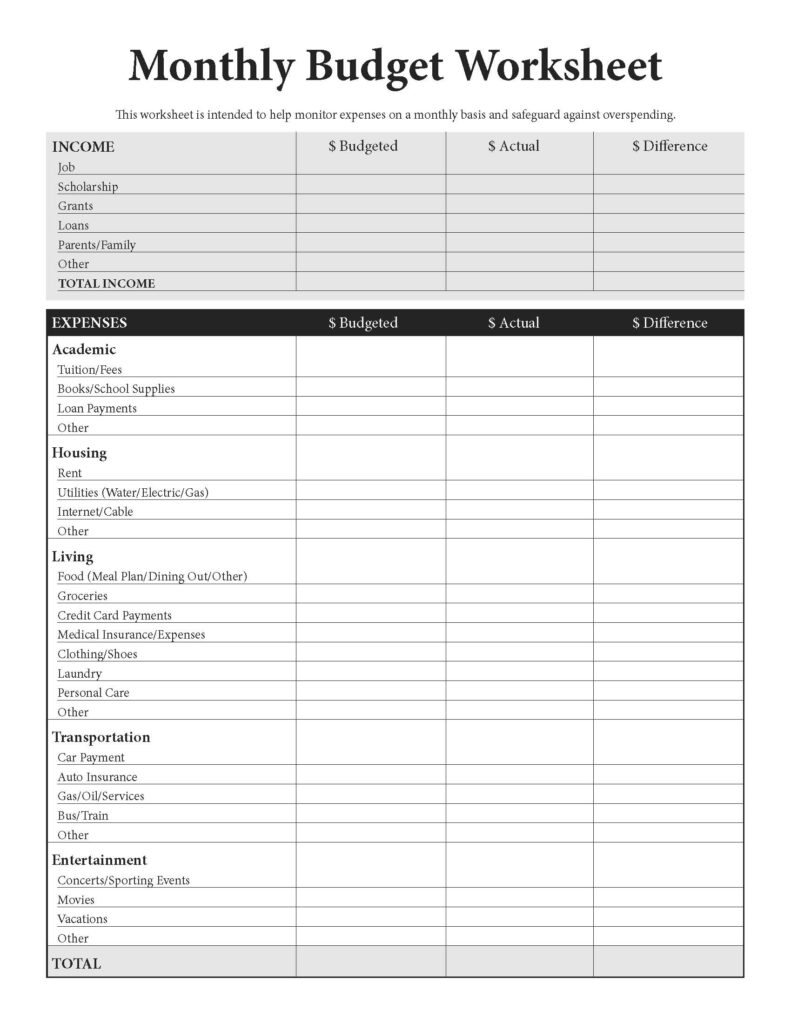

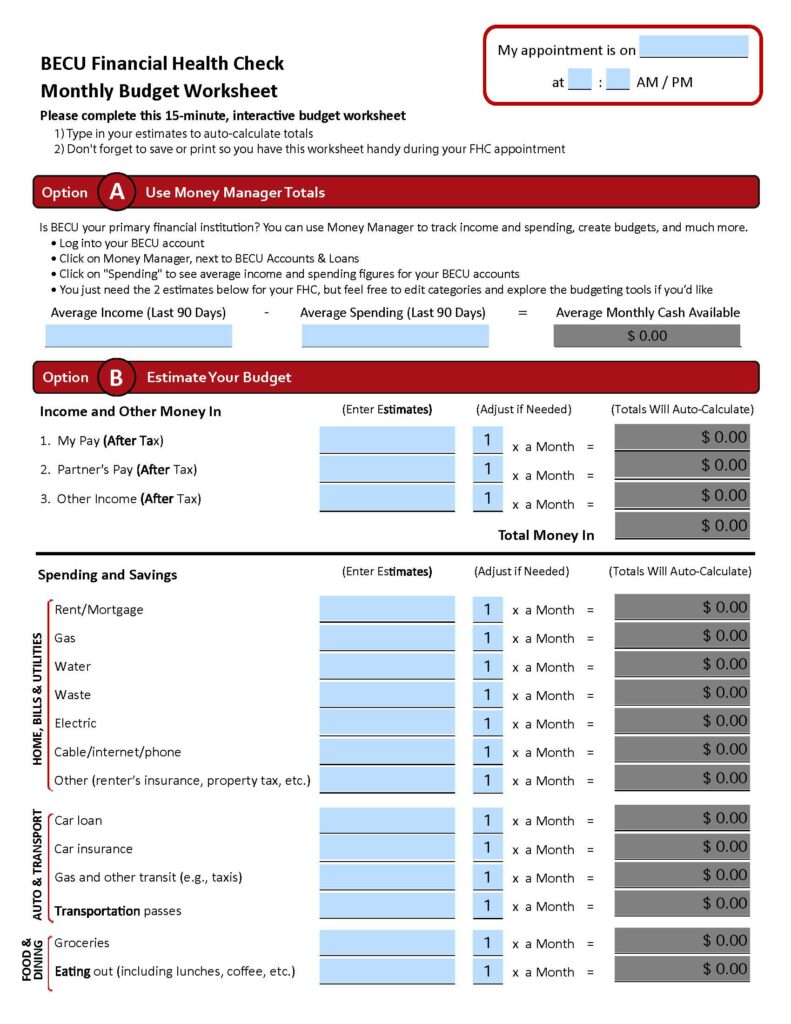

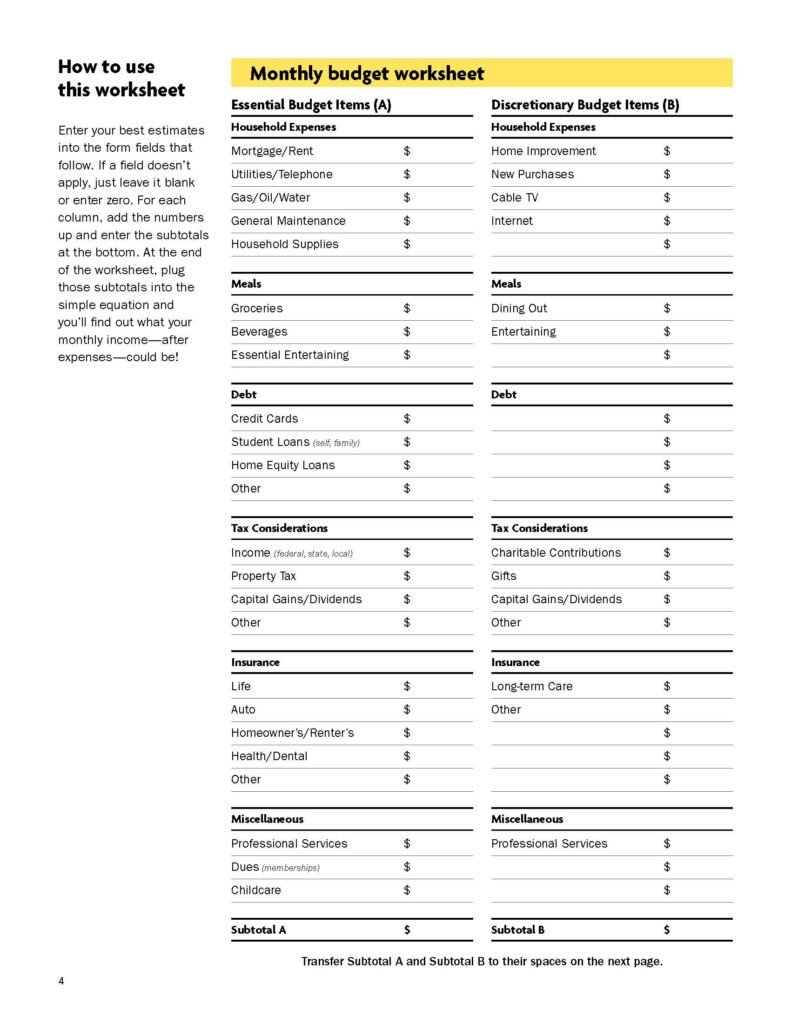

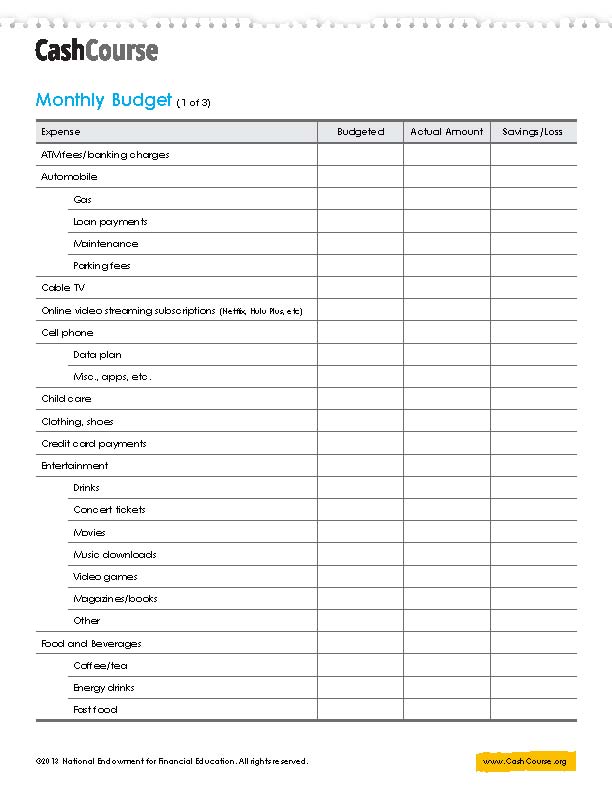

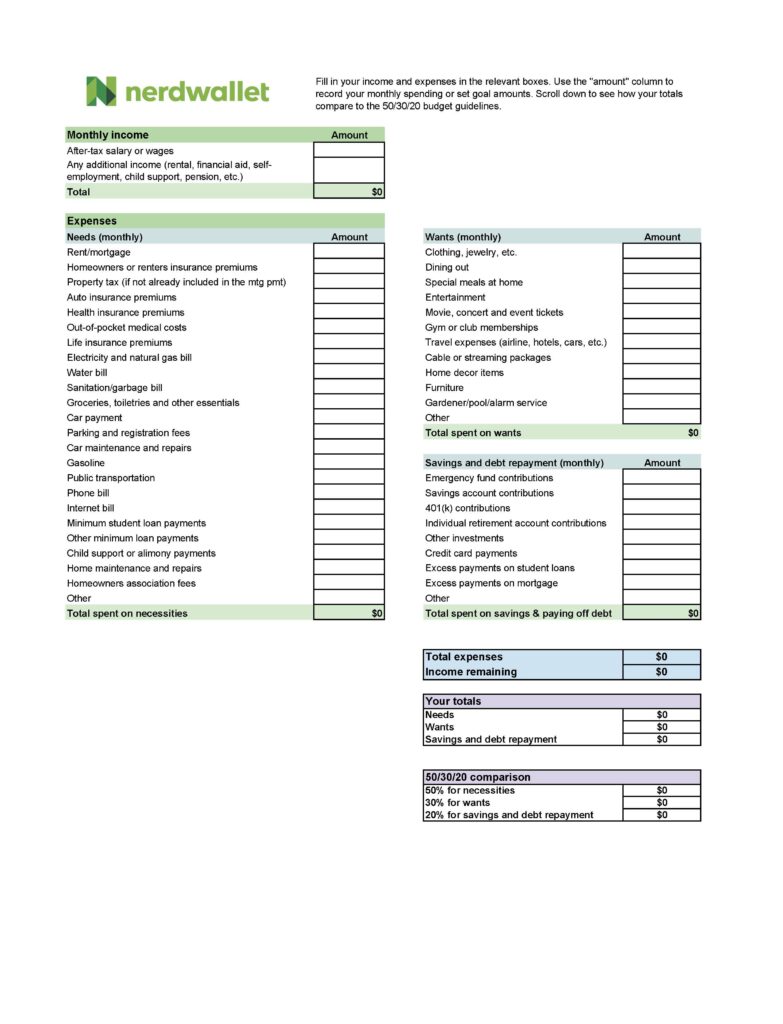

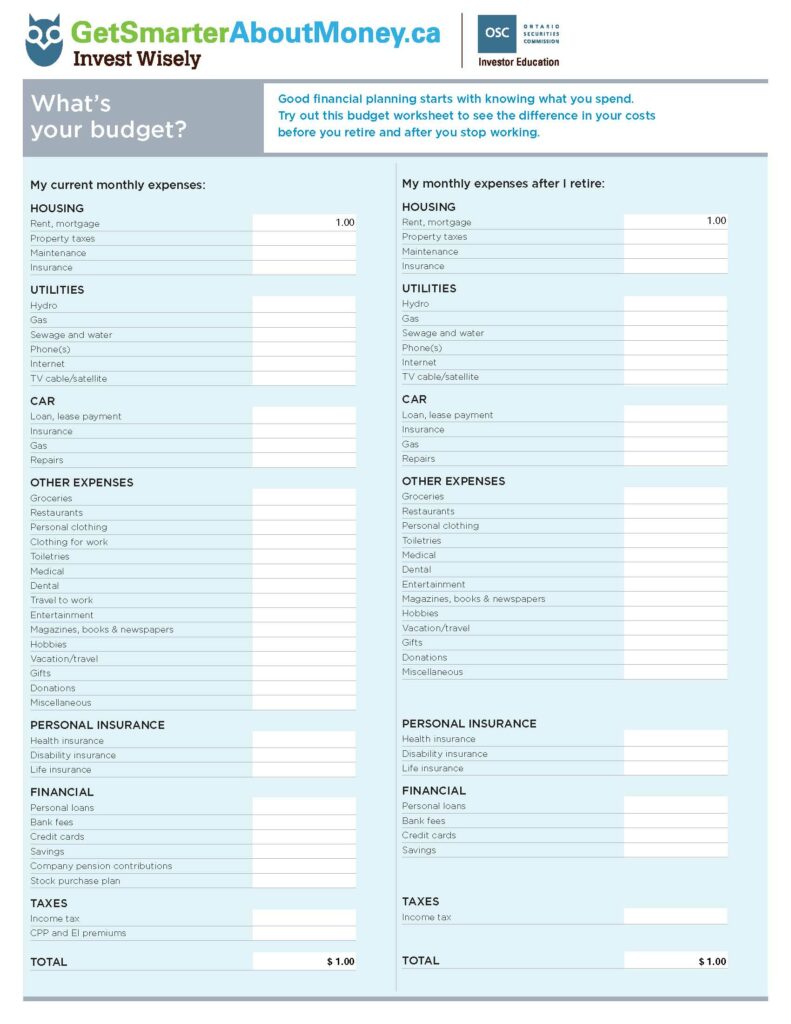

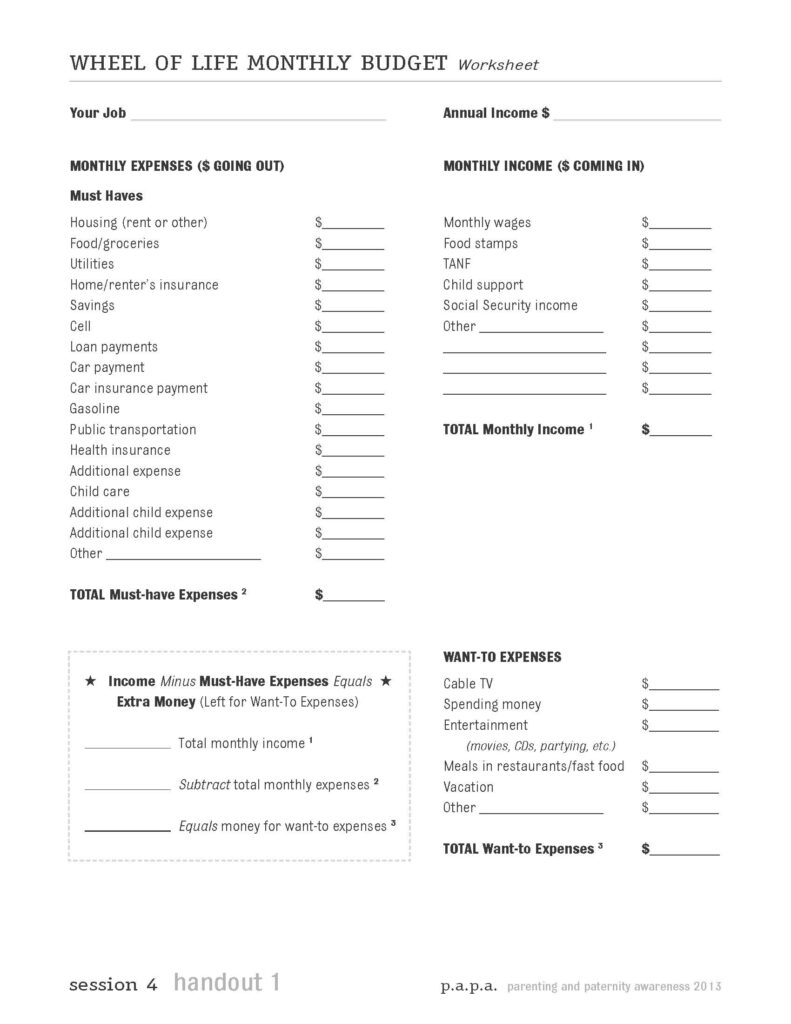

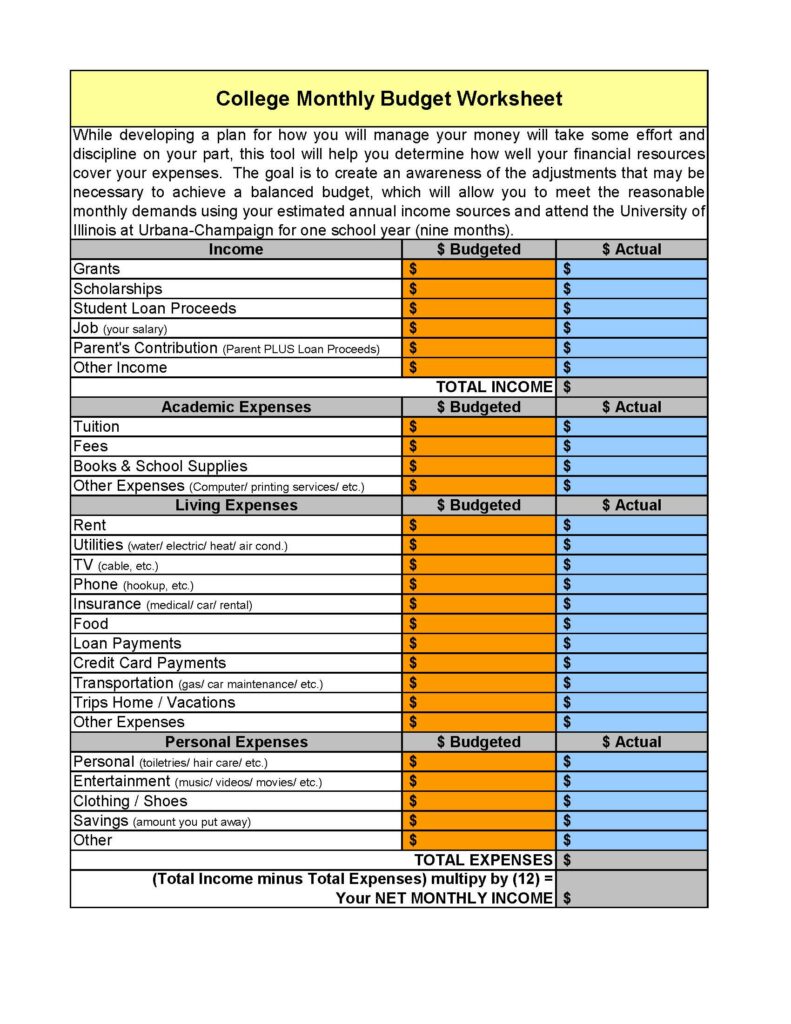

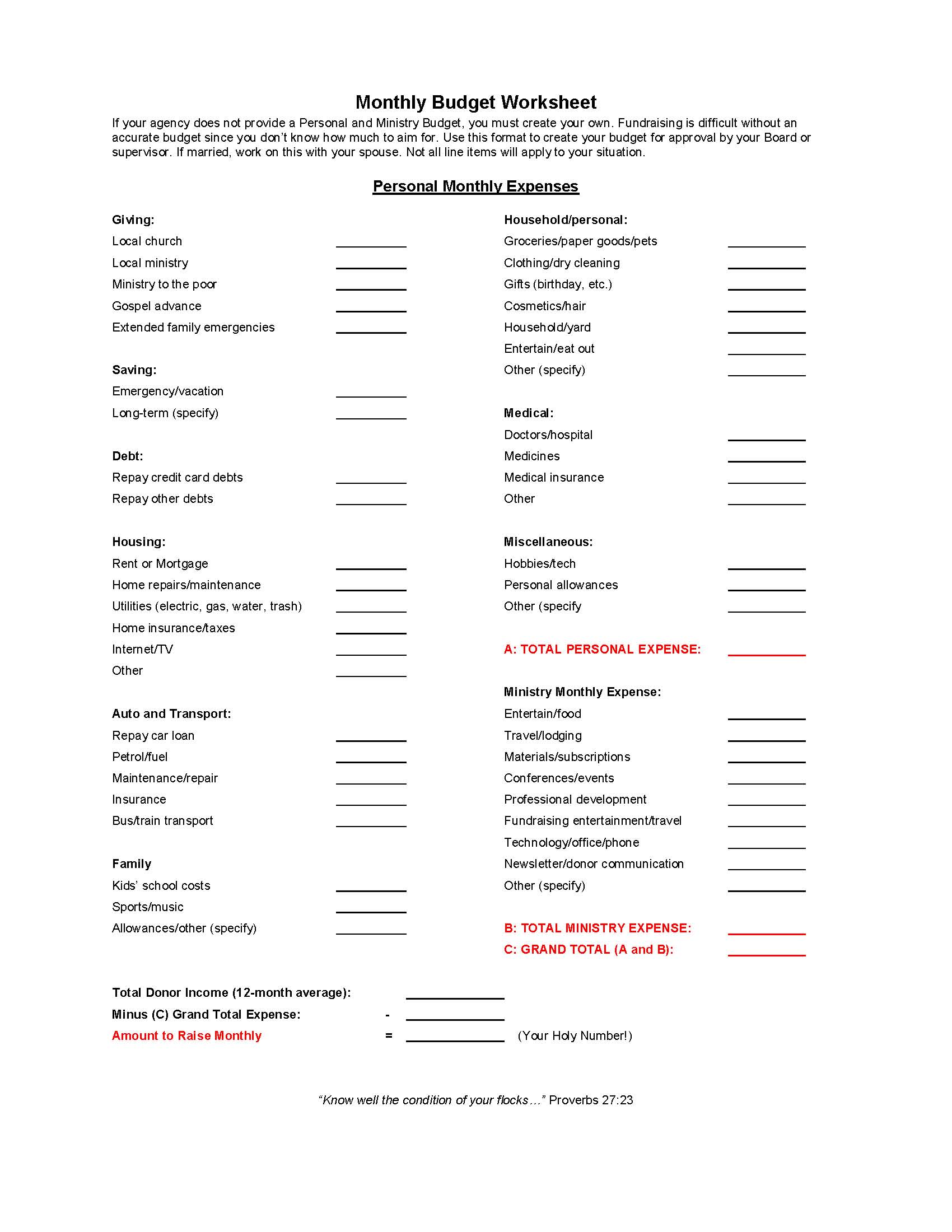

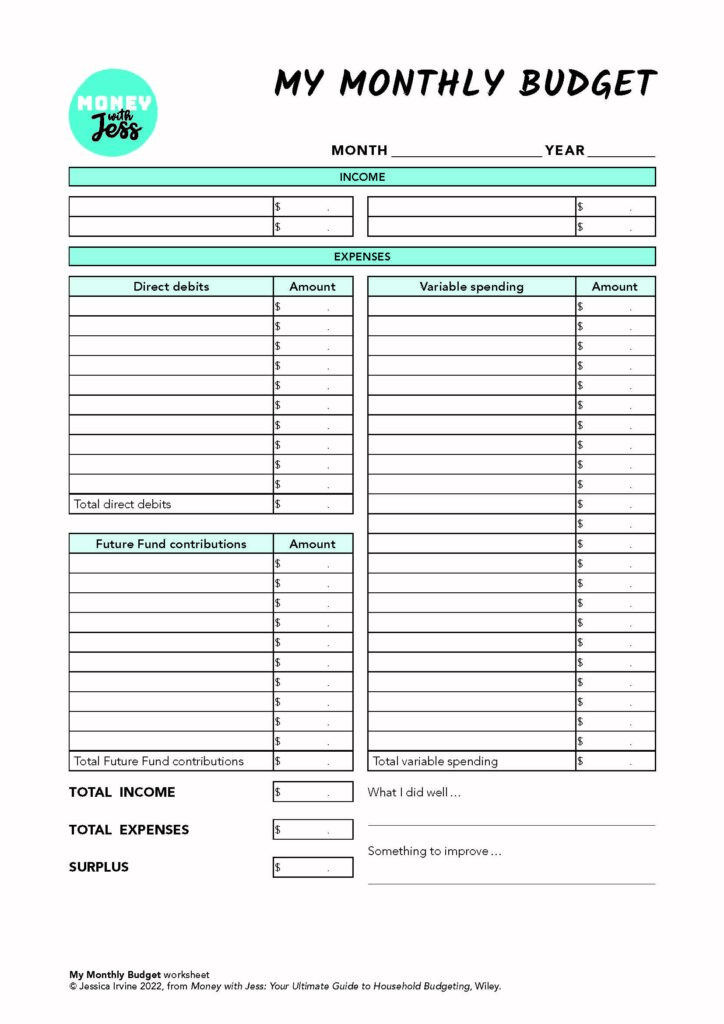

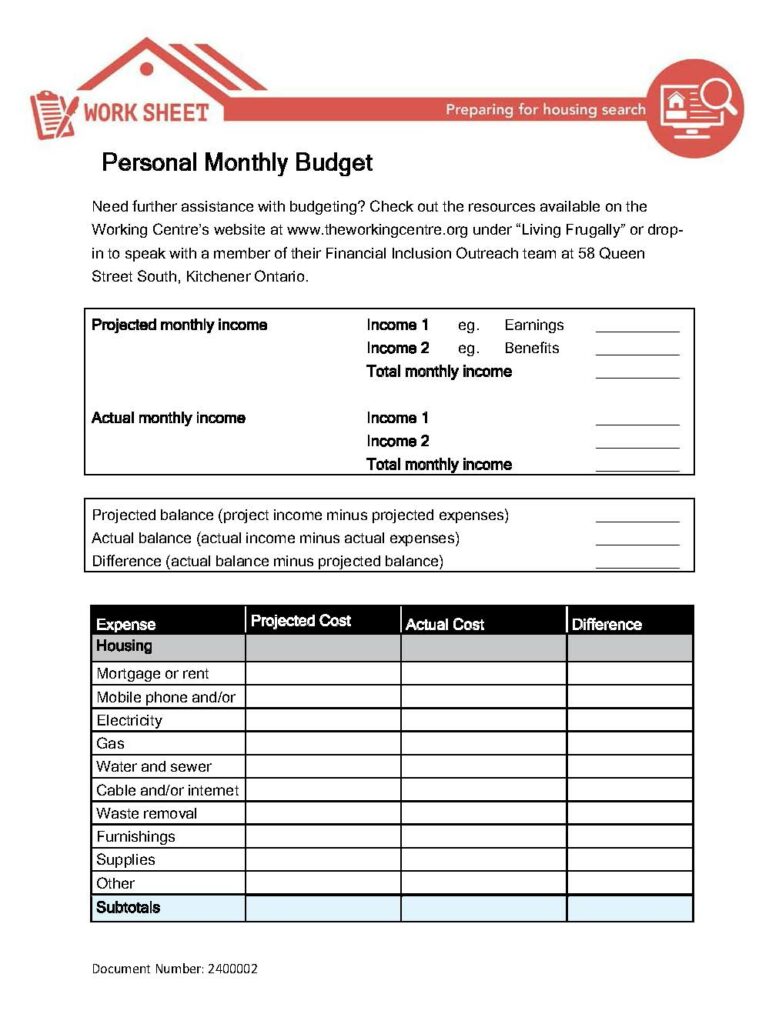

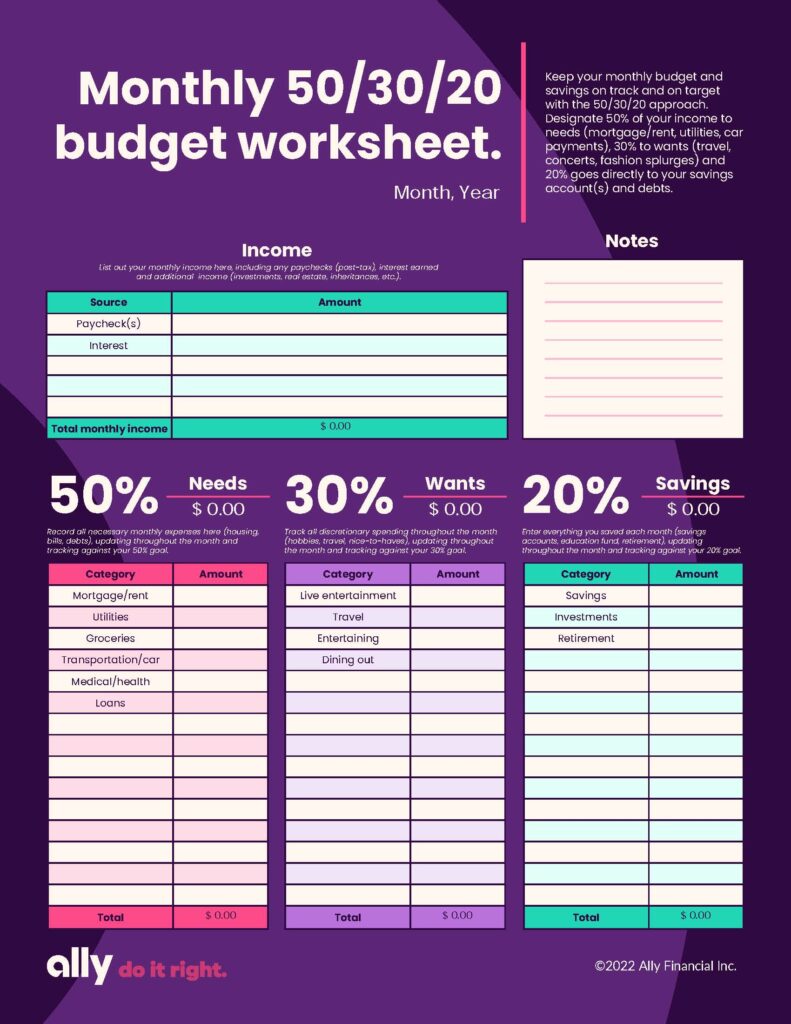

You can determine where you spend the most money and where you can make the most savings by keeping track of and categorizing your expenses. Make a list of your fixed expenses to start. Utilities, car payments, and rent or mortgage payments are examples of regular monthly expenses. You might be able to cut costs in this area. Credit card and bank statements, which itemize and categorize your monthly expenses, are excellent places to start.

Third, Specify reasonable goals

Prior to sifting through the facts, you’ve gathered, make a list of your short- and long-term financial objectives. Although your goals don’t have to be set in stone, being aware of them could help you stick to your spending plan. It could be easier to cut expenses if you are aware that you are saving for a trip.

Fourth, Create an effective strategy

Your actual spending and your desired expenditure are compared in this way. Estimate your future spending using the list of variable and fixed costs you have. After that, think about your priorities and net income. Consider setting up specific—and appropriate—spending caps for each expenditure category.